Tether (USDT) has persevered to transport into exchanges lately. Right here’s why this is a certain building for Bitcoin.

Tether Provide On Exchanges Is Now Very best In 7 Months

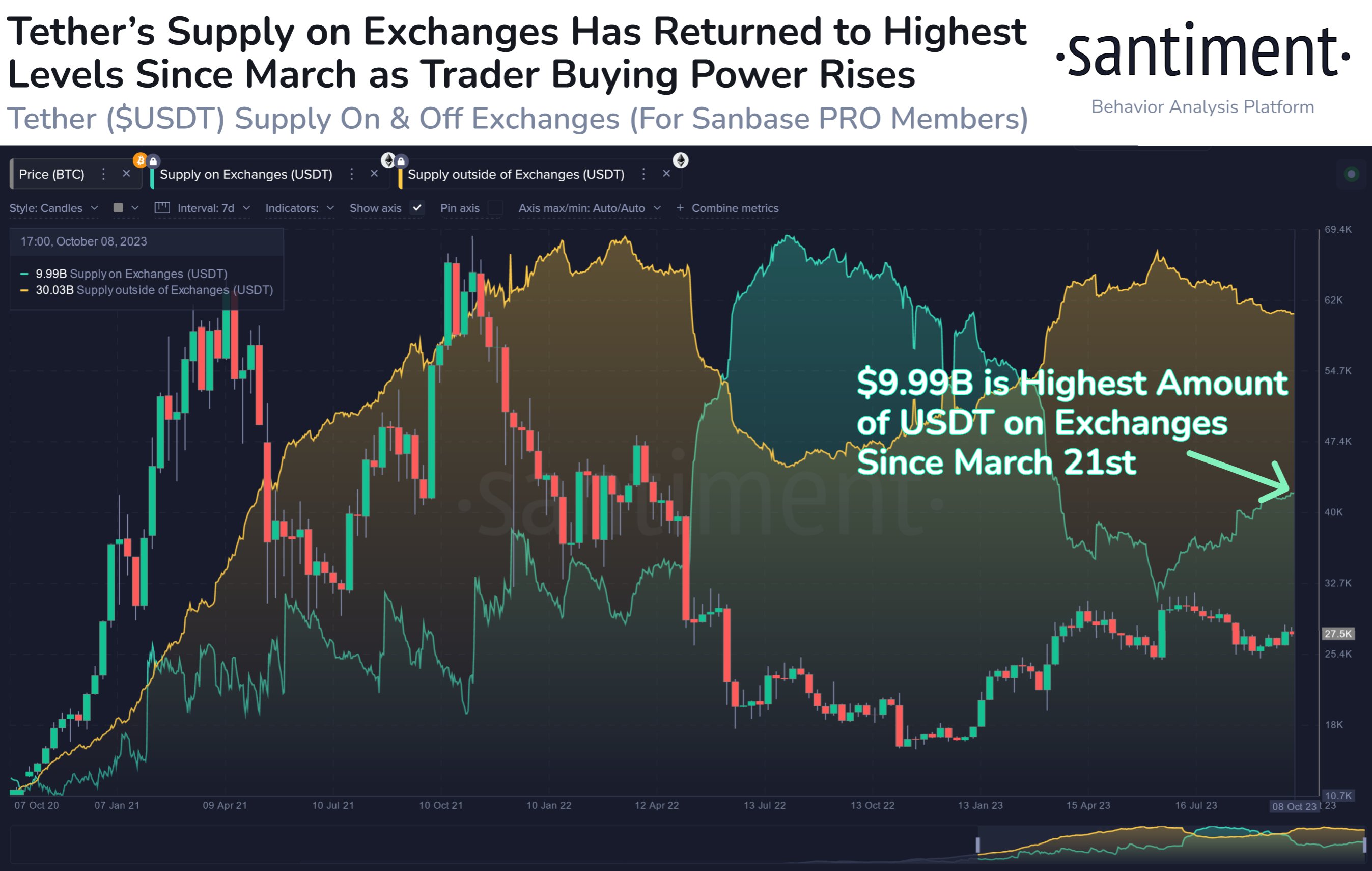

In step with knowledge from the on-chain analytics company Santiment, $9.99 billion price of USDT is now on exchanges. The indicator of relevance this is the “provide on exchanges,” which helps to keep monitor of the overall quantity of a cryptocurrency being saved in all centralized exchanges’ wallets.

The translation of this metric can fluctuate relying on the kind of asset that’s being mentioned. Relating to Bitcoin, as an example, the trade reserve could also be regarded as a measure of the possible promoting force, as probably the most causes traders would possibly deposit the coin is for selling-related functions.

Thus, the cryptocurrency’s provide on exchanges going up is usually a signal that promoting is expanding within the sector, and therefore, the asset’s worth could also be heading in opposition to a bearish result.

Within the context of the present dialogue, BTC’s provide on exchanges isn’t the certainly one of passion, however somewhat the metric for Tether is. USDT is a well-liked stablecoin (the biggest one in accordance with marketplace cap) that at all times has its price pegged to the United States Greenback.

Here’s a chart that presentations the craze within the provide of exchanges for Tether during the last few years:

Seems like the worth of the metric has been going up in contemporary days | Supply: Santiment on X

Most often, an investor would possibly need to dangle their capital as a stablecoin like USDT to stay it clear of the volatility related to different property within the cryptocurrency sector.

Alternatively, many such stablecoin holders use those property as a brief secure haven, as they ultimately want to go back to the unstable marketplace.

When those traders in the end in finding the time to leap again into cryptocurrencies like Bitcoin, they change their USDT for them. Those buyers would possibly use exchanges to make this shift, so a upward thrust within the provide on exchanges of the stablecoin generally is a signal that traders want to change into unstable cash.

Such purchasing the use of Tether can naturally reason a bullish impact at the costs of BTC and others. So, on this approach, the trade provide of the stablecoin may also be regarded as the other of the metric for BTC.

The above graph presentations that the indicator’s price has larger in the previous few weeks. “The $9.99B price of Tether sitting on exchanges is the easiest degree of shopping for energy for crypto’s best stablecoin in roughly seven months,” notes Santiment.

It must be saved in thoughts that the upward thrust within the Tether provide on exchanges most effective implies an building up within the to be had dry powder. Whether or not Bitcoin would have the benefit of a spice up relies on whether or not this dry powder is used to shop for the asset or no longer.

BTC Worth

Bitcoin has declined prior to now couple of days because the asset now trades across the $27,600 degree.

BTC has recovered slightly from its lows from the previous day | Supply: BTCUSD on TradingView

Featured symbol from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Santiment.web