Printed on February twenty second, 2024 through Bob Ciura

The Dividend Kings consist of businesses that experience raised their dividends for a minimum of 50 years in a row. As a result of their remarkable streak of annual dividend will increase, it is not uncommon to view the Dividend Kings as the most effective dividend progress shares within the inventory marketplace.

You’ll be able to see the overall listing of all 56 Dividend Kings right here.

We additionally created a complete listing of all Dividend Kings, at the side of related monetary statistics like dividend yields and price-to-earnings ratios. You’ll be able to obtain the overall listing of Dividend Kings through clicking at the hyperlink underneath:

Phone & Information Techniques (TDS) lately greater its dividend for the fiftieth consecutive yr. Consequently, the corporate now joins the unique listing of Dividend Kings.

This article is going to analyze the corporate’s trade evaluate, long run progress potentialities, aggressive benefits, and extra.

Trade Evaluate

Phone & Information Techniques is a telecommunications corporation that gives consumers with mobile and landline products and services, wi-fi merchandise, cable, broadband, and voice products and services throughout the USA. The corporate’s Mobile Department accounts for greater than 75% of overall working income. TDS began in 1969 as a choice of 10 rural phone firms. Nowadays the corporate has a marketplace cap of $1.7 billion and greater than $5.4 billion in annual revenues.

TDS posted fourth-quarter revenue on February sixteenth. Quarterly income of $1.32 billion beat estimates through $40 million, whilst adjusted earnings-per-share got here to a lack of $0.11 in line with proportion. Income declined 3.2% from the 2022 fourth quarter. The web lack of $0.38 in line with proportion for the fourth quarter was once due essentially to a $547 million non-cash impairment fee at TDS Telecom.

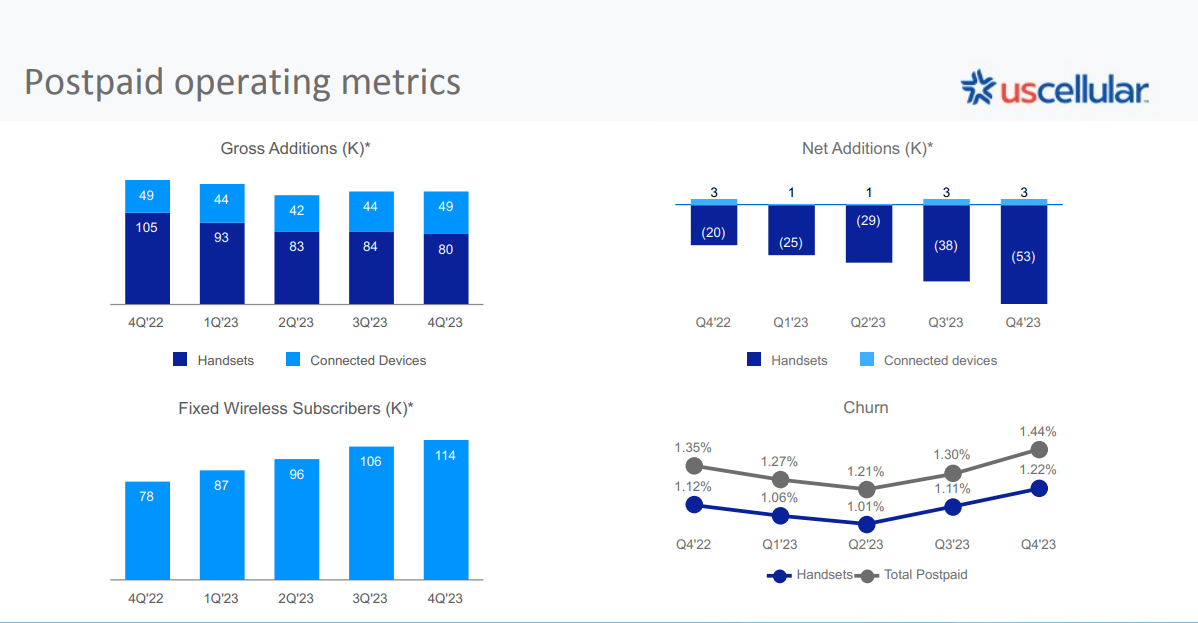

At US Mobile, postpaid moderate income in line with consumer grew 2% for the overall yr 2023. Fastened wi-fi consumers grew 46% to 114,000 whilst tower condominium revenues grew 8% to $100 million.

Together with quarterly effects, the corporate raised its dividend through 2.7% to $0.19 in line with proportion.

Enlargement Possibilities

TDS operates an excessively low-growth trade, as this is a very small participant in a extremely aggressive trade this is ruled through Verizon and AT&T. That has resulted in repeated years of destructive revenue progress. TDS has an 82% stake in U.S. Mobile and necessarily depends on this stake to succeed in progress.

In recent times, U.S. Mobile occupied with connecting consumers in under-served spaces with their fine quality community, in addition to marketplace proportion growth, expanding trade with executive consumers in 5G and IoT, and bettering community modernization and 5G systems.

TDS Telecom grew broadband income with an building up in buyer connections and expanded the achieve in their fiber and 1Gig products and services. TDS has made investments in opposition to rising its consumer base, increasing into new territories, in addition to bettering their community applied sciences, to be able to spice up the corporate’s competitiveness.

Then again, emerging working bills and impairments are taking a few of that merit away over the years, as we noticed with 2023 effects. Along with that, the corporate is making an attempt to construct out its choices in broadband carrier via its fiber infrastructure, which is helping ship quicker and extra dependable information superhighway to flats in its carrier space.

Working income has been kind of flat for a while, and we predict it’ll stay as such for the foreseeable long run. Whilst TDS is making an attempt to speculate for progress, we consider the corporate is dealing with an uphill combat in relation to rising revenue within the years yet to come. We estimate 2% annual EPS progress for the corporate over the following 5 years.

Aggressive Benefits & Recession Efficiency

TDS’ aggressive merit, if it has one, is that it has a captive target audience of types in its carrier spaces. Broadband operators have a tendency to have carrier spaces analogous to energy utilities in that selection for shoppers is most often restricted. That may lend a hand give protection to TDS’ internet-based income over the years, however we see much less of a worth proposition for shoppers on wi-fi income.

Shoppers have a lot more selection in relation to wi-fi income, and whilst TDS hasn’t confronted a consumer exodus, progress is low and we characteristic that to the serious festival within the wi-fi carrier house. The reality is that Verizon and AT&T have scale benefits that TDS does no longer, and we expect that its aggressive place is doubtlessly in peril because of this.

To its credit score, TDS has weathered more than one recessions prior to now, elevating its dividend via they all. Even supposing we get a recession in 2024, we don’t suppose that by myself would put the dividend in peril, as the corporate’s income and revenue aren’t essentially beholden to financial stipulations. Fairly, TDS is extra liable to company-specific chance components, as mentioned above.

Valuation & Anticipated Returns

To worth TDS, we can’t use EPS as the corporate reported a web loss for 2023. Due to this fact, we will be able to use e book price in line with proportion as a proxy for EPS, and price-to-book ratio as a substitute of P/E. The usage of the present proportion charge of ~$14 and e book price in line with proportion of $47.90, the inventory trades with a price-to-book ratio of 0.30.

The ten-year moderate P/B ratio is 0.64, however we peg truthful price at a P/B ratio of 0.45 through 2029. Nonetheless, a variety of the valuation more than one may spice up annual returns through 8.4% in line with yr over the following 5 years.

One at a time, estimated trade progress of two% will spice up shareholder returns. In the end, the inventory has a 5.3% present dividend yield.

Striking all of it in combination, TDS is predicted to go back over 15% once a year over the following 5 years, making the inventory a purchase.

TDS has raised its dividend for fifty consecutive years. It has grown its dividend through ~3% in line with yr on moderate during the last 5 years. Nowadays, its 5.3% dividend yield is considerably upper than the yield of the S&P. Then again, the dividend isn’t sponsored through sure EPS, making it a somewhat dangerous dividend payout.

As TDS and U.S. Mobile function in a extremely aggressive trade, the company lacks a significant aggressive merit. As U.S. Mobile generates the majority of the revenues and revenue of TDS and is recently its maximum vital progress driving force, any headwind that can display up in the best way of U.S. Mobile could have an have an effect on on TDS.

In different phrases, there is not any be sure that TDS will be capable of proceed its dividend building up streak indefinitely, given its destructive EPS and cloudy progress outlook.

Ultimate Ideas

TDS depends on the efficiency of U.S. Mobile, and it’s now present process a strategic overview to resolve its best possible plan of action to unencumber shareholder price, which might end result within the sale of the corporate or its belongings. TDS inventory may nonetheless be offering robust annual go back doable over the following 5 years.

We recently charge TDS inventory a purchase because of its prime projected returns, even though we recognize the prime degree of chance to the dividend and the volatility of the corporate’s effects.

Different Positive Dividend Sources

Thank you for studying this text. Please ship any comments, corrections, or inquiries to toughen@suredividend.com.