The bond marketplace is still even crazier than the inventory marketplace.

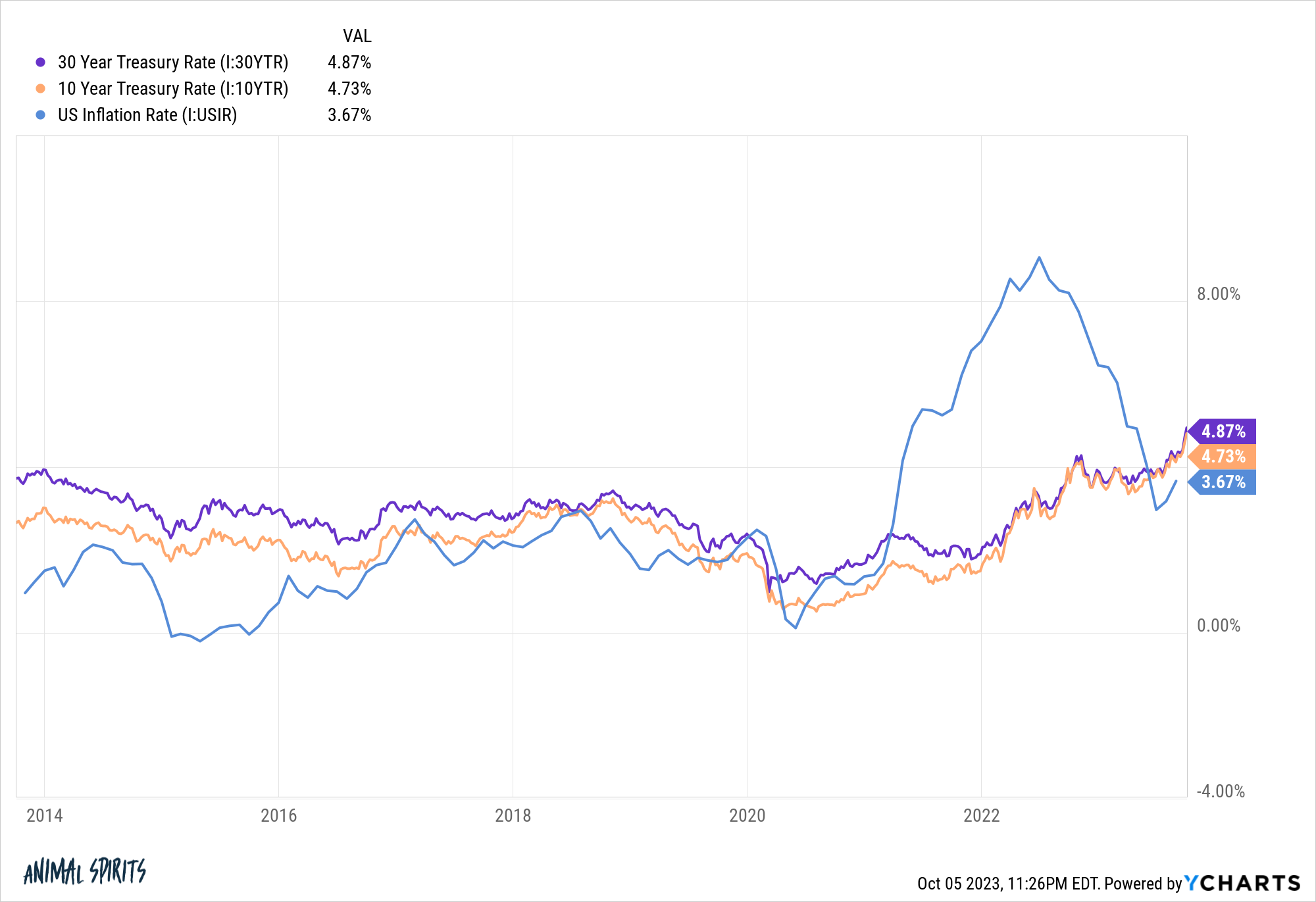

We’ve witnessed an enormous transfer in long-term bond yields those previous couple of weeks and months.

Yields at the 10, 20 and 30 yr Treasury have been all up in the community of 60 foundation issues over the last 16 buying and selling classes. Yields are up 1% or extra on each and every of those bond maturities because the finish of June.

Yields have higher extra previously month than absolutely the ranges of those bonds on the generational lows in 2020.

What’s happening right here? Why are longer adulthood bond yields in any case shifting upper after months and months of being smartly underneath the non permanent charges set via the Fed?

I’m now not a bond whisperer however there are a handful of theories floating round.

Let’s check out the ones theories from doomer to Goldilocks:

Executive debt is spiraling out of keep an eye on. I perceive this one however other folks had been making this declare for smartly over 100 years.

The Fed desires charges upper to sluggish the financial system.

I will be able to imagine this concept as soon as the Fed is attempting to convey charges down however they don’t cooperate.

I’m guessing it might take one sentence from Jerome Powell about purchasing bonds for charges to fall in a rush.

World markets are dropping religion in our political device. I’m sympathetic to this argument since our flesh pressers appear to be hellbent on conserving the federal government hostage each and every 45 days with every other shutdown danger.

However what number of different international locations have a extra strong device than us at this time?

Great concept however I’m now not slightly there (but).

The availability of bonds is just too top and there’s now not sufficient call for. This one sounds excellent in concept too.

However why did it occur all the surprising over the last couple of months?

The federal government has been spending cash like loopy because the onset of the pandemic. It’s now not like bond buyers have been ignorant of the spending binge we’ve been on.

And shouldn’t call for building up as charges upward thrust?

I do suppose the Fed’s purchases of Treasuries all over the pandemic screwed up the availability and insist equation greater than they might have preferred.

Inflation goes to be upper for longer. It’s conceivable we’re getting into a brand new inflation regime however why did it take see you later for bond yields to react to inflation?

Inflation ranges have progressed considerably from the height in the summertime of 2022.

It’s extraordinary how bond yields are emerging extra with inflation below 4% than when it used to be above 9%.

It is advisable to make the argument the bond marketplace assumed inflation used to be transitory nevertheless it’s unusual how temporarily charges have adjusted those previous few months.

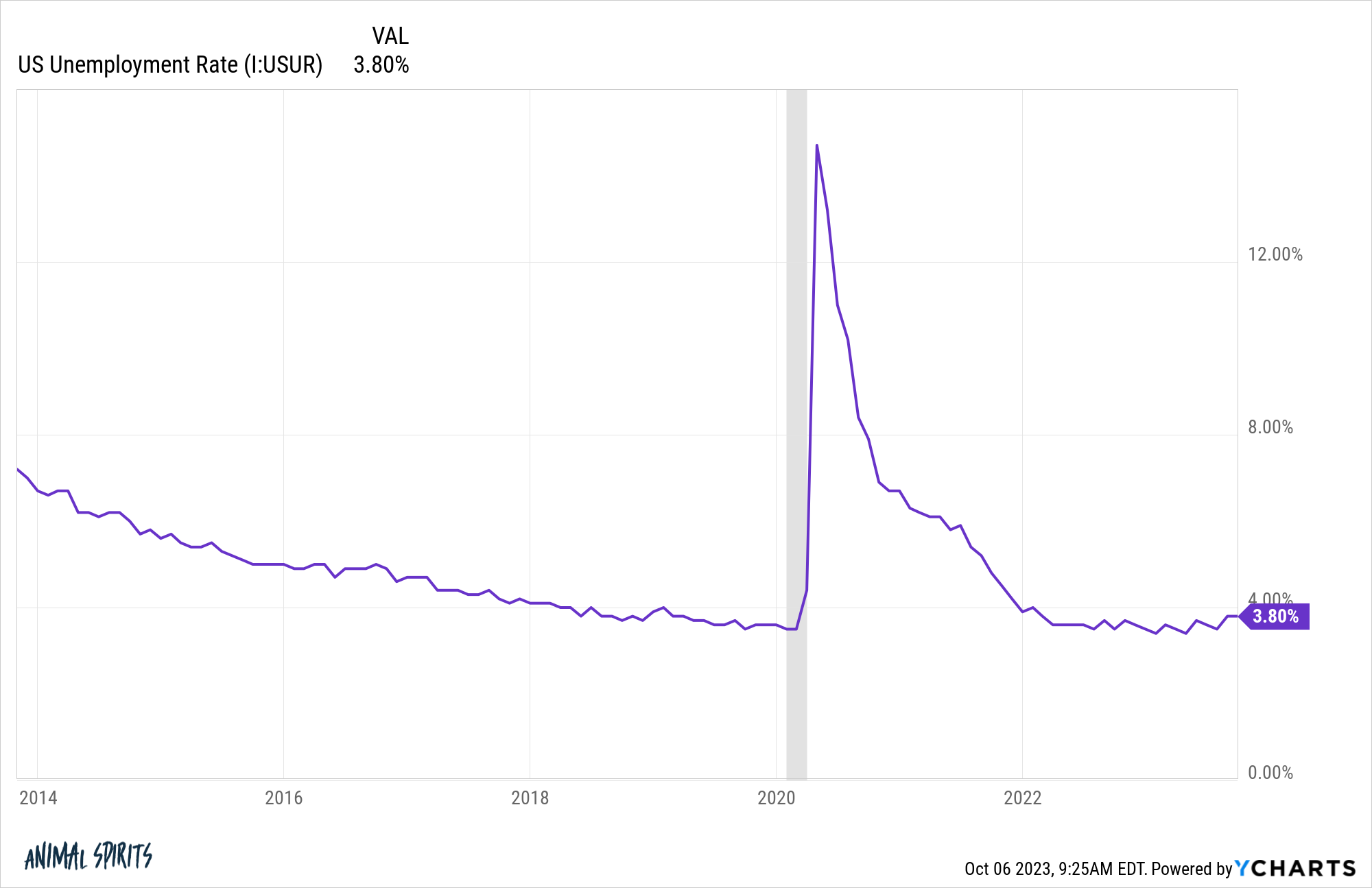

It’s the financial system, silly. I do know the doomer theories of China promoting Treasuries and U.S. debt spiraling out of keep an eye on make for a greater narrative however what if charges are emerging for the reason that financial system stays sturdy?

The exertions marketplace continues to sweep off upper charges:

The Atlanta Fed’s fashion is predicting actual GDP enlargement for Q3 of four.9%. That’s financial enlargement over and above inflation.

If we’re in a brand new financial regime of upper inflation and enlargement, that may be in step with upper long-term rates of interest.

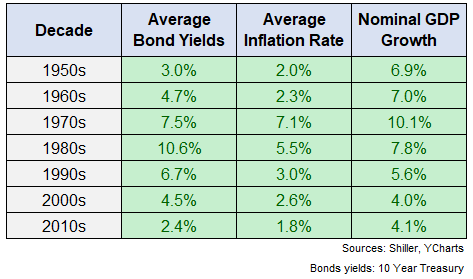

Right here’s a take a look at moderate bond yields, inflation and nominal GDP enlargement via decade again to the Fifties:

Throw out the Fifties for the reason that executive capped charges to inflate away our warfare money owed.

There’s now not a really perfect dating between those components, however upper enlargement and inflation are generally in step with upper bond yields.

Thru June of this yr, nominal GDP enlargement within the 2020s has averaged 6.2% annualized. In fact, inflation has been upper too so perhaps the bond marketplace merely were given stuck offside right here.

The bond marketplace is dumber than we give it credit score for. There may be this outdated wive’s story within the monetary markets that bonds are the good cash.

What if that’s simply now not true?

Robert Shiller has some very good analysis at the bond marketplace’s talent to expect the financial system:

One may suppose that long-term rates of interest have a tendency to be top when there’s proof that there can be upper inflation over the lifetime of the bond, to compensate buyers for the anticipated decline within the buck’s buying energy. The use of information since 1913, when the shopper worth index computed via america Bureau of Hard work Statistics begins, we discover that the there’s virtually no correlation between long-term rates of interest and ten-year inflation charges over succeeding many years. Whilst certain, the correlation between one decade’s overall inflation and the following decade’s overall inflation is best 2%.

However bond markets act as though they suppose inflation will also be extrapolated. Lengthy-term rates of interest have a tendency to be top when the decade’s inflation used to be top. US long-term bond yields, such because the ten-year Treasury yield, are extremely definitely correlated (70% since 1913) with the earlier ten years’ inflation. However the correlation between the Treasury yield and the inflation fee over the subsequent ten years is best 28%.

The bond marketplace reveals recency bias similar to the remainder of us!

The least fulfilling reason for the pointy upward thrust in yields is the bond marketplace is puzzled. We’ve by no means noticed an atmosphere slightly like this with pandemic-induced executive spending, provide chain shocks and competitive financial tightening.

Perhaps the bond marketplace is simply telling us we are living in complicated financial instances.

There are such a lot of cross-currents at this time that I’m adequate admitting I don’t know what comes subsequent from this grand financial experiment.

As Charlie Munger as soon as noticed, “In case you’re now not puzzled, you’re now not paying consideration.”

Michael and I talked loopy bond yield strikes and extra in this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means pass over an episode.

Additional Studying:

Why I’m Extra Fearful Concerning the Bond Marketplace Than the Inventory Marketplace

Now right here’s what I’ve been studying in recent years:

Books: