Definition of Delta Hedging

Delta hedging is a technique by which an investor hedges the danger of a worth fluctuation in an possibility through taking an offsetting place within the underlying safety. That implies that if the cost of the choice adjustments, the underlying asset will transfer in the other way. The loss on the cost of the choice might be offset through the rise in the cost of the underlying asset.

If the placement is completely hedged, the fee fluctuations might be completely matched in order that the similar general greenback quantity of loss at the possibility might be won at the asset.

Generally, hedging is a technique used to cut back menace. An investor hedges a place in a specific safety to attenuate the danger of a loss. The character of a hedge, although, additionally approach the investor will surrender possible features as smartly. For instance, an investor with an choices contract for Corporate ABC that advantages from the inventory value falling would acquire stocks of that corporate simply in case the inventory value rose.

Figuring out Delta

Choices Delta is the measure of an possibility’s value sensitivity to the underlying inventory or safety’s marketplace value. It’s the anticipated exchange in choices value with a 1c exchange in safety value (certain if it rises/falls with a upward thrust/fall in marketplace value; detrimental another way).

For name choices, the delta levels between 0 and 1, whilst on put choices, it levels between -1 and zero. For instance, for put choices, a delta of -0.75 means that the cost of the choice is anticipated to extend through 0.75, assuming the underlying asset falls through a greenback. The vice-versa is equal to smartly.

Achieving Delta-Impartial

An choices place may well be hedged with choices displaying a delta this is reverse to that of the present choices conserving to care for a delta-neutral place. A delta-neutral place is one by which the full delta is 0, which minimizes the choices’ value actions relating to the underlying asset.

For instance, think an investor holds one name possibility with a delta of 0.50, which signifies the choice is at-the-money and desires to care for a delta impartial place. The investor may acquire an at-the-money put possibility with a delta of -0.50 to offset the certain delta, which might make the placement have a delta of 0.

Industry Instance: Hedging Lengthy Inventory With Lengthy Places

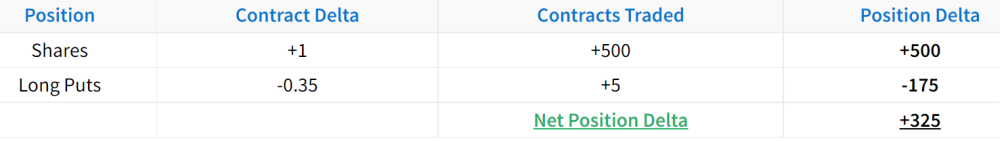

On this instance, we’ll have a look at a state of affairs the place a dealer owns 500 stocks of inventory. Being lengthy 500 stocks of inventory effects able delta of +500. If the dealer sought after to cut back this directional publicity, they must upload a technique with detrimental delta. On this instance, the detrimental delta technique we’ll use is purchasing places.

For the reason that dealer is lengthy 500 stocks of inventory, we’ll acquire 5 -0.35 delta put choices in opposition to the placement. This is how the placement seems to be in the beginning of the duration:

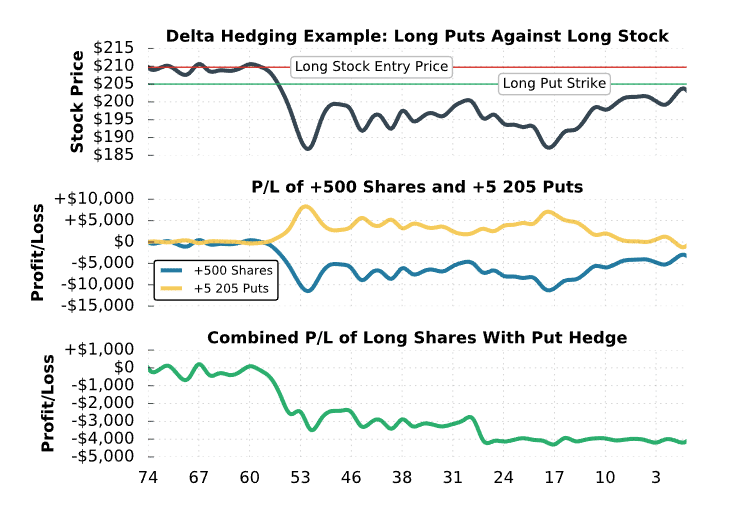

As we will see right here, purchasing 5 -0.35 delta places in opposition to 500 stocks of inventory reduces the delta publicity through 35%. Let’s check out the P/L of each and every of those positions when the inventory value falls:

Within the center portion of this graph, the P/L of the lengthy stocks and the lengthy places are plotted one at a time. As you’ll see, when the inventory value collapses, the lengthy inventory place loses cash, however the lengthy places generate profits. Within the decrease portion of the graph, the blended P/L of the lengthy inventory and lengthy places is plotted.

The important thing takeaway from this chart is that the inventory place on its own reviews a drawdown more than $10,000. Alternatively, with the lengthy places applied as a delta hedge, the blended place most effective reviews a $4,000 drawdown on the lowest level. By means of including the detrimental delta technique of shopping for places to the certain delta technique of shopping for inventory, the directional publicity is much less vital.

Professionals of Delta Hedging

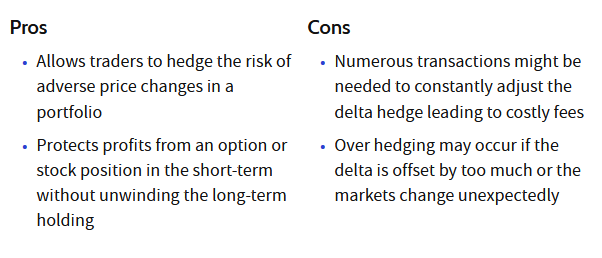

Delta hedging supplies the next advantages:

- It permits buyers to hedge the danger of continuous value fluctuations in a portfolio.

- It protects earnings from an possibility or inventory place within the quick time period whilst protective long-term holdings.

Cons of Delta Hedging

Delta hedging supplies the next disadvantages:

- Investors will have to regularly observe and modify the positions they input. Relying at the volatility of the fairness, the investor would want to respectively purchase and promote securities to keep away from being under- or over-hedged.

-

Taking into account that there are transaction charges for each and every industry carried out, delta hedging can incur huge bills.

What Is Delta-Gamma Hedging?

Delta-gamma hedging is an choices technique. It’s intently associated with delta hedging. In delta-gamma hedging, delta and gamma hedges are blended to chop down at the menace related to adjustments within the underlying asset. It additionally targets to cut back the danger within the delta itself. Remember the fact that delta estimates the exchange in the cost of a spinoff whilst gamma describes the velocity of exchange in an possibility’s delta in step with one-point transfer in the cost of the underlying asset.

Conclusion

Delta hedging is an choices buying and selling technique that targets to hedge the directional menace related to value actions within the underlying. It makes use of choices to offset the danger of a unmarried conserving or a complete portfolio. The purpose is to succeed in a delta impartial state and no longer have a directional bias.

Delta hedging is an effective way to control the delta (value publicity) of each a place and your total portfolio. For top rate buyers, this can be a specifically tough device to stay your delta impartial positions and portfolio… delta impartial.

There’s extra to hide in this matter. You will need to word, that earlier than the use of choices to delta hedge, you want to totally grab the dynamic delta behaviors of your hedges. New buyers must believe risk-defined (pre-delta hedged) positions at industry access. You will need to fit your technique no longer most effective for your technique’s standards and targets but additionally for your choices buying and selling talent and information.