This publish is written by means of Jet Toyco, a dealer and buying and selling trainer.

On the planet of buying and selling oscillators…

You could have the RSI indicator…

The Stochastic Indicator…

Heck – you also have the Stochastic RSI indicator!…

So, with all of the plethora of signs in the market…

What does the ROC indicator convey to the desk?…

…is it there to raised time your entries?

…or to name out developments, possibly?

Nope!

It’s there that can assist you pick out the most productive markets on your watchlist – so that you by no means need to second-guess your self once more!

That’s why in nowadays’s information you’ll be informed…

- What the ROC indicator is and the way it’s intended for use

- A confirmed and examined manner to choose the most productive shares to business with the ROC indicator

- The way to use the ROC indicator to select successful the Forex market pairs to business

- A backtesting end result to determine if the ROC indicator works or now not

This information might be the most important to toughen your buying and selling portfolio (particularly the remaining segment!).

So, get ready your notes and charts – and let’s get began!

What’s the ROC indicator and the way do you utilize it

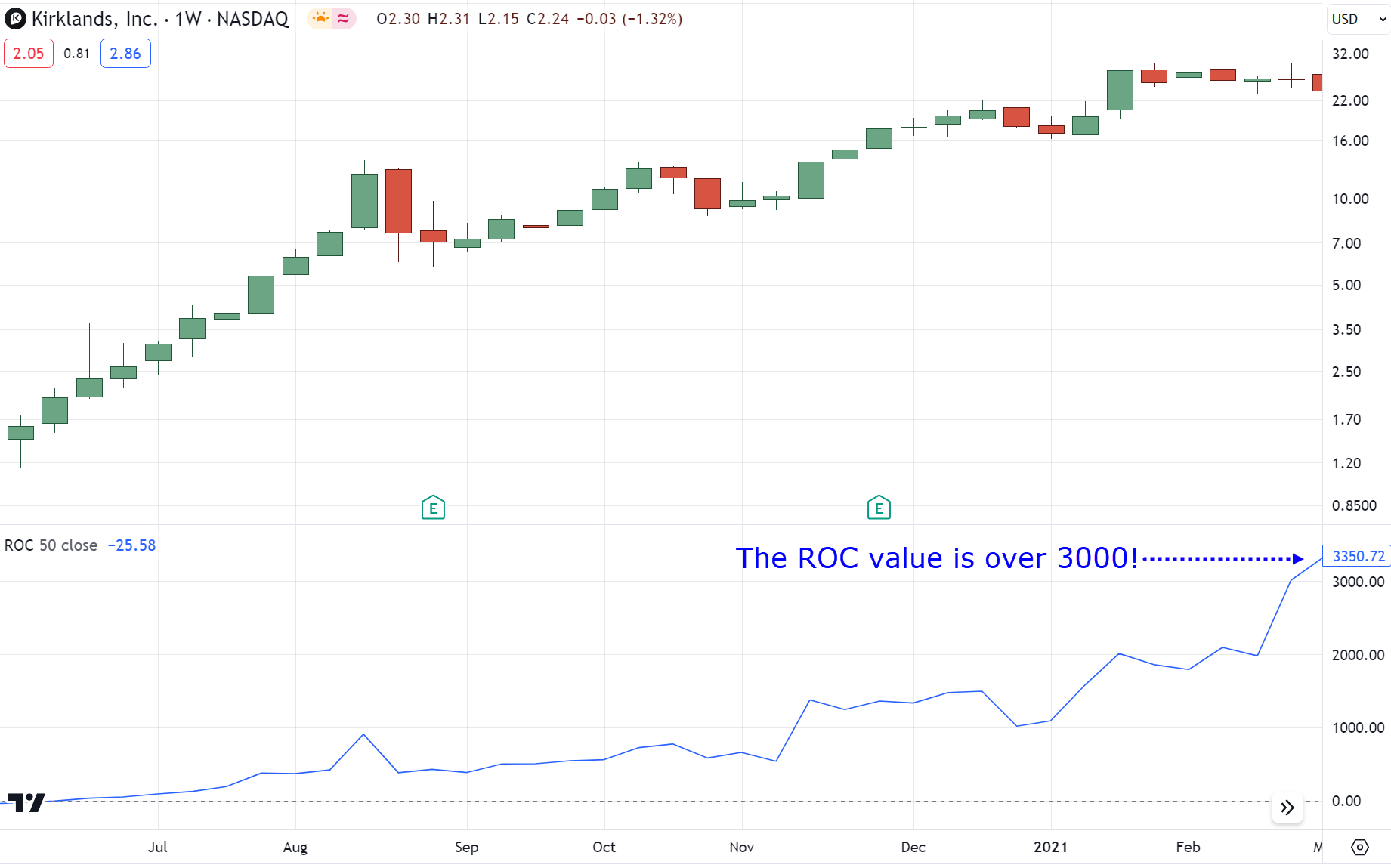

The speed of trade indicator (ROC) is a momentum-based oscillator advanced by means of Fred G. Schutzman again within the Fifties.

It’s existed for a gorgeous rattling long-time – and for excellent reason why!

However, how does it paintings?

In easy phrases…

The ROC indicator measures how robust or susceptible a marketplace is.

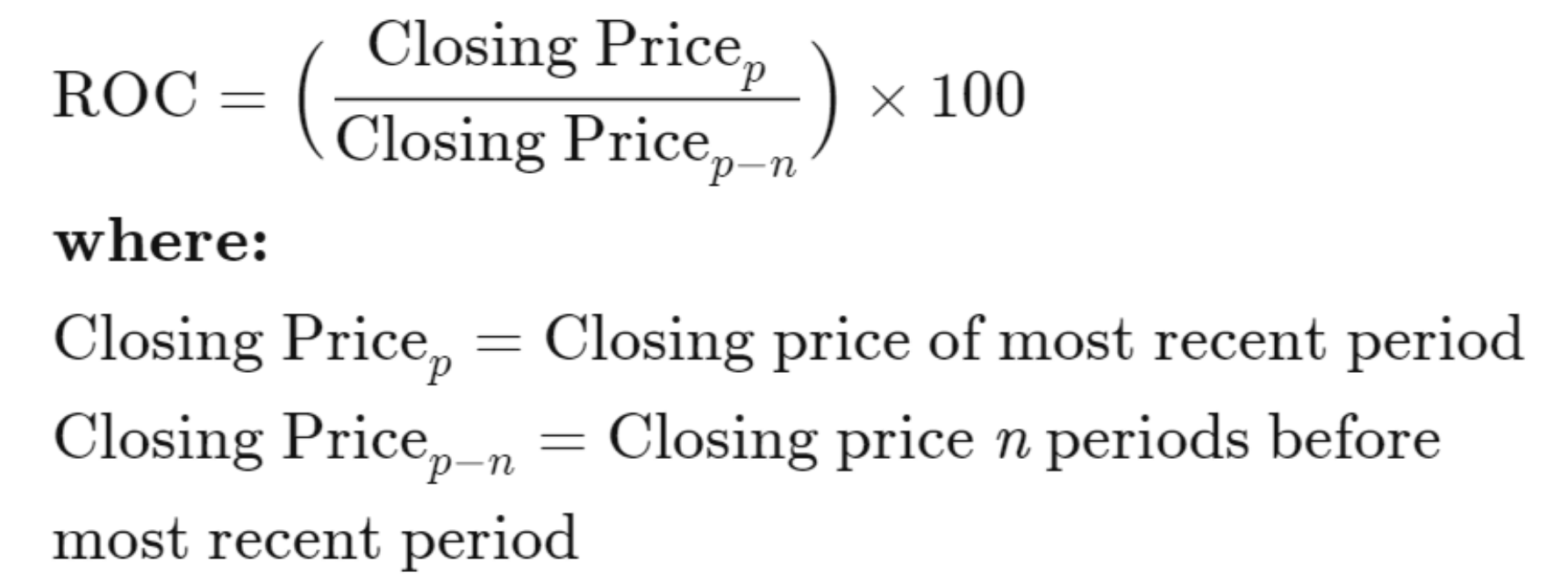

It does this by means of dividing the remaining last value by means of the former last value (relying at the era you select).

Right here’s what I imply:

Supply: Investopedia

To position it in easy phrases…

Let’s say you made a decision to check your bodily energy , between 2016 to 2019.

The ROC indicator can be an excellent metric for this – providing you with a transparent concept of simply how a lot issues had modified in that point

And that’s proper…

There are not any “overbought” and “oversold” ranges right here…

Merely put – the upper the price is, the more potent the marketplace is as a complete (in some way, a better or decrease worth approach the marketplace has been trending neatly).

Alright, now that you know the way it really works…

How do you utilize the ROC indicator?

Two phrases, my buddy…

Marketplace variety

That is what maximum new investors fail to notice.

…as they’re generally manner too serious about glossy new methods and signs!

However right here’s what I need to inform you at this time.

A constant manner to choose markets to business is the largest contributor to strong efficiency.

Now learn that once more.

Were given it?

Nice!

OK, I do know what you’re considering at this time…

“Alright, how precisely do I exploit the ROC indicator to choose markets to business?”

Smartly, you’re in for a deal with.

Let me display you within the subsequent segment…

The usage of the ROC indicator to select the most productive shares to business

“There are millions of shares in the market, which one do I input?”

“Which marketplace sector must I business shares on?”

Have you ever requested those questions earlier than?

I’m certain you might have!

And when the solution isn’t evident, what’s subsequent?

…Search for inventory guidelines, proper?!

Some “insider” information on which shares to select!?

After all, as you recognize, it’s by no means sustainable.

As a substitute…

What you want, to persistently pick out profitable shares, are 3 step by step processes:

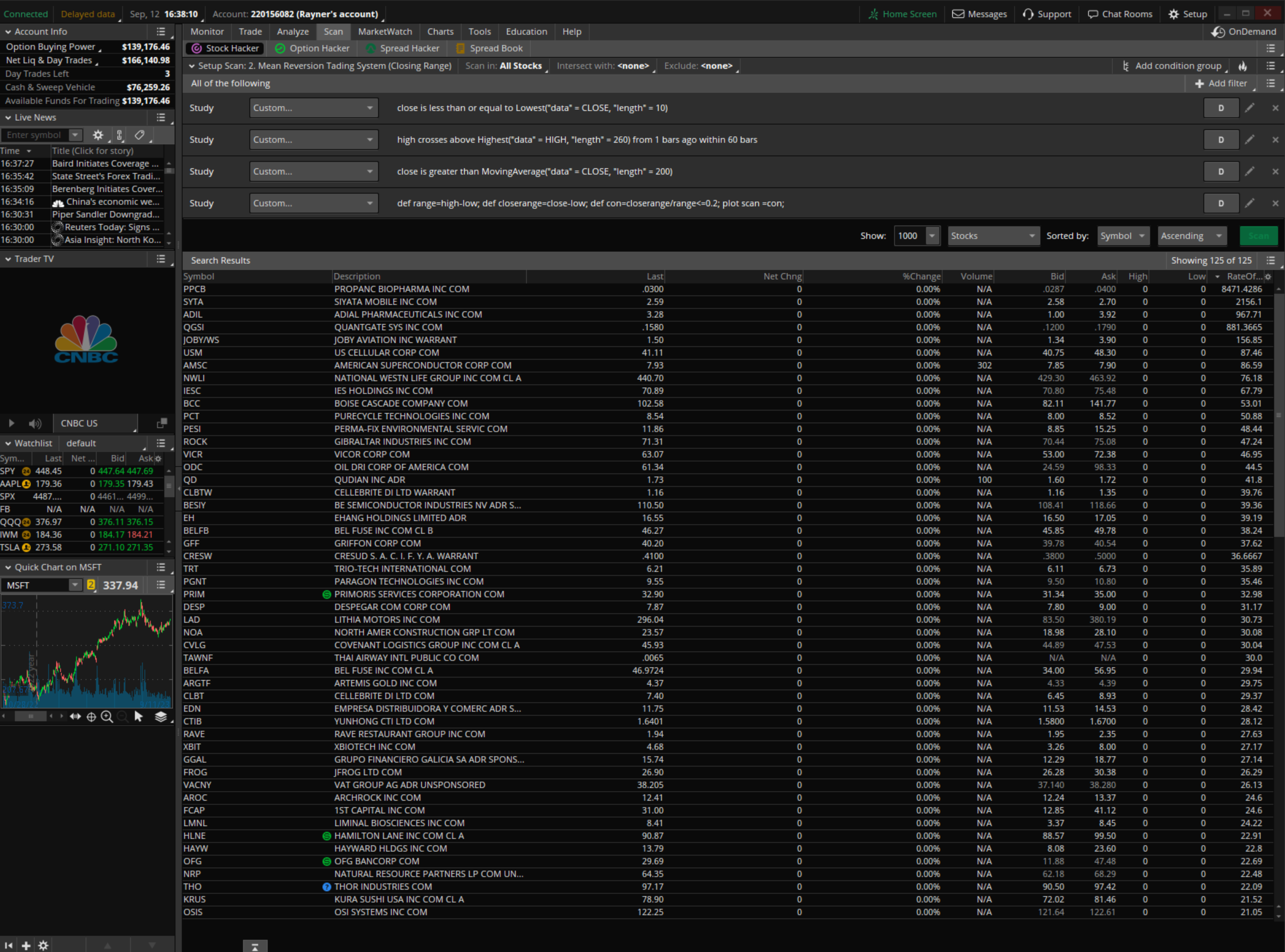

Step #1: Setup your pattern filter out

Similar to a buying and selling technique that tells you when to go into and go out your business…

A pattern filter out is very important in your buying and selling plan.

Now, in case you business the United States Inventory marketplace, you might have get admission to to screeners reminiscent of:

- Finviz

- TradingView

- Thinkorswim

…and more than likely extra.

And the most productive section?

They’re all loose!

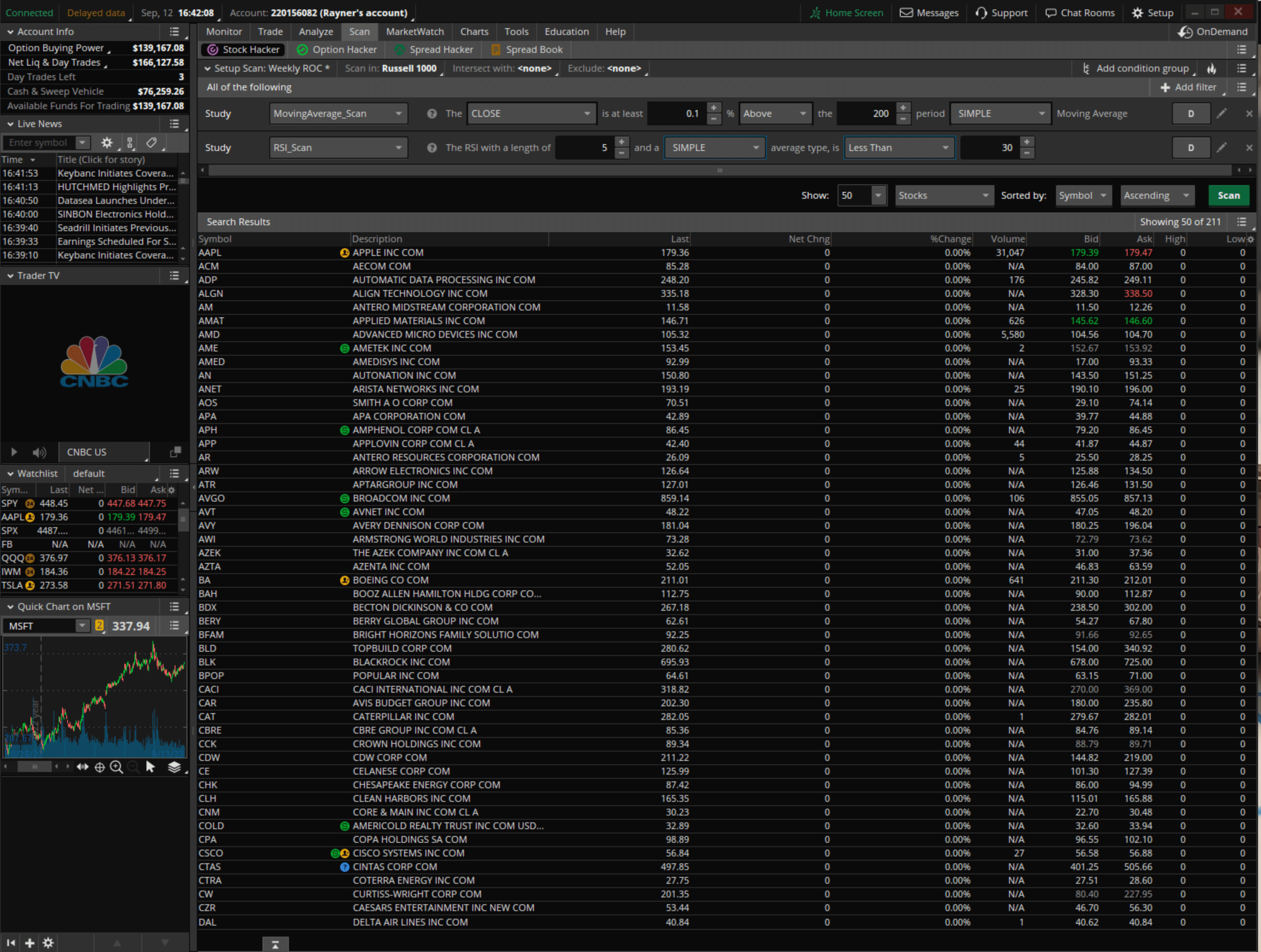

Alternatively, I’ll be the usage of Thinkorswim for instance for this buying and selling information…

And right here’s the article, my buddy…

Whilst I’ll proportion with you a screener that you’ll benefit from to your buying and selling…

…I’ll make it so simple as imaginable – so you might have numerous flexibility to tweak it in your personal!

Sound excellent?

Alright, so…

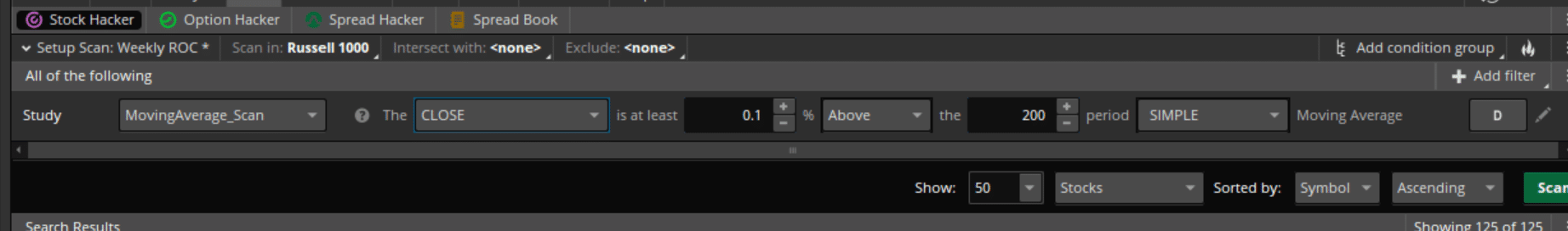

In the event you’re a pattern follower, you’ll merely upload a 200-day transferring reasonable in your filter out…

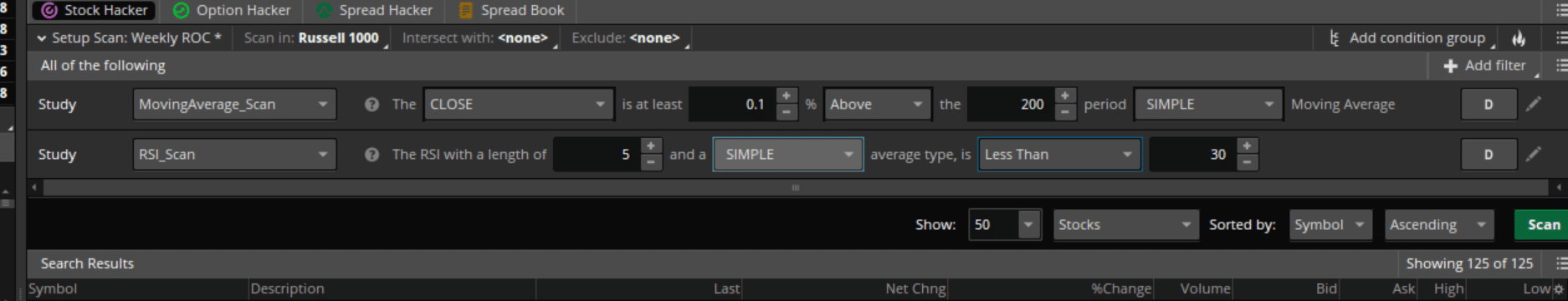

And in case you’re somebody who trades pullbacks throughout the pattern, you’ll additionally upload an RSI (relative energy index) into the combination…

However, “why the RSI?”, you might ask…

Smartly, that is your secret sauce – searching for trending shares which are creating a pullback!

So, if you carry out the scan on Russell 1000, search for trending shares (200 MA) creating a pullback (RSI).

You’ll see a few shares in your effects…

Once more, relying in your buying and selling method you’ll trade the filter out accordingly.

So – now you might have them…

…what do you do with those shares out of your screener?

…which of them must you business first?

I imply, you’ll’t business all of them, proper?

That is the place the ROC indicator chips into the combination.

Step #2: Upload the ROC indicator to the filter out effects

After getting the screener effects…

You merely upload the 50-week fee of trade…

What this does is that it provides every other “issue” or column out of your scan effects some time in the past!…

And by means of the best way…

I selected the 50-week ROC indicator era to measure the inventory’s energy over 12 months of knowledge (long-term energy)…

…however you’re loose to modify it to twenty to 30-period to measure a inventory’s medium-term energy.

What I imply is – there’s no “magic” quantity right here.

…it’s merely whether or not you want to resolve lengthy, quick, or medium-term energy!

Were given it?

So now you might have the ROC indicator values appearing up in your filter out…

…what’s subsequent?

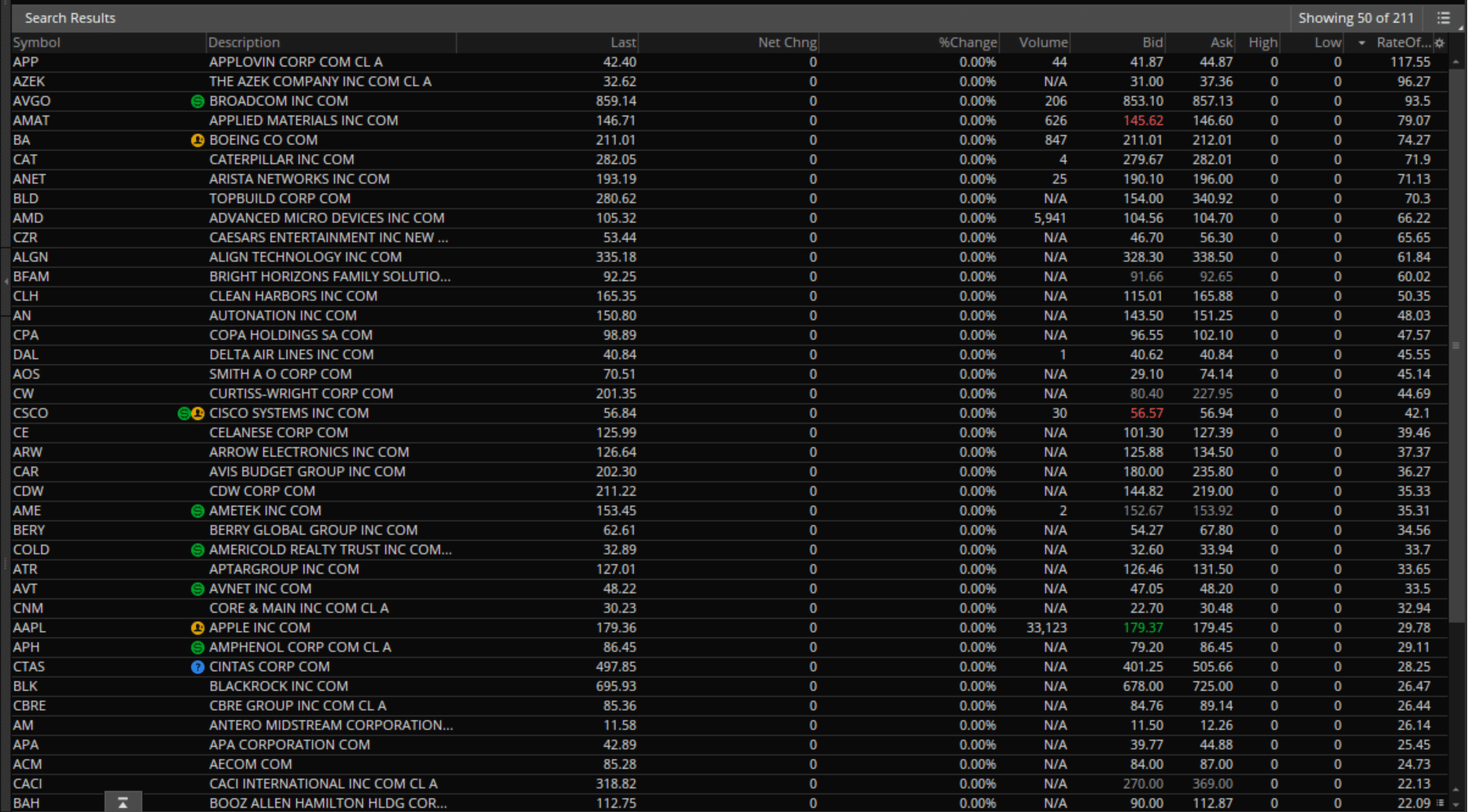

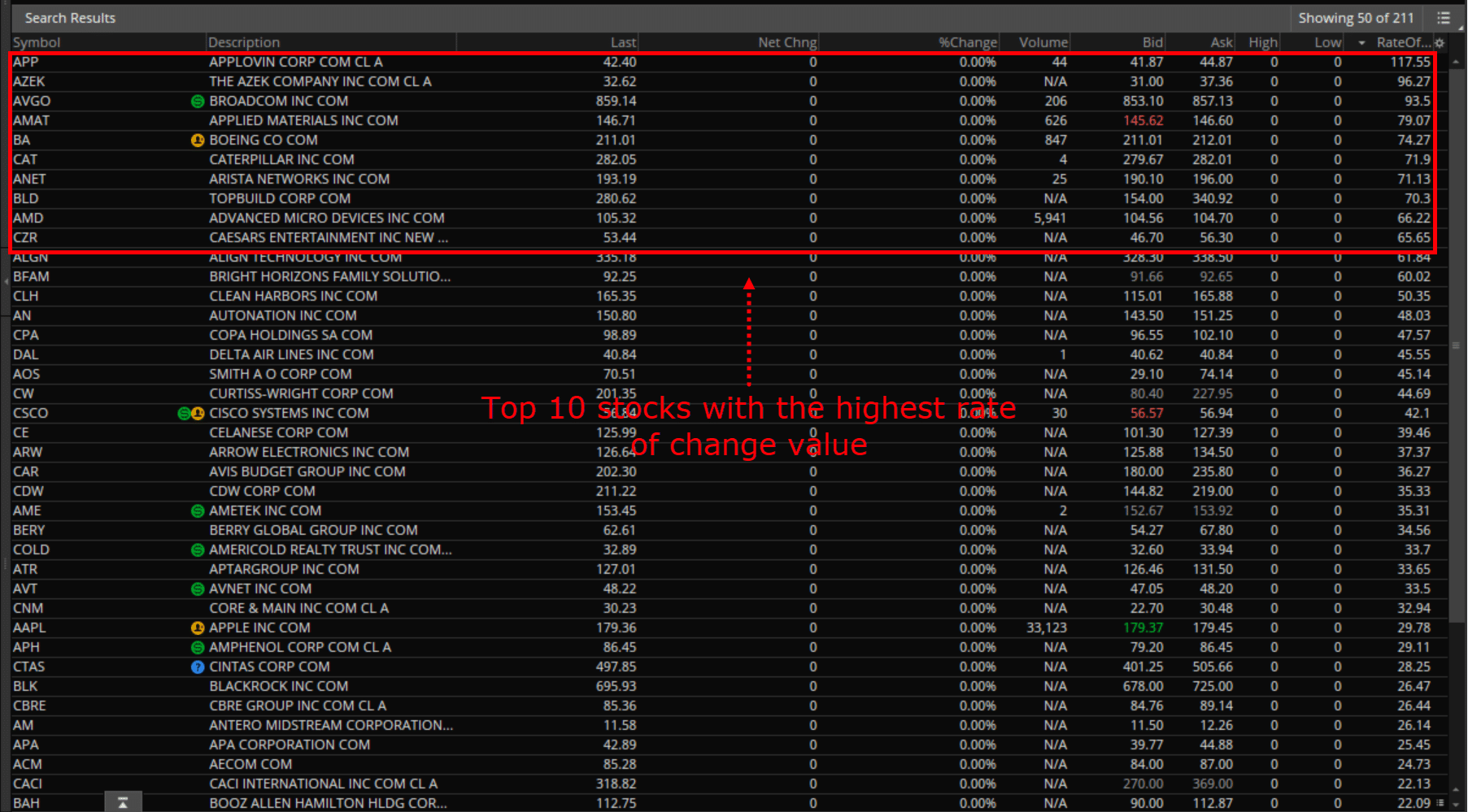

Step #3: Rank the shares with their ROC values accordingly (best possible to lowest)

After getting:

- Development filters set that enhances your buying and selling taste

- ROC indicator values appearing in your screener effects

The 3rd step is to easily to rank the ones values from best to backside…

And prioritize getting into the highest shares at the checklist!

So, In the event you allocate 10% of your portfolio on a inventory which offers you a max of 10 open trades…

Then best pick out the highest 10…

But when you have already got 6 open trades, then best pick out the highest 4 at the checklist.

Make sense?

Right here’s every other factor to remember…

I do know those steps might look like they’d take you without end to execute.

However if truth be told?

…it’ll best take you not up to 5 mins if you’ve arrange your screener!

It’s a small value to pay for persistently selecting profitable shares to business.

Alright, however…

…what in case you don’t business shares?

What in case you business forex?

Do the similar steps practice?

Smartly, sadly now not with this setup…

…however it may be achieved in a different way!

Let me display you the right way to do it…

How to choose foreign exchange pairs to business with the ROC indicator

As you recognize…

There are millions of shares in the market to business…

However within the foreign exchange marketplace?

…Roughly 100 pairs!

That’s manner not up to what you’re used to within the inventory marketplace, proper?

Nevertheless it’s additionally a possibility for the ROC indicator to take the highlight.

As a substitute of constructing a filter out, you’ll be the usage of the ROC indicator to make…

…a foreign money energy cheatsheet…

Step #1: Broaden a foreign money energy cheatsheet

In the event you recall…

The primary theory on why I make screeners is to search for robust shares to business.

However, how do you practice the similar theory when buying and selling the foreign exchange marketplace?

Let me display you.

First, you retrieve the present 50-week ROC indicator values from those pairs:

- USDJPY

- UPDATED

- USDGBP

- USDCHF

- USDCAD

- USDEUR

- USDNZD

Sure – you learn that proper!

The USD pair will have to be the bottom foreign money for this.

Subsequent, retrieve the values by means of pulling out an ROC indicator in your chart…

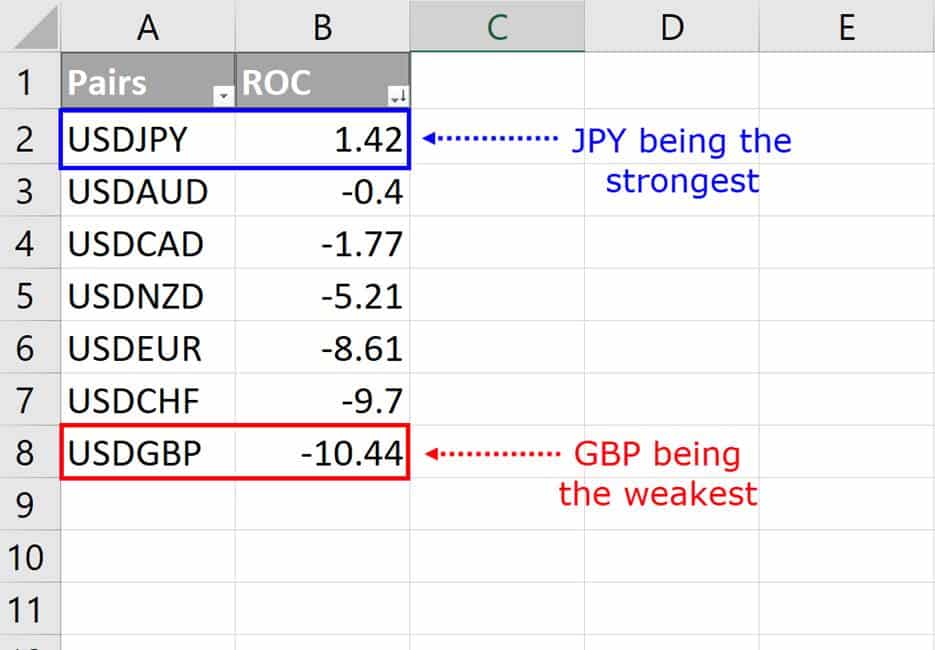

The values must glance one thing like this after gathering they all around the main pairs…

Now that you’ve this “cheat sheet”, what the heck do you do with it?

Step #2: Rank the ROC indicator values from best to backside

Lovely evident, proper?

It’s the similar factor I did just a bit whilst in the past!…

However there’s a twist right here…

Step #3: Fit the weakest and most powerful currencies

That is what makes the foreign exchange marketplace “the” foreign exchange marketplace.

There are all the time two currencies to believe, now not only one!

Now, in case you take a look at the cheatsheet…

…you’ll see that the JPY is the most powerful pair whilst GBP being the weakest pair.

(By means of the best way, the USD is all the time 0 as it’s the foundation)

Realizing those, what do you do subsequent?

You tournament them by means of including GBPJPY in your watchlist!

Easy, proper?

It’s nearly the similar factor as rating shares with the ROC indicator!

The most productive section is that you’ve flexibility over the rating desk, as you’re loose to cross-match different currencies…

So, you’ll believe buying and selling GBPNZD, GBPCAD, GBPAUD, GBPJPY, and so forth – for different currencies as neatly.

That’s all there’s to it!

It’s a constant way to choose foreign exchange pairs to business – the usage of the ROC indicator!

Oh – and sure, the ones ROC values do trade…

So, I counsel you refresh your watchlist each and every week!

Now…

I do know that I shared with you the right way to use the ROC indicator as a marketplace variety instrument for the inventory and foreign exchange markets.

However nonetheless…

It doesn’t trade the truth that it’s simply “a kind of” indicator traces in your chart!

So, to make this instrument stand out to your arsenal…

I’ll carry out a historic backtest to determine whether or not or now not this instrument works.

Able?

Then let’s get began…

The ROC indicator: Does it paintings?

For this take a look at…

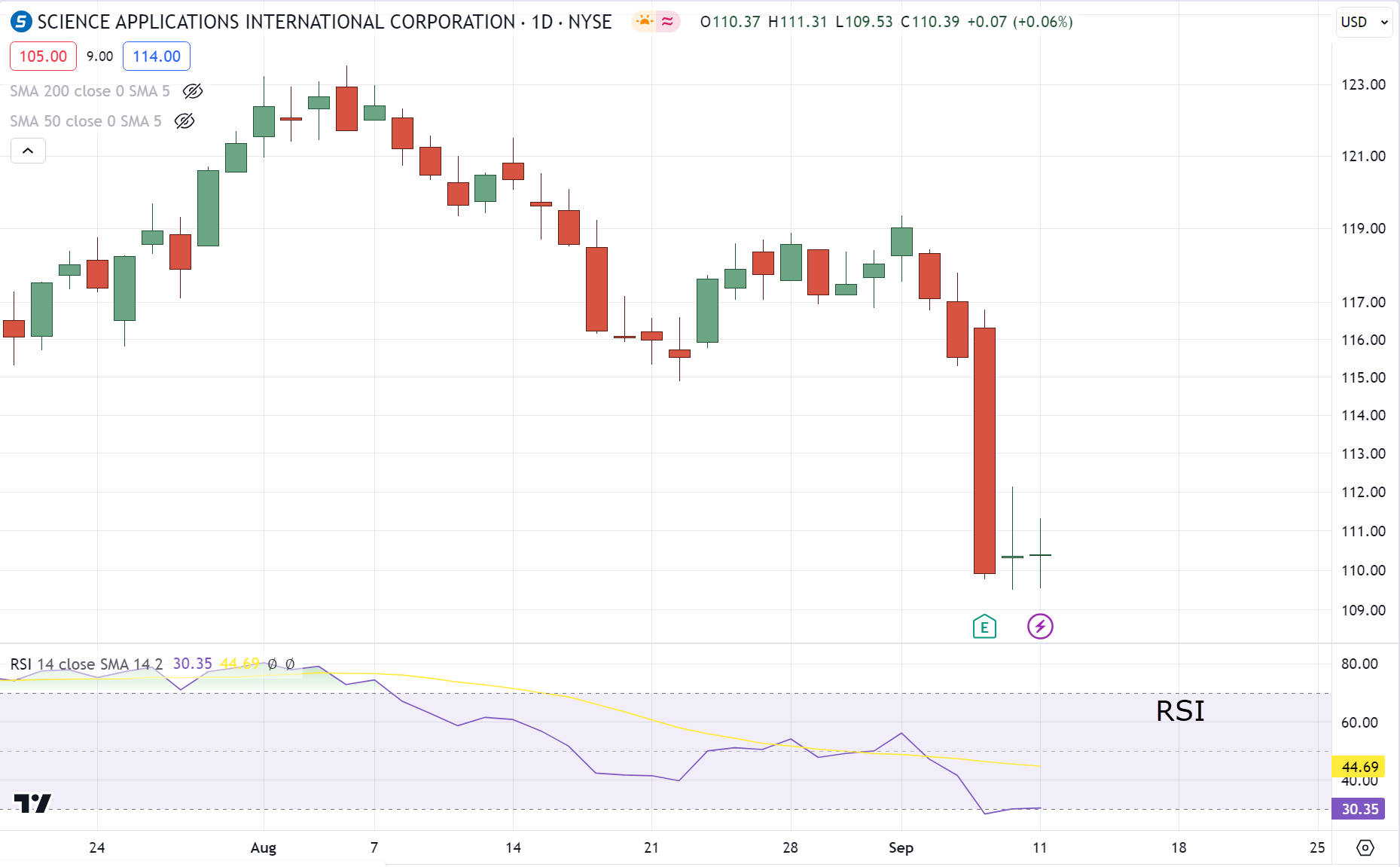

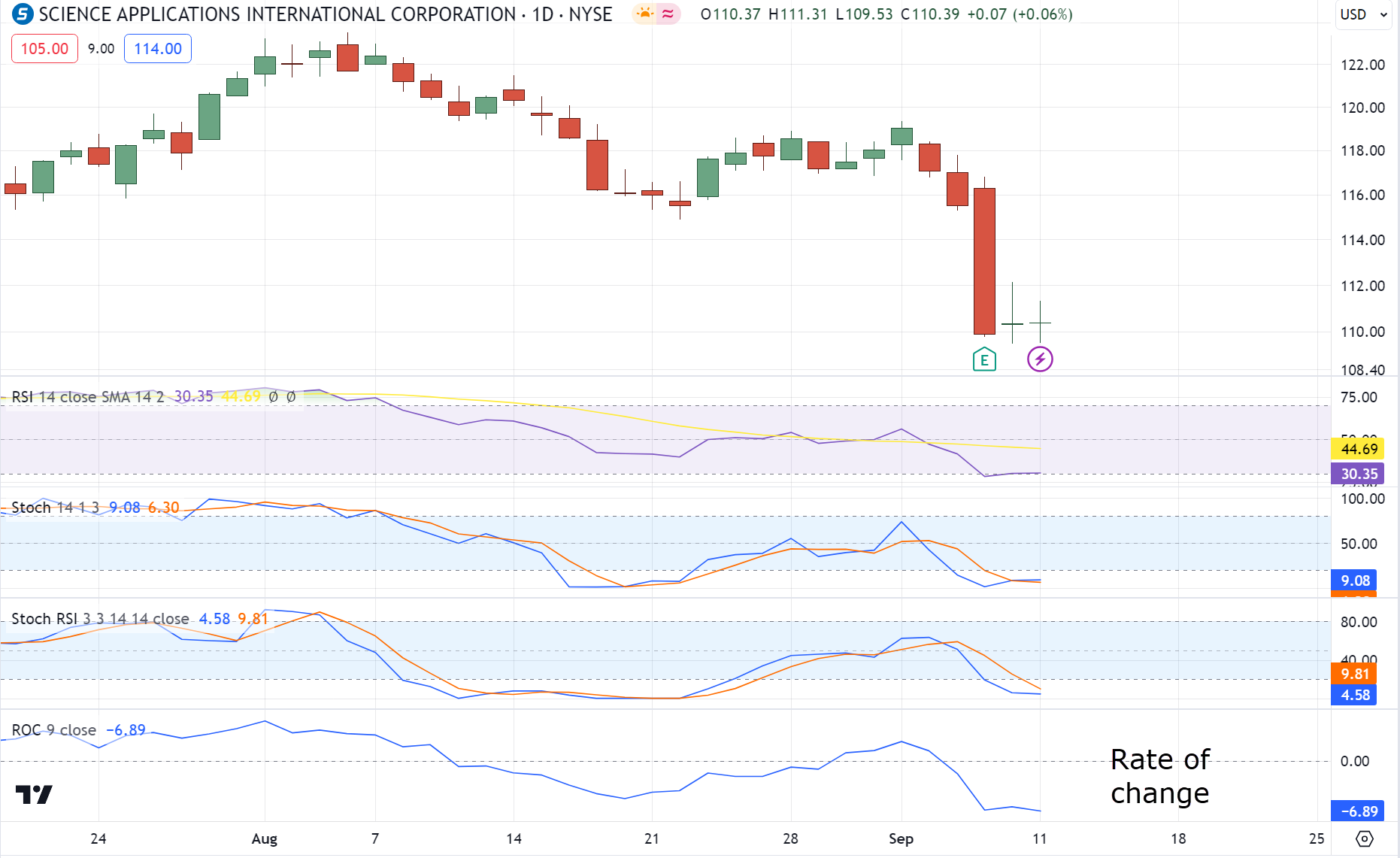

I’ll be the usage of an average reversion buying and selling technique with those laws:

- The inventory will have to be above the 200-period transferring reasonable

- The inventory will have to be underneath 2-period RSI 30

- If the inventory closes above RSI 30 input on the subsequent candle open

- Go out the inventory if it closes above 2-period RSI 50

- Allocate a max of 20% in keeping with inventory (max 5 open trades)

All transparent?

Smartly, after appearing a 20-year backtest with the Russell 1000 inventory marketplace universe…

Right here’s the way it carried out:

- Av annual go back: 8.81%

- Max drawdown: -27.77%

- Win fee: 61%

Now what in case you upload a 100-day ROC indicator filter into the combination the place you rank shares and prioritize buying and selling them?

- annual go back: 13.59%

- Max drawdown: -31.86%

- Win fee: 62.35%

Lovely spectacular, proper?

With out converting the foundations of the method, the efficiency of the gadget has higher!

I merely added a portfolio control rule with the ROC indicator!

Are you able to see how necessary that is?

So, the following time you come across a shedding streak…

…the very last thing you’d need to do is mess along with your technique…

Now at this level, I’m certain you already spotted that I attempted to make this information as sensible as imaginable…

…revealing as many secrets and techniques as I may just.

However all the time take into account…

…checking out the ROC indicator first is the most important earlier than striking your hard earned cash at the line.

Proper! Let’s do a handy guide a rough recap…

Conclusion

The ROC indicator can simply be a “loose improve” in your present buying and selling technique.

It’s a versatile indicator that may be a welcome boost to any buying and selling plan.

So, even supposing you have already got a ton of signs in your chart,

You’ll stay them there and use the ROC indicator that can assist you navigate the place the “giant fishes” are on this huge sea of markets to business.

Nevertheless, right here’s what you’ve realized for nowadays’s information:

- The ROC indicator measures how robust or susceptible a marketplace is, by means of merely evaluating the present value with the former costs (the upper or decrease the values are, the easier)

- The speed of trade indicator can simply be used to business the inventory markets, by means of rating your screener effects in line with its effects

- Making a foreign money energy meter that’s in line with the ROC indicator is a will have to, to resolve the most powerful and the weakest currencies to pair and business

- A backtest end result that presentations how the ROC indicator can toughen your effects, with out even converting your present technique

And there you pass, my buddy!

An entire (no bars held) information to the usage of and buying and selling with the ROC indicator!

So, right here’s what I need to know…

Have you ever been anticipating this information for some time after listening to this indicator more than one instances on movies?

Will you believe the usage of the ROC indicator to your technique after nowadays’s information?

Let me know within the feedback underneath!