Solana skilled an important surge of roughly 20% all through the previous few days of September and into the primary week of October. This unexpected worth building up has piqued the hobby of buyers and fanatics alike, sparking discussions about its underlying reasons.

One outstanding query on other folks’s minds is whether or not this uptick in SOL’s worth is immediately correlated with Bitcoin’s efficiency all through the similar length or if there are distinct elements using SOL’s worth upward push independently of Bitcoin’s actions.

Earlier than this building up, SOL had a tricky time as a result of a U.S. court docket allowed the sale of $1.3 billion value of SOL from the bankrupt change FTX. So, there’s interest about whether or not SOL’s fresh worth leap is hooked up to Bitcoin or if there are different elements in the back of it.

Solana: Demanding situations And Marketplace Attract

The Solana (SOL) blockchain community has noticed fresh difficulties, alternatively it has garnered important consideration and insist out there. Regardless of the lackluster worth efficiency of its local token, the proof-of-stake (PoS) community has utilised the undergo marketplace to give a boost to its technological functions and forge necessary alliances with outstanding entities within the realm of conventional banking.

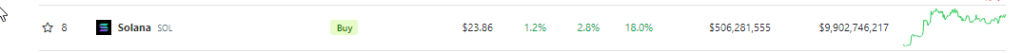

Supply: Coingecko

The chapter court docket has carried out mechanisms to mitigate the prospective antagonistic affect of FTX asset liquidation at the cryptocurrency marketplace. Those measures contain mandating the sale of belongings via a monetary consultant in weekly installments, adhering to predetermined laws.

On the time of writing, SOL used to be buying and selling at $23.43, down a measly 0.3% within the closing 24 hours, however received sustained an 18% rally within the closing seven days, information from crypto marketplace tracker Coingecko presentations.

SOL Liquidity Soars With Community Balance

Nansen, an on-chain analytics company, not too long ago printed a file on Solana, highlighting its key strengths and doable. Solana is understood for its cost-efficiency and high-speed transactions, incomes it the nickname “The Ethereum Killer.” It boasts a transaction processing pace of over 3,000 transactions in keeping with 2d, which is just about 30 instances sooner than Ethereum.

The chain’s liquidity advanced on account of the dramatic building up in community balance. At press time, the TVL with regards to SOL used to be $27.12 million, greater than double what it used to be in the beginning of the yr.

SOL marketplace cap recently at $9.7 billion. Chart: TradingView.com

Solana’s Upward thrust Fueled through DApps And NFTs, Goals Fifth-Greatest Crypto Spot

The surge of SOL used to be additional strengthened through the growth within the adoption of decentralized programs (DApps) and the upward push in nonfungible token (NFT) volumes at the Solana blockchain.

The present worth of SOL is now making efforts to ascertain a strengthen degree at $23, aiming to solidify its place because the fifth-largest cryptocurrency (except for stablecoins) with regards to marketplace capitalization.

Within the fresh Epoch 512, 19.637 million SOL had been unstaked, with a web unstake of 16.516 million SOL (about $372 million). Maximum belonged to a16z and the former Alameda (now or ftx property).

a16z: BZpEFk…oPPBm7 unstaked 5.006 million SOL, a16z-2: GCmFQL…ozXMwY unstaked 2.033…

— Wu Blockchain (@WuBlockchain) October 6, 2023

In the meantime, fresh updates to Solana Compass have published information about fresh actions at the Solana community, in particular all through the 512 epoch.

The site that assists in keeping tabs on SOL staking process suggests that there have been round 19.637 million SOL cash that had been unstaked all through this time.

(This website online’s content material will have to no longer be construed as funding recommendation. Making an investment comes to possibility. Whilst you make investments, your capital is matter to possibility).

Featured symbol from iStock