Are you on the lookout for pupil mortgage forgiveness? You might imagine that there are just one or two methods – and you might have learn the headline “they do not paintings”. However actually, there are over 80 methods (and counting), and you’ll have a greater likelihood than you are expecting to qualify.

Scholar loans generally is a nice funding to your long run, or generally is a large burden if now not absolutely concept out or abused. Should you recently have a pupil mortgage or are eager about getting pupil loans, you want to understand in case you are eligible for pupil mortgage forgiveness.

We estimate that no less than 50% of pupil mortgage debtors qualify to have all or a part of your pupil mortgage will also be canceled in a procedure referred to as Scholar Mortgage Forgiveness. To qualify, you should carry out volunteer paintings, carry out army carrier, observe medication in explicit communities, or meet different standards.

There are such a large amount of other pupil mortgage forgiveness methods to be had it may be onerous to understand the place to start out. And for lots of, it actually relies on your scenario and what your monetary (and profession) targets are.

The function of this information is to mix as most of the alternative ways to seek out pupil mortgage forgiveness (and reimbursement help) into one spot to make it simple so that you can get lend a hand in your pupil mortgage debt.

Let’s take a look at the entire pupil mortgage forgiveness choices to be had for you:

Reimbursement Plan Based totally Scholar Mortgage Forgiveness

Those pupil mortgage forgiveness plans are tied in your pupil mortgage reimbursement plan. In case you are on such a qualifying reimbursement plans, you’ll be able to be eligible for pupil mortgage forgiveness on the finish of your reimbursement time period.

Maximum debtors qualify for pupil mortgage forgiveness thru such a “secret” techniques. The name of the game is inconspicuous: join a qualifying pupil mortgage reimbursement plan, and any final stability in your mortgage can be forgiven on the finish of the plan.

You have to observe that those income-driven reimbursement plan choices due have some standards that should be met to be eligible. If you don’t have any final stability on the finish of the mortgage time period, you get no pupil mortgage forgiveness.

It is usually necessary to notice that the coed mortgage forgiveness on those plans is in most cases regarded as taxable revenue. On the other hand, President Biden made all mortgage forgiveness and discharge tax-free Federally thru December 31, 2025. Be told extra about taxes and pupil mortgage forgiveness right here.

You’ll be able to follow for those reimbursement plans with pupil mortgage forgiveness by way of calling your lender or logging on to StudentLoans.gov.

Source of revenue-Based totally Reimbursement (IBR)

The Source of revenue Based totally Reimbursement Plan (IBR) is among the maximum not unusual reimbursement plans debtors transfer to if they’re having monetary hardship. You probably have loans from ahead of July 1, 2014, you cost is probably not upper than 15% of your discretionary revenue. In this plan, you’re going to make bills for 25 years, and at that time, your loans can be forgiven.

In case you are a borrower with loans after July 1, 2014, your mortgage is not going to exceed 10% of your discretionary revenue, and the mortgage can be forgiven after simply twenty years.

With IBR, you mortgage reimbursement won’t ever exceed the cost of the ten yr same old reimbursement plan, and your mortgage may also be forgiven on the finish of the time period.

The real quantity of your “discretionary revenue” is made up our minds by way of a system according to your circle of relatives measurement and revenue tax returns. Take a look at our Discretionary Source of revenue Calculator to determine what your discretionary revenue can be.

Pay As You Earn (PAYE)

The Pay As You Earn Reimbursement Plan (PAYE) is similar to the IBR Plan. With PAYE, you’re going to now not pay greater than 10% of your discretionary revenue, and your mortgage may also be forgiven after twenty years.

The important thing distinction is that simplest positive loans going again to 2007 qualify for this plan.

With PAYE, you mortgage reimbursement won’t ever exceed the cost of the ten yr same old reimbursement plan, and your mortgage may also be forgiven on the finish of the time period.

For each IBR and PAYE, it could make sense to report your tax go back married submitting one by one to qualify.

Saving On A Precious Schooling (SAVE)

The Saving on a Precious Schooling (SAVE) plan is a brand new pupil mortgage reimbursement plan that may be a changed model of RePAYE (which is now not to be had to debtors).

The reimbursement plan nonetheless caps your cost at 5% to ten% of your discretionary revenue, relying on whether or not you took out simplest undergraduate loans, or had graduate college loans as neatly.

This plan additionally comprises mortgage forgiveness (in a worst case state of affairs) of both 20 or 25 years. Once more, it is twenty years for simplest undergraduate loans, and 25 years for graduate college loans.

On the other hand, for debtors who input reimbursement with $12,000 or much less, you’re going to obtain mortgage forgiveness in 10 years if you do not repay the loans ahead of then. Moreover, twelve months is added for every additional $1,000 you will have. Should you input reimbursement with $13,000, that is 11 years.

In any case, SAVE now not has unfavourable amortization of hobby. That means in case your mortgage cost does not quilt the “complete” quantity, your stability may not develop. It is a large win for debtors.

You’ll be able to be told extra in regards to the new SAVE pupil mortgage reimbursement plan right here.

Source of revenue Contingent Reimbursement (ICR)

The Source of revenue Contingent Reimbursement Plan (ICR) is a bit other than IBR or PAYE. There aren’t any preliminary revenue necessities for ICR, and any eligible purchaser might make bills beneath this plan. Underneath this plan, your bills would be the lesser of the next:

- 20% of your discretionary revenue

- What you may pay on a reimbursement plan with a hard and fast cost over the process 12 years, adjusted in line with your revenue

With the ICR plan, your loans can be forgiven on the finish of 25 years.

You have to observe that with this plan, your bills may just finally end up being upper than the usual 10 yr reimbursement plan. Since you need to post your revenue yearly, in case your revenue rises excessive sufficient, your cost will regulate accordingly.

Occupation-Based totally Scholar Mortgage Forgiveness Choices

Relying on what form of profession trail you select, you might want to qualify for more than a few other pupil mortgage forgiveness choices.

The preferred choice is Public Carrier Mortgage Forgiveness. The reason being that this plan provides the largest quantity of forgiveness within the shortest time period – tax loose. It is usually open to a large number of other jobs beneath the umbrella of “public carrier”.

On the other hand, it is not the one career-based choice.

Public Carrier Mortgage Forgiveness (PSLF)

Public Carrier Mortgage Forgiveness Program will grant pupil mortgage forgiveness on qualifying loans after 120 bills (10 years).

That is the number 1 absolute best approach to get pupil mortgage forgiveness in case you are eligible.

The beauty of public carrier is that the definition could be very extensive. Qualifying employment is any employment with a federal, state, or native executive company, entity, or group or a not-for-profit group that has been designated as tax-exempt by way of the Interior Earnings Carrier (IRS) beneath Phase 501(c)(3) of the Interior Earnings Code (IRC). The sort or nature of employment with the group does now not subject for PSLF functions.

As an example:

- Govt Employees (Federal, State, Native)

- Emergency control

- Army carrier

- Public protection or legislation enforcement services and products

- Public well being services and products

- Academics (Take a look at pupil mortgage forgiveness for lecturers)

- Public schooling or public library services and products

- College library and different school-based services and products

- Public hobby legislation services and products

- Early youth schooling

- Public carrier for people with disabilities and the aged

The group should now not be a exertions union or a partisan political group.

The opposite side of PSLF is that you just should be on a qualifying pupil mortgage reimbursement plan. To find out the absolute best pupil mortgage reimbursement plans right here.

Or, take a look at our information: The Final Information To Public Carrier Mortgage Forgiveness (PSLF).

Brief Expanded PSLF (TEPSLF)

In case you are on the lookout for Brief Expanded Public Carrier Mortgage Forgiveness, take a look at this information: Brief Expanded PSLF (TEPSLF). This program is in particular created for individuals who have Direct Loans, had qualifying employment, however weren’t on the proper reimbursement plan to qualify.

Biden Waiver

In case you are having a look details about the particular Biden Waiver that expires in October 2022, then take a look at this information on What To Do With Your FFEL Loans? This Waiver is in particular designed to lend a hand individuals who have the flawed mortgage kind qualify for PSLF by way of consolidating right into a Direct Scholar Mortgage.

Legal professional Scholar Mortgage Forgiveness Program

This program is for legal professionals who paintings for the U.S. Division of Justice. The Division anticipates settling on new legal professionals every yr for participation on a aggressive foundation and renewing present beneficiaries all through present carrier tasks, topic to availability of price range. ASLRP advantages are paid immediately to the mortgage holder, to not the person legal professional. Preliminary acceptance of ASLRP investment triggers a three-year carrier legal responsibility to Justice.

You’ll be able to be told extra about this program right here.

Similar: Do not disregard to take a look at our complete information to Scholar Mortgage Forgiveness for Attorneys.

College Mortgage Reimbursement Program

The College Mortgage Reimbursement Program from the Well being Useful resource and Services and products Management (HRSA) is helping recruit and retain well being professions college participants by way of encouraging scholars to pursue college roles of their respective well being care fields. That is important for getting ready and supporting the following era of educators.

You’ll be able to obtain as much as $40,000 in pupil mortgage reimbursement, along side more money to lend a hand offset the tax burden of this system.

You’ll be able to be told extra about this program right here.

Federal Worker Scholar Mortgage Reimbursement Program

The Federal pupil mortgage reimbursement program allows companies to pay off Federally insured pupil loans as a recruitment or retention incentive for applicants or present staff of the company.

This plan lets in Federal companies to make bills to the mortgage holder of as much as a most of $10,000 for an worker in a calendar yr and a complete of no more than $60,000 for anybody worker.

You have to observe that an worker receiving this receive advantages should signal a carrier settlement to stay within the carrier of the paying company for a length of no less than 3 years.

An worker should reimburse the paying company for all advantages gained if she or he is separated voluntarily or separated involuntarily for misconduct, unacceptable efficiency, or a unfavourable suitability decision beneath 5 CFR section 731. As well as, an worker should deal with a suitable degree of efficiency in an effort to proceed to obtain reimbursement advantages.

Moreover, you should join this program when you find yourself employed. You’ll be able to’t return in your HR division after you might be already hired and ask for it.

You’ll be able to be told extra about this program right here.

Indian Well being Services and products Mortgage Reimbursement Program

The Indian Well being Carrier (IHS) Mortgage Reimbursement Program awards as much as $20,000 in keeping with yr for the reimbursement of your certified pupil loans in alternate for an preliminary two-year carrier legal responsibility to observe complete time at an Indian well being program web page.

You’ll be able to be told extra about this program right here.

John R. Justice Scholar Mortgage Reimbursement Program

The John R. Justice Scholar Mortgage Reimbursement Program (JRJ) supplies mortgage reimbursement help for state public defenders and state prosecutors who agree to stay hired as public defenders and prosecutors for no less than 3 years.

This program supplies reimbursement advantages as much as $10,000 in any calendar yr or an combination overall of $60,000 in keeping with legal professional.

You’ll be able to be told extra about this program right here.

Nationwide Well being Carrier Corps

The Nationwide Well being Carrier Corps (NHSC) provides tax-free mortgage reimbursement help to reinforce certified well being care suppliers who make a selection to take their abilities the place they’re maximum wanted.

Authorized well being care suppliers might earn as much as $50,000 towards pupil loans in alternate for a two-year dedication at an NHSC-approved web page throughout the NHSC Mortgage Reimbursement Program (NHSC LRP).

Authorised members might function number one care clinical, dental, or psychological/behavioral well being clinicians and will make a selection to serve longer for added mortgage reimbursement reinforce.

Precedence attention is given to eligible candidates whose NHSC-approved web page has a HPSA ranking of 26 to fourteen, in descending order. Eligible candidates might obtain as much as $50,000 in mortgage reimbursement for an preliminary carrier dedication till investment is exhausted.

You’ll be able to be told extra about this program right here.

Nationwide Institutes of Well being (NIH) Mortgage Forgiveness

The 5 NIH extramural Mortgage Reimbursement Methods (LRPs) come with the Medical Analysis LRP, Pediatric Analysis LRP, Birth control & Infertility Analysis LRP, Well being Disparities Analysis LRP, and Medical Analysis LRP for People from Deprived Backgrounds

In go back for mortgage repayments, LRP awardees are legally sure to a carrier legal responsibility to behavior qualifying analysis supported by way of a home nonprofit or U.S. executive (Federal, state, or native) entity for fifty % in their time (no less than 20 hours a week according to a 40-hour week) for 2 years. NIH makes quarterly mortgage repayments concurrent with the awardees’ delight in their carrier legal responsibility.

Cost projections are according to eligible instructional debt at first date of the LRP contract. The NIH will pay off 25 % of the eligible schooling debt, as much as a most of $35,000 in keeping with yr.

Be told extra about this program right here.

NURSE Corps Mortgage Program

The Nurse Corps Reimbursement Program helps registered nurses (RNs), complicated observe registered nurses (APRNs), and nurse college by way of paying as much as 85% in their unpaid nursing schooling debt.

You should paintings at an eligible Important Scarcity Facility in a excessive desire space (for RNs, APNs), and feature attended an authorized college of nursing (for nurse college). You should additionally satisfy two years of labor on this space.

You’ll be able to be told extra about this program right here.

Similar: Do not disregard to take a look at our complete information to Scholar Mortgage Forgiveness For Nurses.

SEMA Mortgage Forgiveness Program

It is a scholarship and mortgage forgiveness program that rewards people who get started a profession within the automobile trade. You should paintings for an employer that is a part of the Strong point Apparatus MarketAssociation (SEMA).

Notice: This program is the legislation, however Congress has did not allocate cash to this system.

Take a look at another choices for pupil mortgage forgiveness for engineering majors.

This program can pay $2,000 towards exceptional pupil loans, mailed immediately in your lender.

You’ll be able to be told extra right here.

Instructor Mortgage Forgiveness Program

Underneath the Instructor Mortgage Forgiveness Program, should you train full-time for 5 entire and consecutive instructional years in a low-income college or instructional carrier company, and meet different {qualifications}, you can be eligible for forgiveness of as much as $17,500.

There are a large number of nuances and choices on this program, and we wreck down the entire main points right here: Scholar Mortgage Forgiveness for Academics.

It is usually necessary to notice how PSLF and Instructor Mortgage Forgiveness play in combination, and why PSLF is more than likely the simpler selection for many.

You’ll be able to know about this program right here.

USDA Veterinary Drugs Mortgage Reimbursement Program

It is a program for many who observe veterinary medication. This program can pay as much as $25,000 every yr against certified instructional loans of eligible veterinarians who comply with serve in a NIFA-designated veterinarian scarcity scenario for a length of 3 years.

You’ll be able to to find out the timing and be told extra details about this program right here.

U.S. Army Scholar Mortgage Forgiveness Choices

Serving our nation generally is a nice profession. And there are excellent incentives to enroll and serve. Scholar mortgage forgiveness has been such a methods.

In case you are taking into consideration a profession within the army, to find out if they’re going to lend a hand pay down or do away with your pupil mortgage debt. You’ll be able to additionally take a look at our complete information to army and veteran schooling advantages.

Air Power Faculty Mortgage Reimbursement Program

The principle Air Power Faculty Mortgage Reimbursement program is paused in 2018 (unfortunately). This program allowed you to stand up to $10,000 in pupil mortgage debt paid off in 3 years.

On the other hand, the Air Power JAG pupil mortgage reimbursement program continues to be lively. You’ll be able to obtain as much as $65,000 in pupil mortgage forgiveness should you cross into JAG within the Air Power.

You’ll be able to be told extra about this program right here.

Military Faculty Mortgage Reimbursement Program

The Military Faculty Mortgage Reimbursement program is probably the most beneficiant of the entire branches, nevertheless it does have some giant “catches” that you want to concentrate on.

First, this program will forgive as much as $65,000 of your pupil mortgage debt for extremely certified people who enlist in one of the most Military’s vital army occupational specialties (MOS).

On the other hand, to qualify, you should have this written into your enlistment contract, AND you should surrender your Publish 9/11 GI Invoice. So, in case you are eager about going again to university, this will not be a excellent deal.

You’ll be able to be told extra about this program right here.

Nationwide Guard Scholar Mortgage Reimbursement Program

The Nationwide Guard Scholar Mortgage Reimbursement program provides mortgage forgiveness as much as $50,000 for qualifying Federal loans for guardsmen who enlist for no less than 6 years.

There also are different phrases and stipulations that should be met for this program.

You’ll be able to be told extra about this program right here.

Military Scholar Mortgage Reimbursement Program

The Military Scholar Mortgage Reimbursement Program is considered one of a number of Military enlistment schooling incentive methods designed to pay federally assured pupil loans (as much as $50,000) thru 3 annual bills all through a Sailor’s first 3 years of carrier.

You should join this program while you enlist, and your recruiter should come with this program to your recruiting forms.

You’ll be able to be told extra about this program right here.

Military Energetic Accountability Well being Professions Scholar Mortgage Reimbursement Program

The Military maintains pupil mortgage forgiveness methods for many who observe medication or dentistry whilst in carrier.

On most sensible of bonuses in pay, they pupil mortgage reimbursement of as much as $120,000, paid in $40,000 installments over 3 years.

You’ll be able to be told extra about this system right here.

Military Well being Professions Scholar Mortgage Reimbursement Program

The Military additionally provides pupil mortgage reimbursement help for many who observe medication whilst in carrier.

You’ll be able to obtain as much as $40,000 in keeping with yr in pupil mortgage reimbursement advantages.

You’ll be able to be told extra about this program right here.

State-Based totally Scholar Mortgage Forgiveness Choices

Nearly each state in america provides some form of pupil mortgage forgiveness or pupil mortgage reimbursement help choice for his or her citizens. Some states have rather a couple of methods that you might want to benefit from.

You’ll be able to discover the other states on our State-by-State Information to Scholar Mortgage Forgiveness, and likewise you’ll take a look at the hyperlinks to more than a few states right here:

Alabama – Alabama is among the few states that does not have a pupil mortgage forgiveness program.

Alaska – Alaska recently has one program.

Arizona – Arizona recently has 3 methods.

Arkansas – Arkansas recently has two methods.

California – California recently has 3 forgiveness methods.

Colorado – Colorado recently has 3 forgiveness methods.

Connecticut – Connecticut is among the few states that does not have a pupil mortgage forgiveness program.

Delaware – Delaware recently has one pupil mortgage forgiveness program.

Florida – Florida recently has two pupil mortgage forgiveness methods.

Georgia – Georgia recently has one pupil mortgage forgiveness program.

Hawaii – Hawaii recently has one pupil mortgage forgiveness program.

Idaho – Idaho recently has one pupil mortgage forgiveness program.

Illinois – Illinois recently has 4 pupil mortgage forgiveness methods.

Indiana – Indiana recently has one pupil mortgage forgiveness program.

Iowa – Iowa recently has six pupil mortgage forgiveness methods.

Kansas – Kansas recently has 3 pupil mortgage forgiveness methods.

Kentucky – Kentucky recently has one pupil mortgage forgiveness program.

Louisiana – Louisiana recently has 3 pupil mortgage forgiveness methods.

Maine – Maine recently has 5 pupil mortgage forgiveness methods.

Maryland – Maryland recently has 3 pupil mortgage forgiveness methods.

Massachusetts – Massachusetts recently has one pupil mortgage forgiveness program.

Michigan – Michigan recently has two pupil mortgage forgiveness methods.

Minnesota – Minnesota recently has ten pupil mortgage forgiveness methods.

Mississippi – Mississippi recently has one pupil mortgage forgiveness program.

Missouri – Missouri recently has 3 pupil mortgage forgiveness methods.

Montana – Montana recently has 3 pupil mortgage forgiveness methods.

Nebraska – Nebraska recently has one pupil mortgage forgiveness program.

Nevada – Nevada recently has one pupil mortgage forgiveness program.

New Hampshire – New Hampshire recently has two pupil mortgage forgiveness methods.

New Jersey – New Jersey recently has 3 pupil mortgage forgiveness methods.

New Mexico – New Mexico recently has 3 pupil mortgage forgiveness methods.

New York – New York recently has 9 pupil mortgage forgiveness methods.

North Carolina – North Carolina recently has 3 pupil mortgage forgiveness methods.

North Dakota – North Dakota eradicated all their pupil mortgage forgiveness methods.

Ohio – Ohio recently has two pupil mortgage forgiveness methods.

Oklahoma – Oklahoma recently has 3 pupil mortgage forgiveness methods.

Oregon – Oregon recently has 3 pupil mortgage forgiveness methods.

Pennsylvania – Pennsylvania recently has two pupil mortgage forgiveness methods.

Rhode Island – Rhode Island recently has 3 pupil mortgage forgiveness methods.

South Carolina – South Carolina recently has one pupil mortgage forgiveness program.

South Dakota – South Dakota recently has one pupil mortgage forgiveness program.

Tennessee – Tennessee is among the few states without a methods.

Texas – Texas recently has 9 pupil mortgage forgiveness methods.

Utah – Utah is among the few states without a pupil mortgage forgiveness methods.

Vermont – Vermont recently has 5 pupil mortgage forgiveness methods.

Virginia – Virginia recently has 3 pupil mortgage forgiveness methods.

Washington – Washington recently has one pupil mortgage forgiveness program.

West Virginia – West Virginia is among the few states without a pupil mortgage forgiveness methods.

Wisconsin – Wisconsin recently has one pupil mortgage forgiveness program.

Wyoming – Wyoming recently has two pupil mortgage forgiveness methods.

The District of Columbia – Washington D.C. recently has two pupil mortgage forgiveness methods.

Employer-Based totally Scholar Mortgage Reimbursement Help Methods

Some employers are actually providing pupil mortgage reimbursement help to their staff as an worker receive advantages. We attempt to stay monitor of the entire record of employers that provide this receive advantages, and as of this newsletter we all know of no less than 17 employers providing pupil mortgage reimbursement help in america.

Those come with some main corporations, similar to Constancy, Aetna, Nvidia, and extra.

You’ll be able to to find the complete record of employers providing pupil mortgage reimbursement help right here.

Employer-based pupil mortgage forgiveness could also be tax-free thru December 31, 2025.

Volunteering-Based totally Scholar Mortgage Forgiveness Choices

Imagine it or now not, there are alternatives to get pupil mortgage forgiveness for volunteering! Now, this is not the similar as volunteering at your native church or meals financial institution. This does require some critical volunteering that is just about an identical to full-time paintings.

AmeriCorps Schooling Award

Should you volunteer with AmeriCorps NCCC, AmeriCorps State and Nationwide, or AmeriCorps VISTA and entire a 12-month time period, you might want to be eligible to obtain help as much as the price of a Pell Grant – which is recently $5,920.

There are advantages to be had to those who entire complete time carrier the entire means right down to associate carrier (simply 100 hours).

You’ll be able to be told extra about this program right here.

Scholar Mortgage Discharge Choices

There also are techniques to get your pupil loans discharged in some instances. We believe pupil mortgage discharged to be a bit bit other than forgiveness, each because of the character of the best way the mortgage is eradicated and the prospective taxability surrounding it.

There are more than a few discharge choices you might qualify for.

Closed College Discharge

This program is for debtors who may just now not entire their program of analysis since the college closed whilst they had been enrolled or inside 120 days in their attendance.

On the other hand, to be eligible, it additionally implies that you weren’t in a position to switch your credit to every other eligible establishment.

Should you suppose this will follow to you, to find the precise touch right here.

False Certification (Identification Robbery) Discharge

You probably have loans taken out to your identify that were not yours – because of identification robbery or different false certification (this implies somebody cast your signature or data on a pupil mortgage), you’re eligible to have your pupil loans discharged.

There are a large number of steps you want to take in case your identification was once stolen and pupil loans had been taken out. You will have to additionally report a police document. Take a look at our complete information to identification robbery and pupil loans.

You’ll be able to to find the false certification discharge software right here.

Loss of life Discharge

You probably have Federal pupil loans, they’re discharged upon loss of life of the borrower. Even for Father or mother PLUS Loans, if the coed dies, the loans will nonetheless be discharged.

That does not imply there don’t seem to be headaches – that may be expensive. Learn this information to what occurs in your pupil loans while you die.

You probably have non-public pupil loans, the cosigner continues to be most probably 100% accountable for the stability of the mortgage. It is one of the most the explanation why we propose non-public mortgage cosigners get a existence insurance coverage at the borrower.

You’ll be able to be told extra about pupil mortgage discharge because of loss of life right here.

Overall and Everlasting Incapacity Discharge

Should you turn into utterly and completely disabled, you can be eligible to have your pupil loans discharged.

To qualify, a health care provider should certify that the borrower is not able to interact in really extensive gainful task because of a bodily or psychological impairment. This impairment should be anticipated to lead to loss of life or ultimate for a continuing length of no less than 60 months, or it should have already lasted for a continuing length of no less than 60 months.

Any final stability in your Federal pupil loans can be discharged from the date that your doctor certifies your software.

The Secretary of Veteran Affairs (VA) too can certify the borrower to be unemployable because of a service-connected incapacity. If the VA qualified your software, any Federal pupil mortgage quantities owed after the date of the service-related harm can be discharged, and any bills you made after your harm can be refunded to you.

Debtors will also be eligible for discharge if they’ve been qualified as disabled by way of the Social Safety Management (SSA) the place the awareness of award for Social Safety Incapacity Insurance coverage (SSDI) or Supplemental Safety Source of revenue (SSI) advantages signifies that the borrower’s subsequent scheduled incapacity overview can be inside 5 to 7 years.

Should you had been authorised because of the SSA decision, any final stability in your Federal pupil loans can be discharged. This receive advantages lately turned into tax-free because of Trump’s pupil mortgage reform.

You’ll be able to be told extra about Incapacity Discharge right here.

Chapter Discharge

Many of us falsely consider that pupil loans can’t be discharged in chapter.

The truth is, debtors could also be eligible to have their pupil loans discharged in chapter – however it is uncommon. You’ll have to turn out to the pass judgement on that repaying your loans can be an undue hardship.

This same old calls for you to turn that there’s no probability of any long run skill to pay off. This key truth – long run skill – is tricky since the long run is a very long time. Shall we say you might be 35 years previous. Are you able to actually say that over the following 50 years you’ll be able to by no means earn sufficient to pay off the loans? It is a tricky same old.

Because of this, it may be tough to discharge Federal pupil loans thru chapter—however now not not possible.

Moreover, many attorneys (or even some judges) don’t seem to be conscious about methods to maintain pupil loans and chapter. You will have to make certain that you will have an legal professional absolutely versed within the necessities if you’re eager about pursing this direction.

Perkins Mortgage Cancellation Choices

Perkins loans perform very another way that the majority pupil loans. Those loans are presented and administered by way of the place you attended college. In addition they have much more mortgage forgiveness choices than different mortgage sorts.

Perkins loans have distinctive necessities for mortgage cancellation according to the sector you’re employed in. Faculties award those Federal loans to high-need scholars attending or making plans to wait school. Remember to fill out the FAFSA every yr and take a look at your monetary help award to peer should you qualify.

Relying at the occupation (see record under), Perkins mortgage debtors may have as much as 100% in their mortgage cancelled over the route of five years (except for when indicated).

Right here’s the way it works:

- 15% in their primary stability and collected hobby will also be cancelled after their first and 2d yr of qualifying carrier.

- 20% in their primary stability and collected hobby will also be cancelled after their 3rd and fourth yr.

- 30% in their primary stability and collected hobby will also be cancelled after their 5th yr.

Perkins loans additionally be offering concurrent deferment if you’re appearing qualifying carrier.

Combining that postponement with those cancellation choices approach you might want to doubtlessly by no means must make bills on those loans. That is an incredible deal!

The professions eligible for cancellation and the necessities are indexed under.

Energetic-Accountability Coming near near Risk Space: You should serve within the U.S. Armed Forces in a adversarial hearth or impending risk space. Chances are you’ll obtain forgiveness for as much as 50% of your exceptional loans in case your lively accountability ended ahead of August 14, 2008. Chances are you’ll obtain as much as 100% forgiveness of your exceptional loans in case your lively accountability comprises or started after August 14, 2008.

Legal professional: You should be a full-time legal professional hired in a Federal or neighborhood defender group. You should carry out certified carrier that started on or after August 14, 2008. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Kid or Circle of relatives Services and products Company: You should be a full-time worker of a public or non-profit kid or circle of relatives services and products company offering services and products to high-risk youngsters and their households from low-income communities. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Firefighter Or Legislation Enforcement: You should be a full-time firefighter, legislation enforcement officer, or corrections officer, whose carrier started on or after August 14, 2008. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

HeadStart: You should be a full-time group of workers member within the schooling part of a HeadStart program. Chances are you’ll obtain as much as 100% forgiveness of your loans, paid out as 15% of the primary stability and collected hobby for every yr of carrier.

Intervention Services and products Supplier: You should be a full-time certified skilled supplier of early intervention services and products for the disabled. Carrier should have begun on or after August 14, 2008. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Librarian: You should be a librarian with a grasp’s stage operating in a Identify I-eligible fundamental or secondary college or in a public library serving Identify I-eligible faculties (to find the record of qualifying faculties right here). You should had been hired on or after August 14, 2008. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness..

Nurse or Clinical Technician: You should be a full-time nurse or clinical technician. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness. Take a look at our complete information to pupil mortgage forgiveness for nurses.

Pre-kindergarten or Kid Care: You should be a full-time group of workers member in a pre-kindergarten or kid care program this is authorized or regulated by way of a state. You should had been hired on or after August 14, 2008. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Speech Pathologist: You should be a full-time speech pathologist with a grasp’s stage operating in a Identify I-eligible fundamental or secondary college. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Instructor – Scarcity Space: You should be a full-time instructor of math, science, international languages, bilingual schooling, or different fields designated as instructor scarcity spaces. Chances are you’ll obtain as much as 100% forgiveness of your loans.

Instructor – Particular Schooling: You should be a full-time particular schooling instructor of youngsters with disabilities in a public college, nonprofit fundamental or secondary college, or instructional carrier company. If the carrier is at an academic carrier company, it should come with August 14, 2008, or have begun on or after that date. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Tribal Faculty College: You should be a full-time college member at a tribal school or college. Your carrier should come with August 14, 2008, or have begun on or after that date. Chances are you’ll obtain as much as 100% pupil mortgage forgiveness.

Understand For Personal Scholar Mortgage Debt

Unfortunately, you probably have non-public loans, there don’t seem to be any explicit techniques to get pupil mortgage forgiveness. Personal pupil loans act a lot more like a automobile mortgage or loan – in that you just pay your quantity and do not need any particular methods along with your mortgage.

There are doubtlessly some choices, and we wreck them down right here: Assist With Personal Scholar Mortgage Debt.

In case you are on the lookout for techniques to decrease your non-public pupil mortgage cost, you could believe pupil mortgage refinancing. You’ll be able to doubtlessly decrease your rate of interest or trade your reimbursement period – each which might decrease your per month cost considerably (and perhaps prevent cash).

We advise Credible to check refinancing choices. You’ll be able to see if it is sensible to refinance in as low as 2 mins. Plus, Faculty Investor readers stand up to a $1,000 present card bonus after they refinance with Credible. Take a look at Credible right here.

Or, take a look at our record of the most productive puts for pupil mortgage refinancing.

Tax Penalties From Scholar Mortgage Forgiveness

You have to observe that whilst those “secret” pupil mortgage forgiveness choices might be useful to a couple debtors, for others they are going to lead to tax penalties (see taxes and pupil mortgage forgiveness).

On the other hand, President Biden lately signed the American Restoration Act, which makes all mortgage discharge and pupil mortgage forgiveness, without reference to mortgage kind or program, tax loose. That is in impact thru December 31, 2025. State taxes might range, so the tips under might nonetheless follow in your state tax go back.

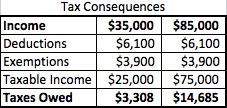

What occurs is the forgiven quantity of the coed mortgage is added to the debtors taxable revenue for the yr. So, should you had $50,000 in pupil loans forgiven beneath those reimbursement plans, it is thought of as revenue. Should you made $35,000 operating, your overall revenue for the yr would now be $85,000. The end result? The next tax invoice.

On the other hand, for lots of debtors, this tax invoice is a lot more manageable than the unique debt itself, so the plan is sensible. The usage of a very easy instance, here’s what the tax invoice will appear to be in each eventualities:

As you’ll see, with those reimbursement plans, you’ll be able to owe an extra $11,377 in Federal Source of revenue Tax within the yr you do it. On the other hand, that is inexpensive than paying the unique $50,000 plus hobby. Moreover, there are alternatives to determine a reimbursement plan with the IRS if you want to, which will also be useful to your scenario.

Insolvency and Forgiveness

What in case you are had an enormous quantity of pupil mortgage debt forgiven and your tax invoice is big? It is a giant worry of a few other folks… That is the place insolvency comes into play.

Insolvency occurs when your overall liabilities exceed the honest marketplace worth of your belongings. You’ll be able to even be in part bancrupt in case your pupil mortgage debt simplest in part exceeds your liabilities.

Belongings are outlined as: money, shares, and retirement plans, actual property and possession hobby in a trade or partnership. The IRS additionally comprises belongings which can be tough to worth similar to clothes, home items, and equipment.

Liabilities come with present and past-due expenses, pupil loans (together with the loans being forgiven), and trade loans.

So, shall we embrace that you’ve got $100,000 in belongings (house fairness, retirement plans, and so forth). Shall we say you will have $200,000 in debt, with $100,000 in pupil loans being forgiven.

So, $200,000 – $100,000 approach you might be $100,000 bancrupt. Because the worth of the coed loans being forgiven is $100,000 – none of it’ll be incorporated in your taxes and won’t depend against your taxable revenue.

This will actually lend a hand debtors who’re frightened about massive quantities of taxable revenue from having their pupil loans forgiven.

We now have a complete article on Insolvency and Scholar Mortgage Forgiveness right here.

Scholar Mortgage Forgiveness FAQs

Listed here are probably the most most frequently asked questions on pupil mortgage forgiveness:

What qualifies you for pupil mortgage forgiveness?

Scholar mortgage forgiveness is according to your employment and mortgage kind. Your college and your stage don’t subject. Some forms of mortgage forgiveness are utterly according to merely being on a qualifying reimbursement plan.

How do I follow for pupil mortgage forgiveness?

Every form of pupil mortgage forgiveness program varies. For many, you fill out the proper shape and post it in your lender. For mortgage forgiveness as a part of your reimbursement program, your loans are mechanically forgiven on the finish of the time period.

The place do I to find pupil mortgage forgiveness methods?

Maximum methods are presented by way of the Division of Schooling, and administered thru your mortgage servicer. On the other hand, virtually each state has some form of mortgage forgiveness program, and employers also are beginning to be offering pupil mortgage reimbursement help.

Are you able to get mortgage forgiveness for personal pupil loans?

Unfortunately, non-public pupil loans don’t be offering any form of pupil mortgage forgiveness.

How lengthy does it take to get your pupil loans forgiven?

Every program has a distinct time period. The shortest are 5 years, for instructor mortgage forgiveness, and the longest are 25 years, which is for income-based reimbursement.

How can I do away with pupil loans legally?

Mortgage forgiveness is one approach to do away with pupil loans. You’ll be able to additionally pay them off, or participate in a reimbursement help program presented by way of your employer.

Ultimate Ideas

The key is that there are a large number of other pupil mortgage forgiveness choices. We have proven you over 80 alternative ways to get pupil mortgage forgiveness.

It sounds adore it might be complicated, nevertheless it doesn’t need to be. Have in mind, you’ll join those methods without spending a dime at StudentAid.gov.

Additionally, should you suppose you want navigating those choices or your pupil loans, you’ll glance into getting skilled lend a hand. We advise the use of Chipper, which is an app that is helping you prepare and pay down your pupil loans, in addition to follow for mortgage forgiveness you qualify for. Plus, they’ve a pupil mortgage concierge that can assist you for a small price. Take a look at Chipper right here >>

If you want extra in-depth help, take a look at the Scholar Mortgage Planner. It is a staff of CFPs which can be professionals in pupil mortgage debt and help you put in combination a complete monetary plan that addresses your pupil loans and existence targets. It is pricier, however for complicated eventualities or massive quantities of debt, it may be price it. Take a look at the Scholar Mortgage Planner right here >>

Tell us should you’ve taken good thing about any of those methods! We would like to understand how a lot you might have stored.