Once a year, Ohio’s minimal salary rises in response to inflation. With each minimal salary building up, small industry house owners want to be sure their payroll is up-to-the-minute and compliant in addition to accounting for greater exertions prices of their funds.

By accident paying your other folks the flawed salary can depart what you are promoting open to pricey fines and complaints — and also you’ll chance disillusioned team of workers and a nasty recognition.

Our final information will let you know the whole thing you wish to have to learn about Ohio minimal salary 2024. We’ll display you find out how to keep on most sensible of minimal salary adjustments so you’ll steer clear of nasty surprises and really feel assured you’re paying your other folks correctly.

Working out Ohio minimal salary for tipped and non-tipped staff

Consistent with the Ohio Division of Trade, the present minimal salary throughout Ohio for non-tipped staff is $10.45 consistent with hour, as of January 1, 2024. That’s an $0.35 building up from 2023’s minimal salary fee. The minimal salary applies to staff of companies with annual gross receipts of greater than $385,000 consistent with yr.

It is a little other for “tipped staff” — categorized as staff who steadily earn greater than $30 per 30 days in pointers, like servers, bartenders, and hairdressers. The minimal hourly salary for tipped staff in Ohio is $5.25 in 2024 (up from $5.05 final yr).

Despite the fact that tipped staff will also be paid a decrease money salary, employers want to ensure that their staff’ pointers and base pay upload as much as an hourly reasonable of a minimum of $10.45 around the pay length. If now not, employers are answerable for topping up their paycheck.

That suggests it’s additional essential for small industry house owners in provider or different tipped industries to stay observe of pointers in addition to wages. Payroll equipment like Homebase could make the method easy with tip scarcity calculation purposes that robotically complement staff’ wages once they fall brief on pointers.

Exceptions to Ohio minimal salary 2024

All companies with gross receipts of over $385,000 consistent with yr will have to pay Ohio’s minimal salary. Alternatively, SMBs who make much less have an exemption underneath Ohio legislation: they are able to pay the present federal minimal salary of $7.25 consistent with hour as a substitute.

There also are exemptions for various classes of staff.

Some key exemptions come with:

- Staff underneath the age of 16

- Folks hired as babysitters or live-in partners, if their tasks are carried out within the employer’s house and don’t come with home tasks

- Staff inside family-owned and operated companies who’re members of the family of the landlord

- Individuals who voluntarily supply charitable services and products in hospitals or well being establishments without cost

- Group of workers at youngsters’s camps or leisure spaces which are run by means of non-profit organizations

A sub-minimum salary fee will also be paid in instances the place this may occasionally steer clear of hardship and lack of employment alternatives for the ones with psychological or bodily disabilities, however this will have to agree to the laws of the Director of the Ohio Division of Trade.

Minimal salary adjustments

On January 1, 2024, Ohio’s minimal salary greater to $10.45 hourly for non-tipped staff and $5.25 consistent with hour for tipped staff, in keeping with the Ohio Division of Trade.

The exemption threshold for companies may also be upper: the brand new minimal salary most effective applies to staff of businesses who gross greater than $385,000 consistent with yr.

The legislation in the back of this pay building up is a 2006 Constitutional Modification in Ohio that ties the state minimal salary to the Shopper Value Index for the former yr. That signifies that wages upward thrust once a year in response to inflation.

There also are projects in positive towns in Ohio encouraging employers to pay wages upper than the present minimal. As an example, the Town of Cleveland has partnered with One Truthful Salary to supply positive companies, like eating places and occasional retail outlets, a grant to pay their team of workers extra.

Time beyond regulation pay necessities

On most sensible of the bottom minimal salary, Ohio employers will have to pay extra time — at 1.5 occasions the common hourly fee — to team of workers for any hours over 40 they paintings in one week.

There’s an exception to this for companies with lower than $150,000 in gross receipts.

As all small companies know, extra time prices can creep up unexpectedly — particularly in case your corporate depends upon shift paintings.

Let’s say your eating place rosters team of workers on a 2-2-3 agenda, the place some weeks, groups will paintings 5 12-hour shifts in per week.

That’s a complete of 60 hours labored within the week (5 days x 12 hours every day).

The primary 40 hours are paid on the common fee of $10.45 consistent with hour, totaling $418.00. However the remainder 20 hours are calculated at time-and-a-half, which quantities to $15.67 consistent with hour in Ohio. You’ll finally end up paying $313.50 in extra time, and $731.50 for this 40-hour week.

To steer clear of mounting prices, you’ll need to both take a unique way to worker scheduling or plan for those exertions prices.

In addition to deliberate shift paintings, small industry house owners want to keep on most sensible of surprising extra time prices because of last-minute agenda adjustments or quilt.

Posting & Recordkeeping Necessities

Along with paying the criminal minimal and extra time wages, Ohio employers will have to agree to particular posting and recordkeeping regulations.

At every place of business or task web site, companies are required to show the newest respectable Ohio Minimal Salary poster revealed by means of the Ohio Division of Trade’s Department of Business Compliance — this adjustments every yr with updates to the minimal salary.

Employers will have to additionally stay transparent payroll information for no less than 3 years, appearing the identify, cope with, profession, and fee of pay for every person worker, in addition to a complete file in their hours labored consistent with day and week and what sort of they had been paid for every pay length.

Failing to fulfill those documentation requirements can cause fines and investigations, so it’s the most important that small companies make a choice the precise device to stay observe of payroll.

Tricks to agree to Ohio minimal salary

Staying compliant with evolving Ohio exertions regulations and minimal salary regulations takes effort as a small industry proprietor. However non-compliance way risking monetary consequences, complaints, harm on your recognition, and disillusioned staff.

Right here’s find out how to keep away from violations and make minimal salary compliance a concern:

- On the finish of the yr, be aware new minimal salary charges that can come into impact in January. Set calendar reminders so that you don’t put out of your mind.

- Obtain and publish the newest respectable Ohio Minimal Salary poster prior to January 1 every yr to obviously be in contact criminal charges to staff — and agree to the legislation.

- Prior to minimal salary will increase take impact, replace your payroll programs, timekeeping equipment, and accounting device. Gear like Homebase can warn you when there’s a metamorphosis and robotically replace your payroll in response to related exertions regulations.

- Evaluate all team of workers classifications to you should definitely’re as it should be making use of minimal salary charges in response to elements like worker age, tipped standing, and hours labored.

- Handle thorough payroll information appearing hours labored, fee of pay, and extra time profits for each worker as evidence of compliance.

- In addition to monitoring hours, observe pointers earned by means of servers, hosts, hair stylists, and different tipped staff. Ensure that their pointers reliably mix with decrease base pay to fulfill or exceed the entire minimal salary.

Really feel assured you’re compliant with Homebase

Managing minimal salary can get difficult with such a lot of adjustments at play. For small industry house owners who’re already time-stretched, staying on most sensible of the entire other laws can really feel overwhelming.

However you don’t have to head it on my own. Homebase is helping small companies like yours simplify payroll and compliance.

Right here’s how:

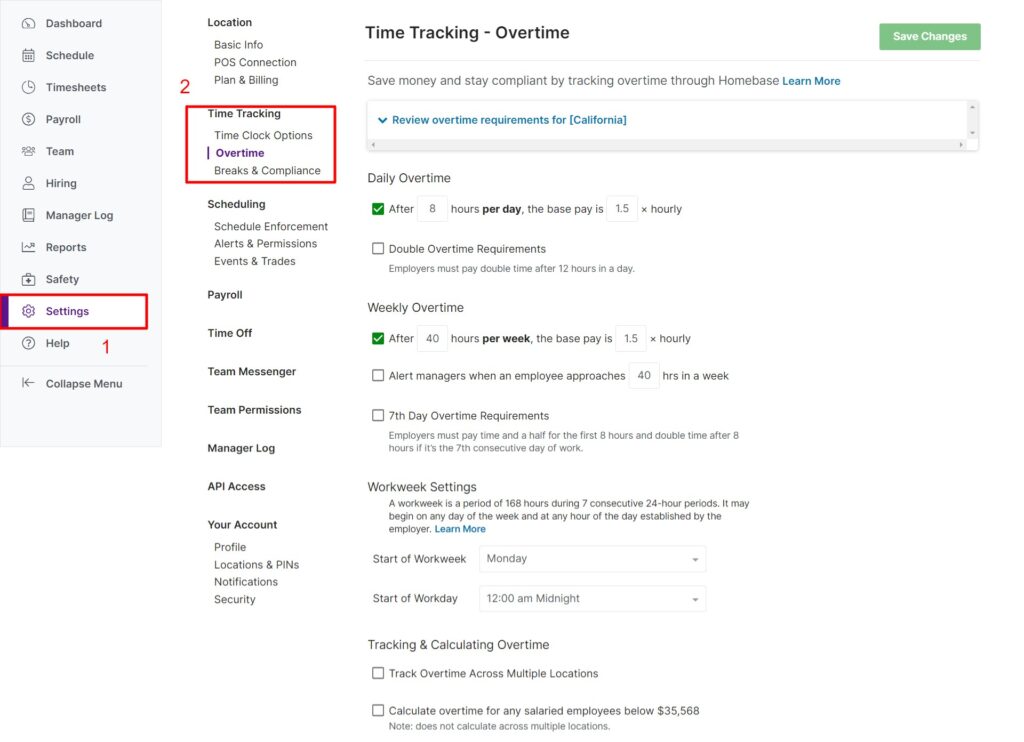

Automated payroll calculations: Homebase calculates hours, breaks, extra time, and PTO when your staff clock in and clock out. That each one will get synced with payroll that can assist you steer clear of errors.

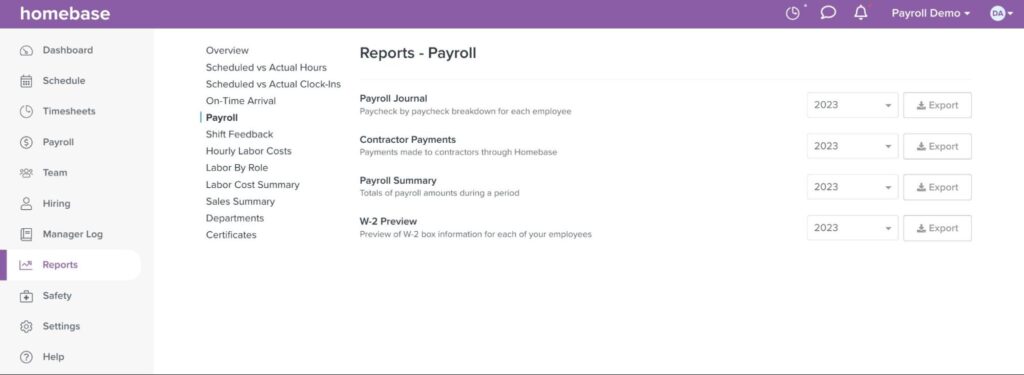

Detailed information: Homebase tracks hours labored, pay charges, and extra time main points for each worker. Detailed salary statements supply coverage in case of an audit or lawsuit.

Proactive compliance signals: Homebase sends well timed notifications of upcoming minimal salary and law adjustments so that you all the time keep present — and in case you have any questions, you’ll communicate to an HR professional to straighten issues out.

With Homebase as your payroll and compliance spouse, you’ll really feel positive you’re paying your other folks relatively and as it should be.