Nvidia (NASDAQ:NVDA) is a pacesetter within the semiconductor business. Its high-end graphics processing gadgets (GPUs) are wildly common, fueling its income to staggering ranges. The corporate has since then expanded into high-growth markets similar to car, information facilities, AI, and extra. Its inventory has observed exceptional positive factors of 227% year-to-date, overtaking the S&P 500’s (SPX) 13% acquire. The sturdy call for for its GPU chips and its talent to adapt on this advanced area of interest is why I’m bullish on NVDA inventory now. Analysts are bullish as neatly.

Nvidia’s graphic processors are utilized in various packages, starting from computer systems to online game consoles. Their tough computing functions are very important for AI-focused duties, enjoying a pivotal function within the good fortune of OpenAI’s ChatGPT and equivalent AI packages.

Nvidia Shattered Q2 Estimates. The Long run Seems to be Shiny

Nvidia reported an astounding 101% build up in income year-over-year to $13.5 billion for the second one quarter ended July 30, 2023. Adjusted profits according to diluted proportion greater via a whopping 429% to $2.70, smashing the consensus estimate of $2.08 according to proportion, and Knowledge Heart gross sales grew via 171% because of greater call for from cloud provider suppliers. In the meantime, its Gaming phase income grew via 22% within the quarter.

Additionally, the non-public pc (PC) marketplace is appearing indicators of restoration, in line with marketplace analysis company Canalys, that means extra gaming income for Nvidia within the coming quarters.

Owing to the heavy call for for H100 GPUs, Nvidia is operating to spice up the provision of those GPUs over the following few quarters. Therefore, control expects income of $16 billion in Q3, pushed via this sturdy call for. If the objective is met, that might replicate an outstanding 170% build up over the corresponding quarter a 12 months in the past.

Each and every chip recently prices between $25,000 and $40,000. If call for remains sturdy, it might imply forged, constant income for the corporate.

In the meantime, analysts expect Q3 income within the vary of $12.2 billion to $19.1 billion, with the consensus coming in at $16 billion. Income according to proportion may vary from $2.38 to $3.69, in line with analysts, with the consensus EPS estimate coming in at $3.32. The corporate has beat expectancies for the previous 3 consecutive quarters, and its subsequent profits liberate will probably be on November 21.

Moreover, Nvidia closed Q2 with a sizeable money stability of $16.0 billion and $8.46 billion in long-term debt. Its speedy progress in profits will have to permit it to repay the debt temporarily. Unfastened money drift within the quarter stood at $6.3 billion, a drastic leap from $837 million within the prior quarter. This surplus money can be utilized to fund long run initiatives.

Dangers and Rewards

Nvidia continues to forge partnerships and collaborations to reinforce its marketplace presence and income progress attainable. As an example, just lately, it collaborated with Indian conglomerates Reliance Industries Restricted and Tata Crew to create AI supercomputers the usage of NVDA’s GH200 Grace Hopper Superchip and DGXTM Cloud generation.

This collaboration would possibly ensue AI-led transformations within the production, client, commercial, and telecommunications sectors.

Whilst the rewards appear engaging, there also are dangers. In keeping with Reuters, OpenAI would possibly glance into developing its personal AI chips to fight the shortage of pricey AI chips. It may additionally intend to diversify its provider base past Nvidia. Moreover, Microsoft (NASDAQ:MSFT) is making plans to release its first AI chip, “Athena,” subsequent month all the way through its annual developer convention for a similar causes, in line with The Knowledge.

With emerging festival within the AI area of interest, simplest time will inform how this tech titan will capitalize in this huge progress whilst keeping up its dominant place within the chip marketplace. For now, Citi analyst Atif Malik is constructive that Nvidia will be capable of maintain its marketplace proportion of 90% within the AI GPU marketplace for the following two to 3 years. The analyst charges the inventory a Purchase, with a goal worth of $630.

Additionally, analysts expect that Nvidia’s income will build up via 99.4% in Fiscal 2024 and via 47.5% in Fiscal 2025.

This month, Goldman Sachs (NYSE:GS) integrated the inventory on its Americas Conviction Checklist. As a result of its aggressive moat and complicated AI fashions, the financial institution believes Nvidia will be capable of retain its marketplace dominance.

Nvidia trades at 29 occasions ahead profits. Its third-quarter effects and analyst forecasts for long run quarters will resolve whether or not this valuation is justified.

Is NVDA Inventory a Purchase, In keeping with Analysts?

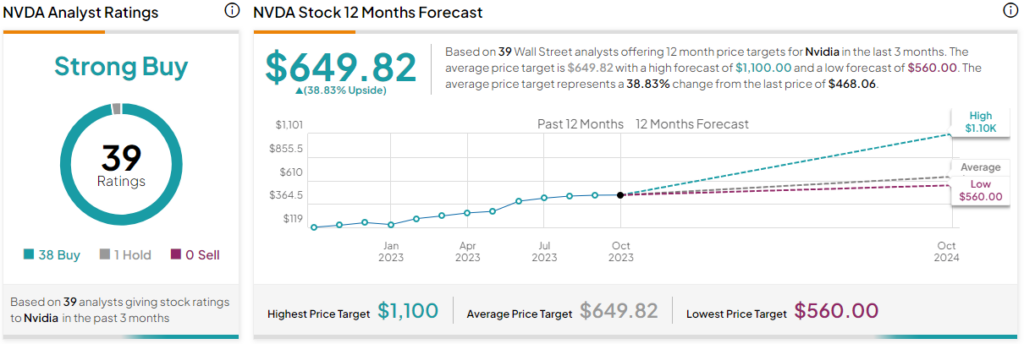

Turning to Wall Boulevard, TipRanks charges NVDA as a Sturdy Purchase, with 38 Buys, one Hang, and no Promote rankings assigned prior to now 3 months. The reasonable NVDA inventory worth goal of $649.82 implies 38.8% upside attainable. The perfect worth goal for the inventory stands at $1,100, whilst the bottom goal worth is $560.

The Takeaway

Nvidia’s income has greater from $4.3 billion in Fiscal 2013 to an excellent $27.0 billion in Fiscal 2023, reflecting the magnitude of its progress. AI, in line with professionals, is simplest getting began. Between 2023 and 2030, the worldwide AI marketplace may develop at a compound annual progress price of 36.8%, achieving $1.345 trillion.

Nvidia’s tough marketplace place, various product portfolio, and ongoing innovation in AI applied sciences would possibly assist the corporate take care of and even build up income within the coming years. Subsequently, I’m now not shocked as to why Wall Boulevard is so bullish at the inventory.