Marketplace Assessment: NASDAQ 100 Emini Futures

The NASDAQ Emini futures week is a bull development bar with a tail underneath on the weekly exponential shifting moderate (EMA). It’s an access bar to the reversal bar of 9/25, ultimate above the prime of closing week.

At the day by day chart, this week seems like a buying and selling vary and an tried breakout of the buying and selling vary on Friday.

NASDAQ 100 Emini futures

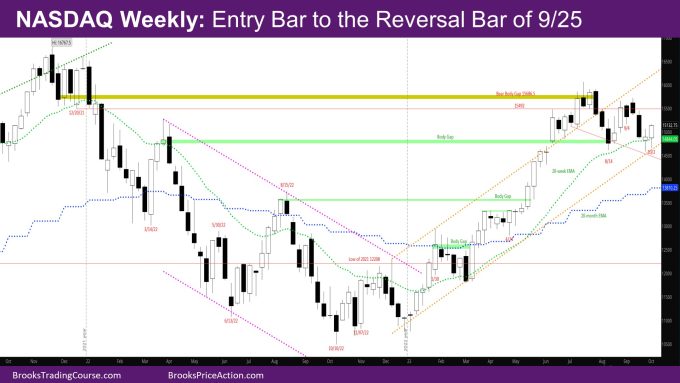

The Weekly NASDAQ chart

- The week is bull bar with a excellent frame and a tail underneath.

- This can be a excellent access bar, barring the tail underneath, to a now not so excellent doji bull reversal bar closing week.

- Ultimate week used to be like a buying and selling vary bar.

- This week went close to the ground part of closing week, then reversed and closed above the prime of closing week.

- Subsequent bulls want a excellent follow-through bar to substantiate it’s breaking out of the buying and selling vary of closing week.

- As discussed in prior studies, there will be some other leg down despite the fact that this can be a upper low.

- There are probably dealers upper – shut of the interior undergo bar 9/4, that have been anticipating a more potent 2nd leg up according to the bar of 8/28.

- On the identical time, bulls were robust sufficient thus far to stop an in depth underneath the shut of 8/14 – the low shut of the 1st robust leg down.

- They’ve additionally averted more than one undergo closes underneath the bull frame hole from March 2022.

- To name the bull hole successfully closed, bears want a few undergo closes underneath that hole.

- If bulls can pass up from right here, the frame hole shut could be a thought to be a detrimental hole – a small overlap, however development resumption up.

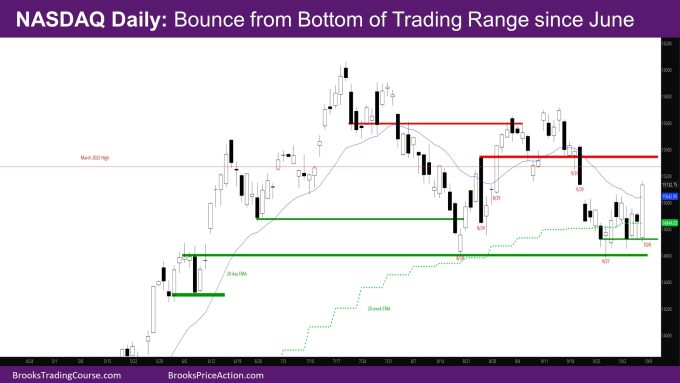

The Day-to-day NASDAQ chart

- Friday is a robust bull development out of doors up (OU) bar with an in depth above the day by day EMA.

- That is the primary time the marketplace has closed above the EMA since September 18.

- Whilst it is a display of energy on a part of the bulls, it’s much more likely to draw dealers since many of the frame of this week is underneath the EMA, and the marketplace is on the 9/20 low, the place the marketplace gapped down from a conceivable double-bottom.

- There are probably dealers close to the prime of 9/20 or the purchase sign bar of 9/19 that prompted after which failed.

- Bulls want a robust follow-through bar on Monday to negate the above.

- Prior studies had discussed that there would most probably be dealers underneath the robust bull bar of 8/28.

- This came about on the finish of closing week when the marketplace virtually reached the low of 8/28 after which bought off.

- That selloff persevered previous this week, when the marketplace bought off in opposition to the low of closing week.

- It then had a pullback on Wednesday, and some other leg down Thursday that reversed.

- Friday went underneath the low of Thursday and reversed up as a large OU bull bar.

- Bulls see the marketplace reversing from a Wedge bull flag all the way down to 9/27 and a double-bottom with 8/18, on the backside of what seems like a buying and selling vary since June.

- Bears see the closing 2 weeks as a 2 legged-pullback to the EMA from the precise shoulder of a head-and-shoulders since June, and need a wreck underneath the neckline.

- The marketplace most probably may have some other push down because of the explanations discussed above.

- On the identical time, given the energy of Friday, it’s most probably that there will probably be 3 pushes as much as the shut of 9/19 or the prime of 9/20 earlier than some other leg down.

Marketplace research studies archive

You’ll get admission to all weekend studies at the Marketplace Research web page.