Believe a global the place your economic records strikes between banks with out compromising safety, the place you’ve got complete keep an eye on over your alternatives, and the place innovation speeds previous any limits or limitations. Because of the concept that of open banking, that is the truth we now are living in.

The open banking ecosystem lets in shoppers to discover the opportunity of an interconnected economic long term. It promotes collaboration and shopper empowerment whilst strongly specializing in safety and knowledge privateness.

What’s open banking?

Open banking, sometimes called open financial institution records, is a convention that allows protected interoperability within the banking {industry}. It offers third-party provider suppliers get right of entry to to visitor banking records and transactions by means of APIs, letting them be offering personalised products and services and enlarge their vary of economic merchandise.

Thru open banking, virtual banking platforms acquire the facility to safely get right of entry to and percentage visitor economic records throughout establishments, providing a holistic view of accounts, transaction records, and monetary well being. In consequence, banks are now not the remoted establishments of knowledge they was once.

Open banking has allowed economic provider suppliers to liberate their vaults and percentage records responsibly. Banking as a provider (BaaS) answers make this occur through integrating economic merchandise into non-financial provider companies the usage of utility programming interfaces (APIs).

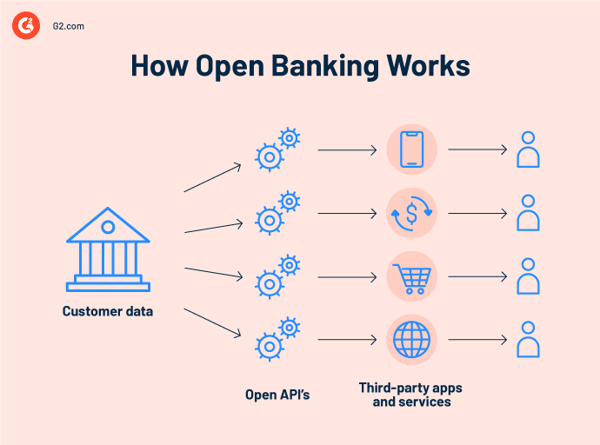

How open banking works

Open banking’s number one function is to extend festival, innovation, and shopper selection within the economic products and services {industry}. It allows other industries to supply quite a few banking services in an interconnected, environment friendly approach.

Open banking makes use of economic records APIs supplied through banks and different economic establishments to grant protected get right of entry to to visitor records. As an example, a financial institution’s API built-in right into a ride-sharing platform shall we customers pay for his or her rides from their financial institution accounts.

This cross-industry collaboration demonstrates the way in which open banking has the prospective to reshape our interactions with the quite a lot of products and services we use in our day by day lives.

The next are the stairs to a super open banking procedure.

- APIs: Banks and monetary establishments expand open banking APIs that percentage records and functionalities with approved third-party suppliers. This allows protected conversation and knowledge trade between the financial institution database and third-party programs.

- Buyer consent: Account holders will have to give their banking establishments particular consent for sharing their economic records with third-party suppliers. This permission is generally given thru a protected authentication procedure. Consumers can specify which non-public records they make a selection to percentage.

- Knowledge get right of entry to and sharing: As soon as consent is established, third-party economic provider suppliers get right of entry to particular economic records like account balances and transaction historical past. This information is used to supply personalised products and services, equivalent to budgeting equipment, debt control, and funding recommendation.

- Safe conversation: Banks and monetary establishments put into effect robust security features, together with encryption, authentication, and authorization protocols, to make certain that visitor records stays confidential.

- Law and requirements: Pointers identify consistency, safety, and interoperability throughout other economic establishments and third-party suppliers.

A temporary historical past of open banking

Open banking used to be first presented in 2015 with the release of the fee products and services directive 2.0 (PSD2) in Europe. The concept that facilitated a shift within the mindset of banks from performing as records stewards to having a look at their shoppers’ records as helpful property.

Even if economic products and services corporations are actually much more likely to supply up their records units, the principles set through PSD2 explicitly give the shoppers the ability to percentage – or not to percentage. There are knowledgeable consent prerequisites in PSD2 that require banks to inform their shoppers precisely which records they’re granting the financial institution permission to percentage.

Open utility programming interfaces are publicly to be had APIs that builders use to get right of entry to backend records. They generally depend at the insights in that records to construction product building methods to deal with the desires printed.

The time period “open APIs” with regards to utilization within the economic products and services {industry} is a little of a misnomer, as those APIs aren’t in reality open. The foundations and laws in PSD2 require that each and every developer the usage of an “open” API is vetted and monitored, ensuring that records is used accurately.

Key rules of open banking

Those rules jointly outline the root of open banking and information its implementation to verify visitor agree with, records safety, festival, and progressed economic products and services.

- Get right of entry to to visitor knowledge: Open banking comes to real-time sharing of information, together with statements and transactional records, from a visitor’s checking account with different approved economic provider suppliers. It lets in for a extra complete and up-to-date evaluation of a visitor’s economic state of affairs than conventional fashions.

- Initiation of real-time bills: Which means third-party organizations can start up bills immediately from the client’s checking account (with their consent). The main supplies the ease of on-line bills, and budget switch thru virtual banking platforms and apps.

- Get right of entry to to product and repair knowledge: Open banking informs its shoppers about services supplied through other economic establishments. This shall we shoppers simply examine provides, make knowledgeable choices, and make a selection the most productive resolution for his or her wishes.

- Secured fee flows: Open banking guarantees confidentiality, integrity, and authenticity of transactions. It implements complete security features to give protection to the delicate records exchanged between events. Encryption, authentication protocols, and cybersecurity practices safeguard fee flows to forestall unauthorized get right of entry to.

- Transparency and visitor consent: Open banking promotes transparency through ensuring that consumers understand how their records shall be used. It prioritizes visitor consent and keep an eye on over their records, construction agree with amongst shoppers, economic establishments, and third-party suppliers.

Open banking use instances

Open banking has given upward push to a variety of use instances that employ the shared records between economic establishments and third-party suppliers. Learn on for a couple of examples.

- Non-public finance control: 3rd-party programs use BaaS answers to combination records from a couple of economic establishments by means of APIs, giving customers a complete view in their economic well being. Those apps be offering spending research and suggestions for higher economic control.

- Virtual fee answers: Those equipment pave the way in which for direct bills and transfers from third-party apps, easy peer-to-peer bills, invoice bills, and transfers throughout other accounts and banks.

- Credit score scoring and mortgage approval: The use of a much wider vary of information to evaluate creditworthiness and be offering correct mortgage approvals in particular advantages people with restricted credit score historical past.

- Actual-time expense monitoring: Open banking lets in for fast price range monitoring and notifications for account job. Customers can obtain signals for enormous transactions, low balances, and strange spending patterns.

- Account aggregation: This option shall we customers get right of entry to and set up loans, bank cards, checking, and financial savings accounts inside of a unmarried banking app or virtual banking platform for transparent economic control.

Advantages of open banking

Open banking transforms the economic panorama through selling festival, innovation, and customer-centric products and services. It offers people better keep an eye on over their economic records and alternatives and advantages each shoppers and the banking {industry} as a complete.

Probably the most key advantages come with:

- Greater festival. Open banking fosters festival through permitting new entrants, together with fintech startups, to supply leading edge economic services. This results in a extra various vary of choices and higher pricing for shoppers.

- Personalised products and services. Open banking can lend a hand you within the introduction of personalised economic products and services in keeping with a complete view of your economic state of affairs. This may come with expense monitoring, credit score rating tracking, and different answers that cater to person economic objectives.

- Comfort. Consumers can get right of entry to and set up their economic records and products and services from quite a lot of establishments in one utility. This streamlines the banking enjoy and gets rid of the want to log in to a couple of accounts.

- Higher get right of entry to to price range. Open banking can enhance get right of entry to to credit score and monetary products and services, particularly for underserved populations. Selection credit score scoring fashions that believe a much wider vary of information lend a hand extra other people qualify for loans.

- More straightforward bills and transfers. Open banking facilitates seamless bills and fund transfers immediately from third-party programs. This reduces the want to transfer between other platforms for economic transactions.

- Knowledge possession and keep an eye on. Consumers have better energy over their economic records. They make a decision which records is shared and with whom, fortifying their privateness.

- Monetary inclusion. Open banking can advertise economic inclusion through offering people with restricted get right of entry to to conventional banking products and services the chance to make use of selection economic services.

Barriers of open banking

Whilst open banking provides quite a lot of advantages, it additionally comes with dangers and barriers. Those want to be addressed to make certain that open banking stays protected, clear, and really helpful for all stakeholders.

- Knowledge safety and privateness issues: Sharing economic records between establishments and third-party suppliers will increase the chance of information breaches and unauthorized get right of entry to. Consumers is also involved concerning the safety in their delicate economic knowledge.

- Asymmetric implementation: The implementation of open banking requirements varies amongst other banks and monetary establishments. Inconsistent APIs and knowledge codecs impede easy records trade.

- Inequalities in get right of entry to: Now not all shoppers have get right of entry to to, or are pleased with, the usage of virtual equipment and platforms. This can result in inequalities in get right of entry to.

- Possibility of misuse: 3rd-party suppliers may exploit visitor records for promoting or different functions with out correct oversight, probably inflicting privateness issues and visitor dissatisfaction.

- Fraud and cybersecurity problems: Open banking may supply new avenues for frauds and cybercriminals to leverage vulnerabilities and behavior scams that concentrate on each shoppers and monetary establishments.

- Buyer agree with: Consumers may well be skeptical about sharing their economic records with third-party suppliers, particularly in the event that they aren’t adequately skilled about the advantages and dangers of open banking.

- Dependency on era: Open banking closely is dependent upon era infrastructure and APIs. Technical system faults, device outages, or cyberattacks may just disrupt products and services and compromise visitor stories.

Knowledge sharing in open banking: Boon or bane?

One of the most attainable issues for patrons is privateness in regards to records sharing. The extra puts your records is held, the extra inclined. Shoppers are extra conscious about safety dangers than ever earlier than and feature develop into extra hesitant handy over get right of entry to to their records.

The truth that shoppers need to explicitly settle for all data-sharing requests will have to alleviate a few of their problems about open banking. As well as, there’s a steadily up to date record of regulated open banking third-party suppliers that will have to sign up with an open banking regulatory frame to make certain that solely regulated suppliers get right of entry to shopper knowledge. Uneasy shoppers can seek the advice of the record to verify whether or not the banking supplier or fintech utility they use is there.

Transaction records shared thru open banking APIs is anonymized, which means no non-public knowledge is hooked up to the information. Open banking’s use of APIs in lieu of display screen scraping is any other notch within the records protection belt.

Display scraping comes to using precise visitor login main points to achieve get right of entry to to their accounts. This will increase the opportunity of fraudulent job, as login knowledge may also be hacked and used maliciously. Open banking, as soon as once more, does no longer have interaction on this observe which will have to set the shoppers’ minds relaxed.

Knowledge sorts shared by means of open banking

The 3 maximum commonplace forms of economic records shared the usage of open banking are:

- Cost requests observe the place requests come from, which seller makes the request, and when the requests are made.

- Steadiness knowledge is the client’s stability, in conjunction with the date.

- Transaction records comprises essential knowledge like service provider identify, acquire location, and buy class.

Banks and fintech builders can use the guidelines to create helpful programs for shoppers in keeping with their non-public records, equivalent to their wage or spending conduct. Shoppers use the programs created on account of their records – programs restricted solely through the creativity and ingenuity of the builders operating on answers for the ones shoppers.

An instance of open banking is HSBC’s Attach Cash utility, which permits shoppers to look all in their accounts from other banks inside of a unmarried utility. The app is a harbinger of items to return. Banks will quickly be capable of roll out programs in the similar vein, and fintech can engineer programs that make the most of the information on be offering.

Absolute best practices for open banking

Regardless of the dangers and demanding situations related to open banking, economic establishments and third-party suppliers can identify a protected, compliant, and user-friendly open banking surroundings that advantages all stakeholders concerned. Making use of very best practices manner open banking procedures all the time have:

- Powerful security features. Prioritize records safety through imposing robust encryption, multi-factor authentication, and protected APIs. Ceaselessly behavior safety audits, vulnerability tests, and penetration checking out to deal with attainable threats.

- Person consent control. Keep in touch to customers how their records shall be used and shared. Download their consent earlier than having access to or sharing their economic knowledge with third-party suppliers. Permit them to simply revoke consent for records sharing through providing user-friendly interfaces that set up their personal tastes.

- Sturdy authentication. Ensure that protected authentication strategies are in position for each customers and third-party programs to forestall unauthorized get right of entry to to delicate economic records.

- API design and requirements. Increase APIs consistent with {industry} requirements and cause them to user-friendly, constant, and well-documented. Supply complete documentation for builders to facilitate integration.

- Regulatory compliance. Keep up-to-date with related open banking laws, equivalent to normal records coverage legislation (GDPR) in Europe or the Shopper Knowledge Proper (CDR) in Australia. Put in force measures to agree to privateness, records coverage, and monetary laws.

- Possibility evaluation and mitigation. Frequently assess and set up dangers related to open banking actions. Arrange possibility control methods that deal with attainable vulnerabilities and threats.

Open banking provider suppliers

A number of firms have tapped into the open banking marketplace and already supply treasured products and services. Let’s check out a few of these innovators.

- An AI chatbot that is helping shoppers observe spending, construct credit score, and succeed in their economic objectives, Cleo by no means retail outlets your banking knowledge and assists in keeping you on best of your cash in a read-only layout.

- Moneybox and Plum lend a hand their shoppers with the method of saving and making an investment for better figuring out and visitor delight.

- Bringing all banking accounts and transactions right into a unmarried app, Cake supplies marketplace insights and cash-back choices.

- Trustly is a fee manner the place bills move immediately from one account to any other with out the desire for app downloads or playing cards.

- Tully has helped over 13,000 shoppers construct a web based price range and be informed extra about their economic state of affairs. It could actually additionally provide you with debt recommendation.

- Plaid is an middleman between economic apps and banks. It lets in app customers to log in and percentage their economic records securely.

Long term of open banking

The way forward for open banking is poised for dynamic expansion, with a number of key traits at the horizon. As open banking continues to unfold globally, a focal point on standardization and interoperability will stay integration seamless throughout establishments. The growth of products and services past bills and account knowledge will create a holistic economic enjoy, whilst data-driven personalization thru AI will lift visitor engagement.

Regulatory frameworks will evolve to deal with privateness issues and technological shifts, and innovation between conventional banks, fintech corporations, and different industries will give upward push to built-in, user-centric answers. Reinforced cybersecurity and fraud prevention measures will safeguard records integrity, whilst cross-border open banking projects and enhanced shopper training will form a extra inclusive and knowledgeable economic panorama.

3 issues want to occur for open banking to develop into an unequivocal good fortune:

- Shoppers will have to buy-in. Open banking remains to be contingent on shoppers opting into records sharing.

- Conventional banks will have to embody it. Conventional banks will have to absolutely embody open banking and spouse with fintech to ship new merchandise and extra environment friendly products and services.

- Fintech suppliers have to acknowledge the prospective. Answer suppliers want to perceive the features of open banking and actively pursue product building in keeping with records gleaned from open APIs.

Say open sesame to a funtech long term

Open banking stands as a pivotal transformation within the economic panorama, able to bring in a brand new generation of connectivity, innovation, and empowerment. As conventional boundaries fall apart, shoppers are now not confined through the constraints of conventional banking fashions. As a substitute, they’re granted extraordinary keep an eye on over their economic records, unlocking personalised products and services and seamless stories adapted to their distinctive wishes.

This evolution, pushed through the harmonious collaboration between established establishments and agile fintech disruptors, has the prospective to reshape how we understand, get right of entry to, and set up our cash.

Be informed extra about the upward push of virtual transformation in banking and the way it has in reality benefited the protected method economic products and services function as of late.