Maximum of 2023 has been outlined by means of the large tech shares riding bullish sentiment and overcoming 2022’s endure marketplace. That stated, since about midway throughout the summer time, the bull marketplace has been on pause with the chance of rates of interest last excessive for longer than anticipated, amongst different macro elements, placing a dampener on court cases.

Nonetheless, going by means of the previous week’s efficiency, there are indicators the bulls’ price is ready to renew in earnest. In truth, with Q3 profits season about to begin, Goldman Sachs’ portfolio strategist Cormac Conners issues out that going by means of previous occasions, the approaching duration may well be a bountiful one, particularly for the tech leaders.

“Historical past means that the impending 3Q effects might catalyze a momentum reversal within the biggest tech shares,” Conners lately wrote. “Since 4Q16, the mega caps in mixture have overwhelmed consensus gross sales enlargement expectancies 81% of the time and feature outperformed in two-thirds of profits seasons, in most cases by means of 3pp.”

With this in thoughts, we made up our minds to get the lowdown on two mega-cap tech names the Goldman analysts imagine are primed to make use of the approaching profits season as a catalyst for additional good points. Additionally, in step with the TipRanks database, each are these days rated as Robust Buys by means of the analyst consensus. Listed here are the main points.

Nvidia Company (NVDA)

We’ll get started with Nvidia, a significant participant within the semiconductor chip business. The corporate has discovered a forged base of make stronger in sturdy buyer call for for its high-end GPU chips, that have develop into very important to the speedy enlargement of AI era.

The explosive enlargement of AI because the finish of closing yr has obviously been excellent for Nvidia. Since 2020, the corporate has been crucial provider of GPU chips for OpenAI, whose ChatGPT sparked off the present AI revolution. OpenAI has already indicated that it is going to want some 10,000 chips heading into subsequent yr, simply to take care of ChatGPT’s efficiency features. Nvidia’s publicity to this, and to different sides of AI, has fueled a surge in its most sensible and backside strains over the last a number of quarters, and Nvidia has develop into one in every of simply 5 publicly traded corporations valued at greater than $1 trillion.

A handy guide a rough glance again at Nvidia’s closing profits file will display the magnitude of the corporate’s fresh enlargement. Nvidia reported an organization document of $13.5 billion in quarterly earnings for fiscal 2Q24, its closing unencumber. This used to be up 101% year-over-year, and beat the forecast by means of over $2.4 billion. The base line of $2.70 in step with adj. percentage, used to be 61 cents in step with percentage forward of the estimates – and used to be up a whopping 429% in comparison to the prior yr quarter.

Taking a look forward, the Boulevard expects additional good points when Nvidia experiences its fiscal Q3 effects subsequent month. The outlook for earnings is $15.87 billion, and for non-GAAP EPS is $3.35.

For Goldman’s Toshiya Hari, the near- to mid-term seems to be excellent for the corporate. Nvidia will have to receive advantages, in his view, from persevered sturdy buyer call for, fueled by means of information middle and AI programs. The 5-star analyst writes, “Taking a look forward, we see the combo of a robust/broadening call for profile in Information Middle and an making improvements to provide backdrop supporting sustained earnings enlargement via CY2024. Importantly, even though we acknowledge rising festival from the massive cloud provider suppliers (i.e. captive/inner answers) in addition to different service provider semiconductor providers, we think Nvidia to take care of its standing because the speeded up computing business usual for the foreseeable long term given its aggressive moat and the urgency with which consumers are growing/deploying increasingly more advanced AI fashions.”

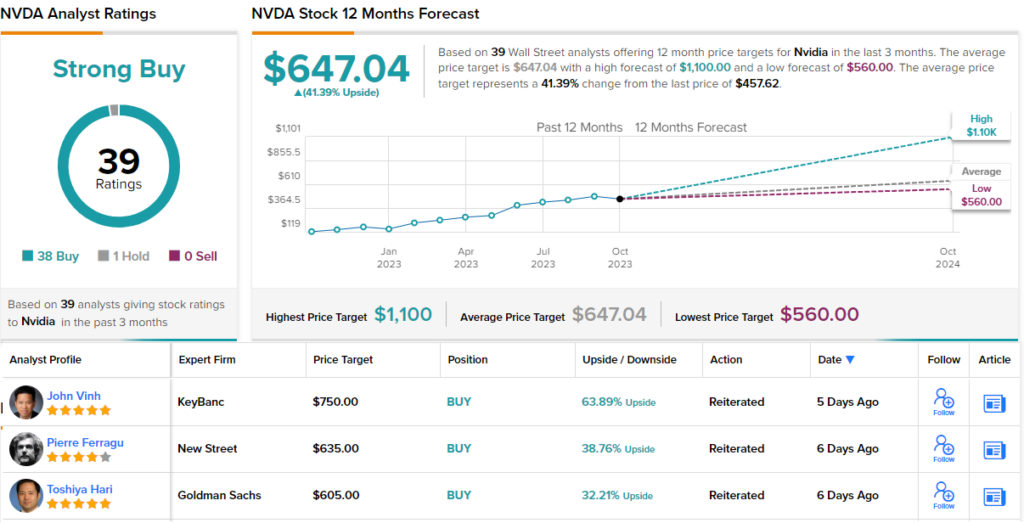

This inventory is off the height price it hit on the finish of August, however it’s nonetheless up by means of 219% year-to-date and Hari thinks there are nonetheless forged good points forward to stay up for. He provides NVDA stocks a Purchase score, with a $605 worth goal to suggest 32% upside doable for the following three hundred and sixty five days. (To observe Hari’s observe document, click on right here)

The tech giants by no means lack for Wall Boulevard consideration, and Nvidia has 39 fresh analyst evaluations on document – with a lopsided 38 to one breakdown favoring Buys over Holds, for a Robust Purchase consensus score. The stocks have a buying and selling worth of $457.62, and their $647.04 reasonable worth goal is extra bullish than Hari’s, suggesting a 41% achieve for the yr forward. (See NVDA inventory forecast)

Amazon (AMZN)

Subsequent up is Amazon, one of the vital international’s right away recognizable emblem names. Amazon boasts a confirmed document as a ‘tech survivor,’ having gotten its get started within the past due ‘90s – after which surviving the dot.com bubble that winnowed the early box of tech corporations. As of late, Amazon leads the worldwide e-commerce marketplace, and with its $1.3 trillion marketplace cap is any other of the 5 biggest companies within the public inventory markets. This spectacular edifice stands at the corporate’s on-line retail operations, which closing yr moved roughly $690 billion in gross products quantity.

Whilst on-line retail will get the headlines, Amazon has its fingers in more than one pots. The corporate is continuously growing new merchandise to profit from newly opened niches – have a look at the best way Amazon Internet Products and services briefly was a significant participant in cloud computing. Amazon additionally has more than one AI-based merchandise below construction, with distinguished tasks together with a chatbot, a picture construction platform, and a device code construction instrument. The corporate could also be integrating AI into the prevailing AWS, which within the closing reported quarter, 2Q23, generated over $22 billion in earnings.

Amazon stocks have retreated some ~12% from their September top even though the inventory remains to be up 49% for the year-to-date, an general achieve in accordance with forged efficiency.

We noticed the ones efficiency metrics within the corporate’s 2Q23 effects. Amazon’s most sensible line got here to $134.4 billion, beating the forecast by means of $3 billion and rising 11% y/y. We’ve already famous the y/y enlargement in AWS, which helped to energy the entire earnings overall; the corporate’s North American retail used to be additionally up year-over-year, by means of 11%, to succeed in $82.5 billion. Amazon’s Q2 EPS determine of 65 cents used to be 31 cents higher than anticipated – however that determine benefited from a $200 million achieve because of non-operating bills from the corporate’s fairness holdings in Rivian Automobile, the place the similar determine within the earlier yr quarter used to be a $3.9 billion loss.

Once we glance in opposition to Amazon’s upcoming Q3 effects, we see that Wall Boulevard is anticipating an EPS of 58 cents, supported by means of revenues of $141.5 billion.

5-star analyst Eric Sheridan covers this inventory for Goldman, and in his view, the corporate’s sturdy AWS efficiency will stay within the motive force’s seat, whilst Amazon as an entire does neatly on the long run: “We stay satisfied that AWS stays heading in the right direction to go back to a extra normalized enlargement/margin construction in 2024 and that the section is easily located (opposite to present investor belief) towards the emerging computing shifts in opposition to AI. Taking a look over a multi-year time-frame, we reiterate our view that Amazon will compound a mixture of forged earnings trajectory with increasing margins as they ship yield/returns on more than one yr funding cycles.”

Sheridan’s stance helps his Purchase score, and his $180 worth goal implies a robust 41% upside doable at the one-year horizon. (To observe Sheridan’s observe document, click on right here)

General, Amazon has picked up 41 fresh analyst evaluations, and those come with 40 Buys towards a unmarried Cling to offer the inventory a Robust Purchase consensus score. AMZN boasts a median worth goal of $176.02, suggesting an build up of 37.5% from the present $127.96 percentage worth. (See Amazon inventory forecast)

To search out excellent concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Best possible Shares to Purchase, a newly introduced instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured analysts. The content material is meant for use for informational functions most effective. It is important to to do your personal research ahead of making any funding.