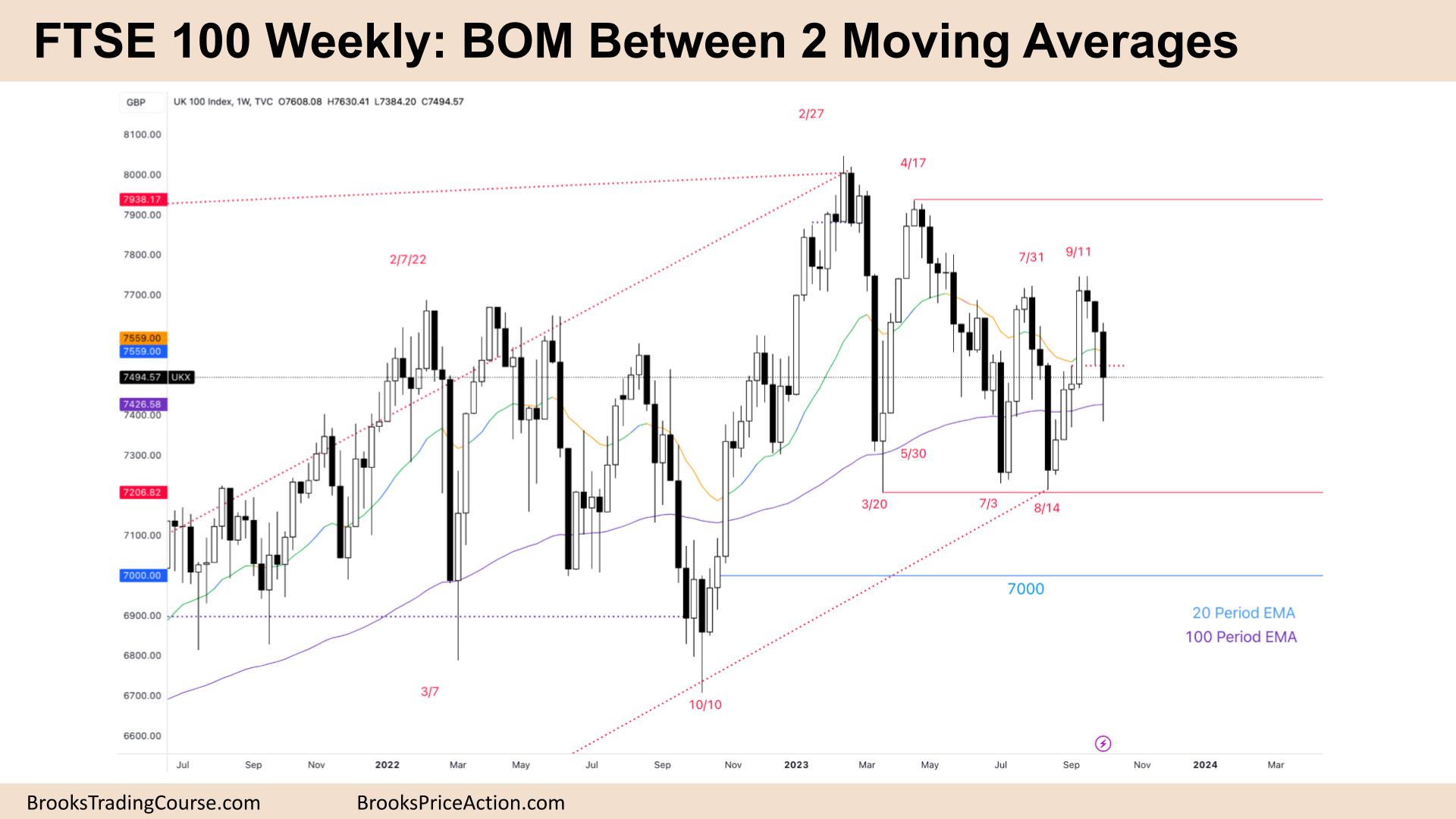

Marketplace Assessment: FTSE 100 Futures

The FTSE futures marketplace is in breakout mode (BOM) between 2 shifting averages. The marketplace is deciding the place to move from right here. There’s a DB and a DT. It may be a wedge bull flag or a wedge undergo flag. Take your select! In this time frame 50/50 so higher to make use of a 2:1 goal. Higher trades can be one time frame down at the day-to-day for many buyers.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures at the weekly chart was once a large undergo bar ultimate close to its midpoint with a large tail under – its breakout mode (BOM.)

- Each buyers see the huge bull channel. Bulls see a wedge bull flag right down to July, and we’re trying out the DB, some other more or less wedge backside or triple backside.

- Bulls wish to get away above the DT and get a MM upper to the ATH.

- The bears see a promote climax and a deep pullback to a LH DT.

- It’s complicated as a result of it’s an increasing triangle – we went above the prior top and under the prior low.

- Increasing triangles transfer briefly within the center and are unexpected on the extremes, so buyers will have to watch out.

- We brought on the promote under closing week however weren’t in a position to near a lot under the low.

- This week has a large tail, so a foul give up access promote industry under, and this can be a undergo bar, so a foul purchase sign on the shut.

- Be expecting restrict order patrons to look under the low as they made cash closing week doing that. They’re going to most likely take a look at once more.

- Large bars in buying and selling levels typically opposite – as buyers are scalping, BLSHS and taking fast income, the unexpected marketplace present is a great time to go out. Subsequent week will have to pull again.

- However buying and selling levels are disappointing, so higher to be flat in BOM.

- We knew there can be patrons under the low of the massive bull bar.

- It was once a bull microchannel, and now we’re a 50% pullback, so most likely patrons right here and under.

- However bears have a undergo microchannel, and that places dealers above the top and above the top of closing week.

- It’s BOM so the chance is 50%. However at the HTF the bulls have beef up on the 200-week MA.

- Till bears get a bar under that MA, it’s higher to both be lengthy or flat.

- Purchase low and be affected person. Be expecting sideways to up subsequent week.

The Day by day FTSE chart

- The FTSE 100 futures on Friday was once a bull bar ultimate on its top and above the top of Thursday’s bull bar.

- It’s a purchase sign, a Prime 1 in a undergo spike, and we’re at a TTR if you happen to glance to the left so a most likely beef up degree.

- The issue is the undergo microchannel main into it which is robust. That reduces the chance.

- Some buyers will assume that’s sturdy sufficient for another leg down, so this primary reversal is almost definitely minor.

- Some bulls who purchase right here will take a smaller place and glance to scale in under.

- My downside with the purchase is it’s an inside of bar, which limits the upside. Should you cross lengthy right here you could get one bar sooner than it reverses. So max benefit goal is the MA.

- However the place do I put my give up? Inside of bars are small, so the marketplace has a tendency to check all sides. I may just use a swing give up 2 x the IB under, however my RR isn’t nice.

- The swing level is not likely to in the end shape right here as a result of this can be a undergo bar.

- A greater industry, I believe, is purchasing under that inside of bar someplace after the bears get a 2d leg. That 2d leg could be one bar.

- As it has a excellent shut, it’s a greater promote above the bar – possibly one scalp measurement above the bar, the MA most likely.

- Should you take a look at the chart this can be a buying and selling vary, and prevent entries are uncommon. The trades that figure out have susceptible indicators and powerful access bars.

- So the previous 2 weeks have been a marvel as they’d two stop-entry shorts that labored out.

- The bears may take a look at it another way. That we brought on an always-in-short industry, consecutive undergo bars under the MA, excellent closes, and excellent measurement.

- The marketplace steadily assessments that access level sooner than proceeding.

- So, continually briefly, with a excellent purchase sign right here, a conceivable Prime 2, however the chance is reasonably higher for promoting.

- We’re close to 50% of the buying and selling vary, so a greater purchase might be discovered a little bit decrease.

- Bulls need the two-legged pullback to the MA.

Marketplace research reviews archive

You’ll get admission to all weekend reviews at the Marketplace Research web page.