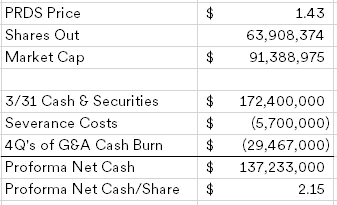

Pardes Biosciences (PRDS) ($90MM marketplace cap) is some other biotech for the basket, this morning the corporate introduced deficient medical effects, an 85% relief of their personnel and the verdict to pursue strategic choices. The corporate has a questionable historical past, it used to be based in a while after the covid pandemic started in 2020 to pursue new remedies for viral illnesses that result in pandemics, they entered right into a merger settlement with a SPAC in June 2021 and finished the deSPAC procedure in December 2021. Fortuitously for them, this used to be ahead of we began seeing heavy accept as true with redemptions, with nearly the entire SPAC money being dropped at Pardes plus a $75MM PIPE funding. Pardes has one asset, Pomotrelvier, a covid remedy that simply failed to satisfy its Segment 2 number one endpoint, thus triggering the halt in their construction program. Although trial used to be a success, it sort of feels like society has moved on from covid and the percentage value mirrored the skepticism that this can be a industrial product.

What makes Pardes reasonably extra fascinating is their restricted historical past, not like others, they have not had time to increase important NOLs (most effective have $66MM) that could be horny to a reverse-merger spouse. Pardes additionally does not have a vital hire or different primary shutdown prices, so whilst a reverse-merger is most probably nonetheless the primary possibility, this one could be a robust candidate for a rather blank liquidation. I do marvel once we see a shift against extra liquidations, as we get an increasing number of of those pursuing strategic choices, there cannot be sufficient reverse-merger offers to head round (we nonetheless have dozens of SPACs doing the similar too).

Of their 8-Ok launched nowadays, Pardes disclosed a present money steadiness of $172.4MM and $5.7MM of severance similar prices to be incurred in the second one quarter associated with the personnel relief. For the margin of protection swag, I integrated a yr’s price of G&A, it would possibly not be that prime however must give various room for unexpected bills. I purchased a small place nowadays.

Disclosure: I personal stocks of PRDS