On this Off the Cuff video, mounted source of revenue senior portfolio supervisor Albert Ngo discusses inflation, financial enlargement and conceivable results for the marketplace.

Abstract:

Hello, that is Albert Ngo, Senior Portfolio Supervisor at Empire Existence. Given the hot volatility, I sought after to supply an replace and proportion somewhat bit about how we’re desirous about this marketplace.

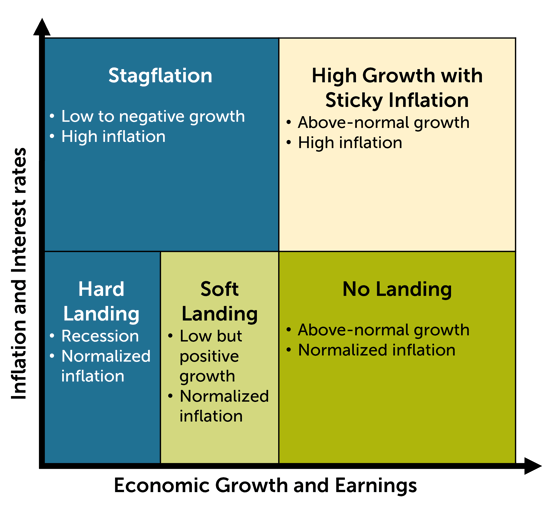

We’re surely in complicated instances. The marketplace seems dependent at the Fed; the Fed relies on knowledge; and the information relies on an financial system that has been tough to expect. I believe the place this marketplace finally ends up, will in the long run come right down to the trail of each enlargement and inflation, which can be unpredictable however I believe will also be summarized into the next eventualities:

- The most efficient conceivable consequence is a “No Touchdown” situation, the place enlargement is above-normal and inflation declines

- Every other doable situation is one with a resilient financial system however inflation stays sticky

- Different doable eventualities are a “Comfortable Touchdown” the place we enlargement is below-normal however nonetheless sure whilst inflation declines or a “Laborious Touchdown” the place we input right into a recession

- And the worst consequence could be “Stagflation” the place we don’t have any enlargement whilst inflation stays top

Sadly, it’s unimaginable to expect the place the financial system will finally end up. As an example, from September to January, inflation have been on a downward development whilst the financial system remained resilient, so the marketplace started pricing-in the risk of a no touchdown situation, which led to sturdy efficiency throughout mounted source of revenue and equities. Then again, in February, knowledge recommended the financial system remained resilient with sticky inflation and so markets priced-in upper charges and a extra inverted yield curve and glued source of revenue and fairness markets gave again a lot of the January efficiency

So, what are we pondering and the way are we positioning our mounted source of revenue portfolios? Given the unpredictability of marketplace instructions, as all the time, we’re taking a balanced manner. Given sexy all-in yields and with an inverted yield curve, we’re obese upper high quality non permanent company bonds that yield between 5 and six.5% that experience low volatility and really top drawback coverage. We nonetheless deal with varied and feature balanced publicity to long run govt bonds as we consider longer-term inflation will normalize. After we dig deeper into the inflation knowledge, we’re seeing disinflation in the cost of items and early indicators of easing inflation in safe haven. Then again, the stickiest elements of inflation were inside non-housing products and services akin to airfare and automotive insurance coverage, which we’re tracking very intently and can regulate our positioning accordingly.

The higher inversion of yield curves is sending a more potent sign of a slowing financial system, which has traditionally benefitted mounted source of revenue whilst large coupon yields of four to six% supply top source of revenue to cushion our mounted source of revenue portfolios within the match of higher volatility.

With that, I sought after to thanks for listening and as all the time, we admire your reinforce.

Segregated Fund contracts are issued by way of The Empire Existence Insurance coverage Corporate (“Empire Existence”). Empire Existence Investments Inc. is the Portfolio Supervisor of the Empire Existence segregated finances. Empire Existence Investments Inc. is a wholly-owned subsidiary of The Empire Existence Insurance coverage Corporate. An outline of the important thing options of the person variable insurance coverage contract is contained within the Data Folder for the product being thought to be. Any quantity this is allotted to a segregated fund is invested on the possibility of the contract proprietor and might building up or lower in worth. Previous efficiency is not any ensure of long term efficiency. All returns are calculated after taking bills, control and management charges under consideration.

This video/file contains forward-looking knowledge this is in response to the critiques and perspectives of Empire Existence Investments Inc. as of the date mentioned and is matter to switch with out realize. This data will have to no longer be thought to be a advice to shop for or promote nor will have to it’s relied upon as funding, tax or prison recommendation. Data contained on this file has been received from third-party resources believed to be dependable, however accuracy can’t be assured. Empire Existence Investments Inc. and its associates don’t warrant or make any representations in regards to the use or the result of the ideas contained herein with regards to its correctness, accuracy, timeliness, reliability, or differently, and does no longer settle for any accountability for any loss or injury that effects from its use.

March 8, 2023