Buying and selling Replace: Thursday October 12, 2023

S&P Emini pre-open marketplace research

Emini day-to-day chart

- The Emini rallied the day gone by and closed above the August 18th low. Then again, the day gone by used to be a susceptible doji, an indication of the bulls’ hesitation and loss of momentum. This may occasionally build up the chances of a pullback quickly.

- The reversal over the last 4 buying and selling days is powerful sufficient to make the marketplace At all times In Lengthy and build up the chances of a 2d leg up.

- The bears are hopeful that this week’s reversal up is a purchase vacuum check of a 50% pullback from the selloff that started round September 14th.

- Whilst this is a imaginable purchase vacuum that can turn out to be a decrease top within the endure channel that started again in July, the bears wish to expand extra promoting power.

- The marketplace will most probably pull again for a minimum of an afternoon or two prior to the bulls get their 2d leg up. It is because the day-to-day chart is in a buying and selling vary, and breakouts inside buying and selling levels most often have deep pullbacks. Those deep pullbacks permit trapped prohibit order bears to scale in upper and keep away from a loss.

- The bulls are hopeful that any pullback might be small and the rally will proceed upper. This may squeeze the bears and power the bears to shop for again shorts at upper costs, riding the marketplace upper.

- Whilst the bulls have executed a very good task over the last 4 buying and selling days, understanding that the day-to-day chart is in a buying and selling vary is very important. This implies the chances prefer the bulls getting upset. This implies the chances are towards the marketplace reversing briefly to the July top.

- Much more likely, the bulls gets a 2d leg up, and the marketplace will cross sideways. The marketplace will most probably check 4,500 quickly, which may be the midpoint of the buying and selling vary that lasted from the center of August to the center of September.

- General, buyers will have to be expecting a pullback quickly for a minimum of 1- 3 days and fall under a prior bar at the day-to-day chart. Buyers can pay shut consideration to how deep the pullback is. The deeper the pullback, the marketplace upset the bulls might be and the much more likely the marketplace will cross sideways.

Emini 5-minute chart and what to anticipate nowadays

- Word: I’m penning this document 3 hours prior to the open; subsequently, the marketplace would possibly glance other when the U.S. Consultation starts.

- The marketplace has rallied throughout the in a single day consultation and is lately above the day gone by’s top.

- The bulls are hopeful that they’re going to be capable to shut above the day gone by’s top. Then again, the bulls will have to stay the marketplace above the day gone by’s top for all the U.S. Consultation. Whilst that is imaginable, the chances prefer a pullback over the following couple of days and for nowadays to be disappointing for the bulls. This implies the marketplace would possibly rally above the day gone by’s top at the open however fail to near above the day gone by’s top. This may be an indication of lowering momentum for the bulls.

- Buyers will have to pay shut consideration to the day gone by’s top, the day gone by’s low, and the day’s open.

- As I ceaselessly say, buyers will have to imagine ready 6-12 bars prior to hanging a industry at the open. It is because there may be an 80% likelihood that nowadays might be a buying and selling vary open and just a 20% likelihood that nowadays might be a development from the open.

- For the marketplace to shape a buying and selling vary, it must shape a double best/backside and a wedge best/backside. This most often would require 12 bars to shape.

- The day past shaped a climactic rally into the shut. There’s a 75% likelihood that nowadays can have no less than two hours of sideways buying and selling starting prior to the top of the second one hour. There’s a 50% likelihood that the marketplace will shape a temporary rally at the open, adopted through two hours of sideways buying and selling.

- There’s just a 25% likelihood of a development from the open up or down lasting all day.

- Buyers will have to be in a position for a gap reversal after any temporary rally or selloff. This may create a buying and selling vary day.

- If the marketplace does shape a gap reversal, buyers will have to take note of a imaginable measured transfer of the outlet vary. If the marketplace will get a measured transfer of the outlet vary, buyers will have to take note of the day’s open as it could be in the midst of the day’s vary. This may build up the chances of a buying and selling vary day, making the day open a magnet later within the day.

- General, buyers will have to be affected person at the open. Buyers will have to try to catch the outlet swing that ceaselessly starts after the formation of a double best/backside or a wedge best/backside. This normally takes an hour to expand. Through looking forward to the above trend, a dealer can position a swing industry with nice risk-reward and first rate chance (40-50%).

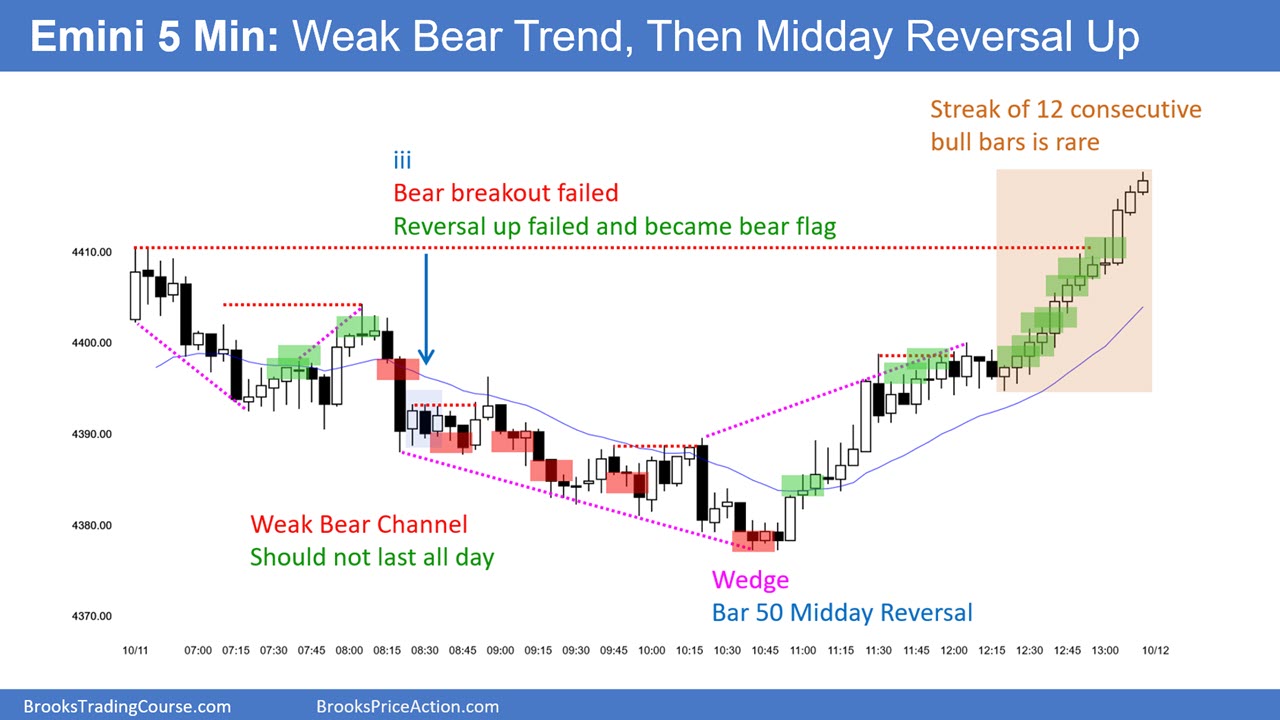

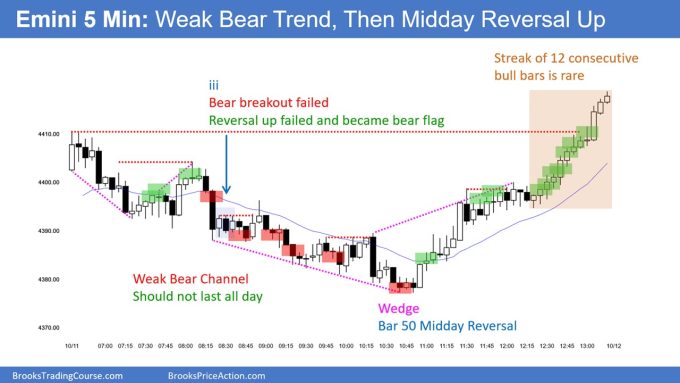

Emini intraday marketplace replace

- The marketplace offered off at the open with 5 consecutive endure bars. The selloff used to be sturdy sufficient to extend the chances of a endure development or buying and selling vary day, no longer a bull development day.

- The bulls shaped a powerful reversal up round bar 8. The bulls need a gap reversal and some other bull development day. Then again, as a result of the explanations discussed previous within the weblog, the chances are towards it.

- Buyers will have to think the rally after bar 8 will result in a buying and selling vary, no longer a bull development day.

- As of bar 12, the bulls are trying out the open of the day, on the other hand the chances are towards a powerful bull breakout.

- The selloff at the open is powerful sufficient that the bears would possibly get a 2d leg down. This implies buyers will have to be ready for the marketplace to check the low of the day.

The day past’s Emini setups

Al created the SP500 Emini charts.

Listed below are a number of affordable forestall access setups from the day gone by. I display every purchase access with a inexperienced rectangle and every promote access with a purple rectangle. Consumers of each the Brooks Buying and selling Direction and Encyclopedia of Chart Patterns have get admission to to a close to 4-year library of extra detailed explanations of swing industry setups (see On-line Direction/BTC Day-to-day Setups). Encyclopedia participants get present day-to-day charts added to Encyclopedia.

My purpose with those charts is to give an At all times In point of view. If a dealer used to be looking to be At all times In or just about At all times Able all day, and he used to be no longer lately out there, those entries can be logical occasions for him to go into. Those subsequently are swing entries.

You will need to needless to say maximum swing setups don’t result in swing trades. Once buyers are upset, many go out. Those that go out like to get out with a small benefit (scalp), however ceaselessly must go out with a small loss.

If the danger is just too large in your account, you will have to watch for trades with much less menace or industry an alternate marketplace just like the Micro Emini.

EURUSD the Forex market marketplace buying and selling methods

EURUSD the Forex market day-to-day chart

- The EURUSD closed above the 20- Duration Exponential Transferring Moderate the day gone by for the primary time in since overdue August.

- Whilst the bulls have executed a very good task, and the marketplace is most probably At all times In Lengthy, it isn’t obviously At all times In Lengthy. This implies the marketplace will most probably cross sideways and shape a deep pullback prior to the bulls get their 2d leg up.

- The marketplace has been clear of the transferring moderate for lots of bars, expanding the chances of dealers close to the transferring moderate.

- For the reason that rally up is tight, the bears would possibly hesitate, expanding the chances of any selloff being minor and resulting in a 2d leg up.

- You will need to understand that the channel at the day-to-day chart is tight and is a breakout at the upper time frames (weekly chart). Which means that the most productive the bulls can be expecting is a buying and selling vary at the day-to-day chart, and the bears will most probably get a 2d leg down at the weekly chart. Then again, it’s going to take a number of months to shape.

Abstract of nowadays’s S&P Emini value motion

Al created the SP500 Emini charts.

Finish of day video evaluation

Reside circulation movies to practice Monday, Wednesday and Friday (matter to modify).

See the weekly replace for a dialogue of the associated fee motion at the weekly chart and for what to anticipate going into subsequent week.

Buying and selling Room

Al Brooks and different presenters communicate in regards to the detailed Emini value motion real-time on a daily basis within the BrooksPriceAction.com buying and selling room days. We provide a 2 day unfastened trial.

Charts use Pacific Time

When occasions are discussed, it’s USA Pacific Time. The Emini day consultation charts start at 6:30 am PT and finish at 1:15 pm PT which is quarter-hour after the NYSE closes. You’ll learn background knowledge in the marketplace reviews at the Marketplace Replace web page.