Buying and selling Replace: Tuesday October 10, 2023

S&P Emini pre-open marketplace research

Emini day by day chart

- The Emini is forming a backside and is trying out the August 18th low.

- I’ve been pronouncing for the previous few weeks that the Emini will almost certainly take a look at the August 18th breakout level low because of trapped bulls.

- It used to be cheap for the bulls to shop for the breakout underneath the August 18th low and scale in decrease, having a bet on a buying and selling vary.

- Investors pays shut consideration to peer how the marketplace reacts to the August 18th low. The Bulls hope they may be able to ruin a ways above the low, and the Bears need to stay the August 18th breakout level hole open. Alternatively, much more likely, the space goes to near.

- As sturdy because the selloff right down to the October low seems, it’s most likely a fancy two-legged pullback on the next period of time. This implies the percentages appreciated a buying and selling vary forming, no longer a endure development.

- It’s imaginable that the selloff to the October low is a 2nd leg entice. The rally might be deep and move a ways above the August 18th low.

- The marketplace may well be At all times In Lengthy. Alternatively, the bulls have no longer performed sufficient to make it At all times In Lengthy. Preferably, the bulls want to get 1-2 closes above the transferring moderate prior to buyers will likely be satisfied they have got taken keep watch over.

- Alternatively, the rally during the last two buying and selling days is robust sufficient for the marketplace to be At all times In Lengthy and more likely to result in upper costs.

- The bears need to entice the bulls through forming a robust endure development bar. Alternatively, that will create a Low 1 quick, and consumers would most likely be underneath it.

Emini 5-minute chart and what to anticipate nowadays

- I’m touring in Europe and because of the time zone distinction, I’m penning this weblog a number of hours prior to the open, and the marketplace is most effective 10 issues clear of the day before today’s shut.

- Investors will have to take note of the August 18th low because the marketplace might try to achieve it nowadays or day after today.

- There’s an 80% likelihood of a buying and selling vary open and just a 20% likelihood of a development from the open.

- Maximum buyers will have to believe ready 6-12 bars prior to striking a business. As discussed above, there’s an 80% likelihood of a buying and selling vary forming at the open.

- Investors will have to try to catch the hole swing that ceaselessly starts prior to the tip of the second one hour after forming a double best/backside or a wedge best/backside.

- Through looking forward to one of the most patterns discussed above to shape, a dealer can input on a forestall access, letting them have a super possibility/praise setup.

- On account of the previous two days forming sturdy bull development bars at the day by day chart, the disadvantage is most likely restricted. It’s imaginable nowadays to create a pullback at the day by day chart prior to the marketplace reaches the August 18th low.

- Finally, crucial factor within the open is being affected person and able for the rest. A dealer should be calm and not in denial of the associated fee motion in entrance of them. As Al Brooks says, “Business the chart in entrance of you, no longer what you hope will occur.”

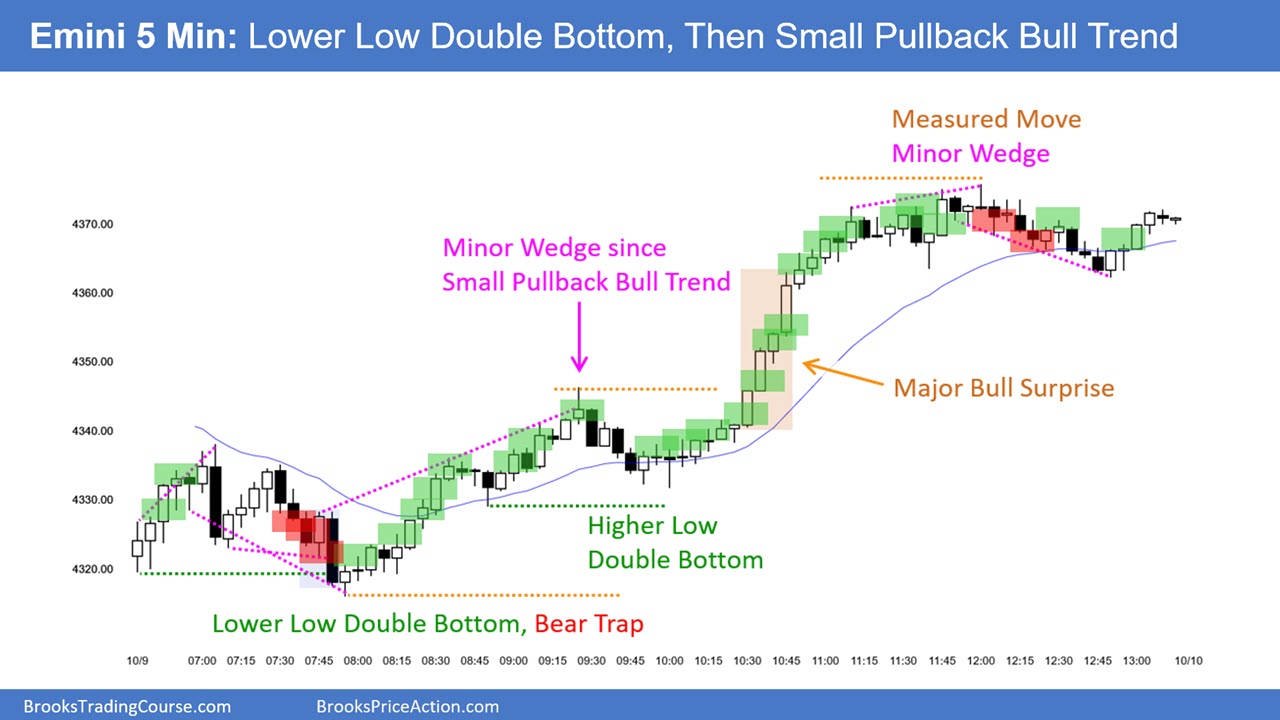

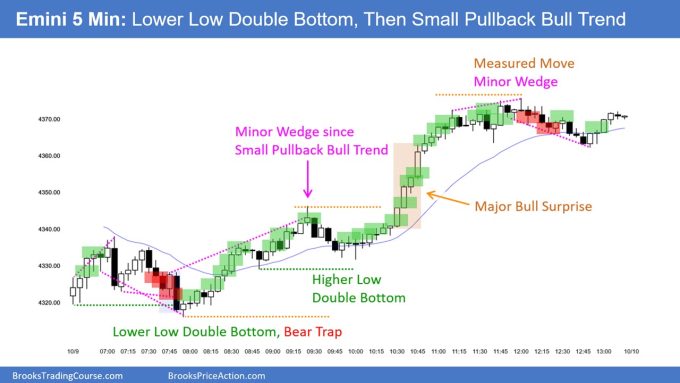

The day past’s Emini setups

Al created the SP500 Emini charts.

Listed here are a number of cheap forestall access setups from the day before today. I display each and every purchase access with a inexperienced rectangle and each and every promote access with a crimson rectangle. Patrons of each the Brooks Buying and selling Path and Encyclopedia of Chart Patterns have get admission to to a close to 4-year library of extra detailed explanations of swing business setups (see On-line Path/BTC Day-to-day Setups). Encyclopedia contributors get present day by day charts added to Encyclopedia.

My purpose with those charts is to offer an At all times In point of view. If a dealer used to be seeking to be At all times In or just about At all times Able all day, and he used to be no longer recently available in the market, those entries could be logical occasions for him to go into. Those subsequently are swing entries.

It is very important take into account that maximum swing setups don’t result in swing trades. Once buyers are disillusioned, many go out. Those that go out like to get out with a small benefit (scalp), however ceaselessly need to go out with a small loss.

If the danger is simply too large on your account, you will have to look forward to trades with much less possibility or business another marketplace just like the Micro Emini.

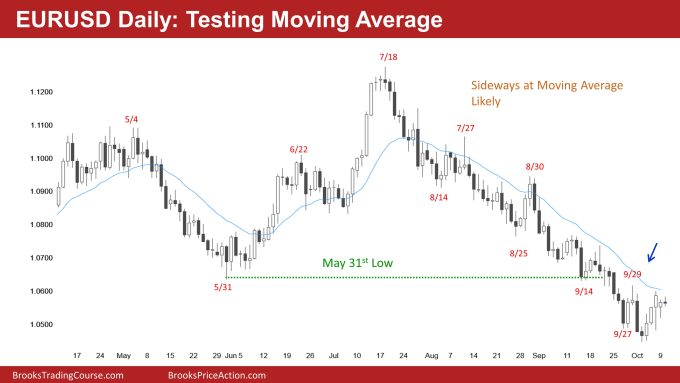

EURUSD the Forex market marketplace buying and selling methods

EURUSD the Forex market day by day chart

- The EURUSD examined the transferring moderate (blue line) closing Friday. Alternatively, it failed to achieve it and pulled again the day before today.

- This may increasingly building up the likelihood that the marketplace should achieve the transferring moderate over the next day to come or two.

- The day past, I shaped an inside of bar, a Top 1 purchase sign bar. There it will likely be dealers above the day before today’s prime, no less than in short. Top 1 purchase sign bars usually result in deeper pullback adopted through resumption of the transfer.

- The bears are hopeful that nowadays will shape a endure bar final on its low. Alternatively, if it does, bears might hesitate to promote underneath it. It’s because buyers will query if the transferring moderate has been adequately examined. The marketplace closed above the transferring moderate on August thirtieth, and buyers be expecting the similar to occur right here.

- Total, the marketplace will almost certainly shut above the transferring moderate in the next day to come or two. Alternatively, since the channel down is tight, the upside shall be restricted over the following a number of weeks.

Abstract of nowadays’s S&P Emini worth motion

Al created the SP500 Emini charts.

Finish of day video overview

Are living flow movies to apply later (Brad travelling).

See the weekly replace for a dialogue of the associated fee motion at the weekly chart and for what to anticipate going into subsequent week.

Buying and selling Room

Al Brooks and different presenters communicate in regards to the detailed Emini worth motion real-time on a daily basis within the BrooksPriceAction.com buying and selling room days. We provide a 2 day unfastened trial.

Charts use Pacific Time

When occasions are discussed, it’s USA Pacific Time. The Emini day consultation charts start at 6:30 am PT and finish at 1:15 pm PT which is quarter-hour after the NYSE closes. You’ll learn background knowledge available on the market stories at the Marketplace Replace web page.