Marketplace Evaluation: S&P 500 Emini Futures

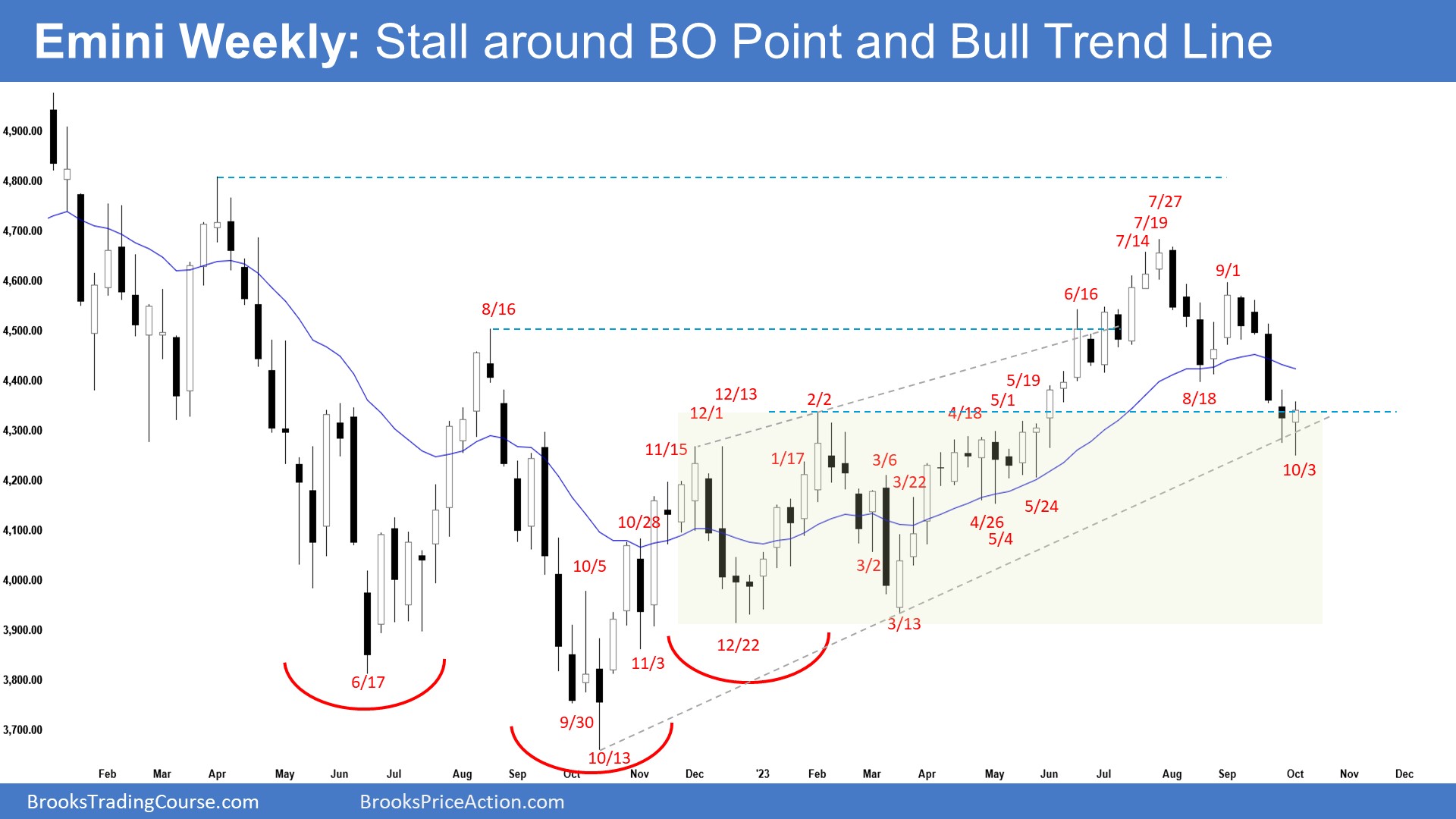

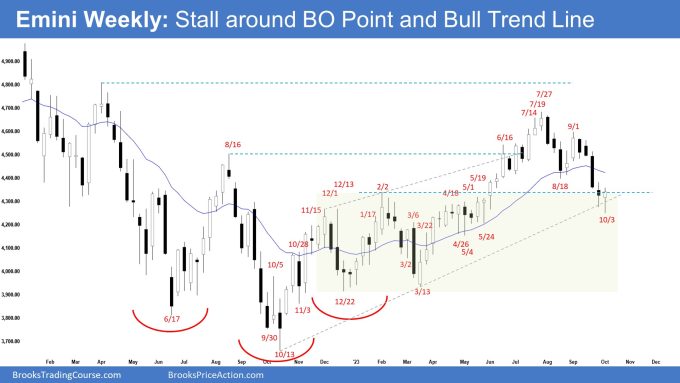

The weekly chart shaped an Emini check breakout level; a two-legged pullback trying out the February 2 prime (breakout level) and the bull development line. The bulls see the present transfer down merely as a 50% pullback (of the transfer which began in March) inside of a huge bull channel. If the marketplace trades upper, the bears need every other leg down to finish the wedge trend with the primary 2 legs being August 18 and October 3.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick used to be a bull reversal bar ultimate within the higher part with an extended tail underneath.

- Ultimate week, we mentioned that whilst the Emini may nonetheless business just a little decrease, odds fairly want the marketplace to nonetheless be All the time In Lengthy.

- This week traded underneath closing week’s low however reversed right into a bull reversal bar.

- In the past, the bulls were given a robust development up (from March) in a good bull channel.

- The bulls need the Emini to opposite again above the 20-week exponential shifting moderate.

- They hope to get a retest of the July 27 prime from a double-bottom bull flag (Aug 18 and Oct 3).

- They see the present transfer down merely as a 50% pullback (of the transfer which began in March) inside of a huge bull channel.

- Subsequent week, the bulls will wish to create follow-through purchasing to extend the chances of a retest of July 27 prime.

- The bears were given a two-legged pullback trying out the breakout level (Feb 2) and the bull development line.

- They would like a robust breakout underneath the bull development line with follow-through promoting.

- If there’s a pullback (leap), they would like every other leg down to finish the wedge trend with the primary 2 legs being August 18 and October 3.

- Since this week used to be a bull bar ultimate close to its prime with an extended tail underneath, this is a purchase sign bar for subsequent week.

- Odds fairly want the marketplace to business a minimum of just a little upper.

- Investors will see if the bulls can get a robust follow-through bull bar or will subsequent week business fairly upper, however shut with an extended tail above or a endure bar.

- For now, odds fairly want the marketplace to nonetheless be All the time In Lengthy (bull development stays intact; upper highs, upper lows).

- The pullback has additionally fulfilled the minimal requirement of TBTL (Ten Bars, Two Legs).

The Day by day S&P 500 Emini chart

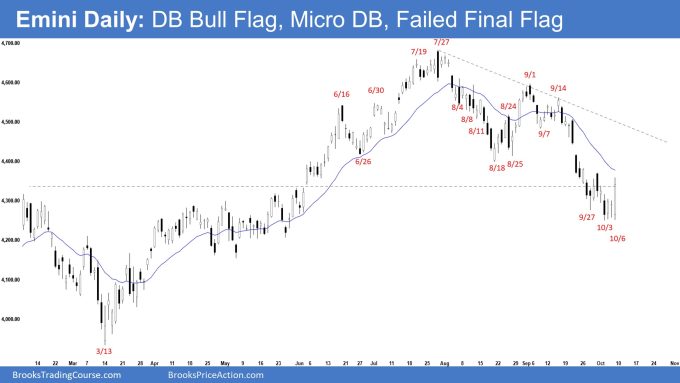

- The marketplace traded fairly decrease early within the week adopted by means of a sideways buying and selling vary forming an ii (within within trend on Wednesday and Thursday. Friday broke underneath the ii trend however reversed to damage above it, ultimate as a large out of doors bull bar.

- In the past, we mentioned that the marketplace might nonetheless be within the sideways-to-down pullback section. Investors will see if the bears can create follow-through promoting or will the marketplace business fairly decrease however in finding patrons across the February 2 prime house.

- Up to now, the marketplace is stalling across the February 2 prime house.

- The bears were given a 2nd leg sideways to down from a decrease prime main development reversal and a double best endure flag (Sept 1 and Sept 14).

- They were given a 50% pullback of the transfer which began in March, trying out the February 2 prime which used to be the breakout level of the rally.

- If the marketplace trades upper from right here, they would like every other leg down finishing the wedge trend with the primary two legs being August 18 and October 3.

- The bulls need a reversal up from a double backside bull flag (Aug 18 and Oct 3), a micro double backside (Oct 3 and Oct 6) and a failed ultimate flag (Oct 6) adopted by means of a retest of the July 27 prime and a powerful breakout above.

- They see the present transfer merely as a 50% pullback and a check of the breakout level (Feb 2) of the rally.

- The following goals for the bulls are the endure development line and the September prime.

- Since Friday used to be a large out of doors bull bar ultimate in its higher part, this is a purchase sign bar for Monday.

- Odds fairly want the Emini to business a minimum of just a little upper.

- Investors will see if the bulls can create consecutive bull bars ultimate close to their highs. In the event that they get that, the chances of a retest of the September prime build up.

- Or will the marketplace business fairly upper however is susceptible and sideways (overlapping bars, doji(s), endure bars)? Whether it is susceptible, the chances of a retest of the present leg low (Oct 3) build up.

- For now, whilst the marketplace might nonetheless business sideways to down for a couple of extra weeks, the bull development stays intact.

Buying and selling room

Al Brooks and different presenters communicate in regards to the detailed Emini worth motion real-time every day within the BrooksPriceAction.com buying and selling room. We provide a 2 day unfastened trial.

Marketplace research studies archive

You’ll be able to get admission to all weekend studies at the Marketplace Research web page.