Up to date on October fifth, 2023 by way of Aristofanis Papadatos

The Dividend Kings are a gaggle of simply 50 shares that experience larger their dividends for no less than 50 years in a row. We imagine the Dividend Kings are a number of the highest-quality dividend development shares to shop for and hang for the longer term.

With this in thoughts, we created a complete listing of the entire Dividend Kings.

You’ll obtain the total listing, along side essential monetary metrics corresponding to dividend yields and price-to-earnings ratios, by way of clicking at the hyperlink underneath:

Every yr, we in my opinion evaluate the entire Dividend Kings. The following within the sequence is Canadian Utilities (CDUAF).

Canadian Utilities has larger its dividend for fifty consecutive years, which makes it the one Canadian corporate at the listing of Dividend Kings. This article is going to analyze the corporate in higher element.

Industry Assessment

Canadian Utilities is a software inventory with roughly 5,000 workers. ATCO owns 53% of Canadian Utilities. Based totally in Alberta, Canadian Utilities is a assorted world power infrastructure company that delivers answers in electrical energy, pipelines & liquid, and retail power.

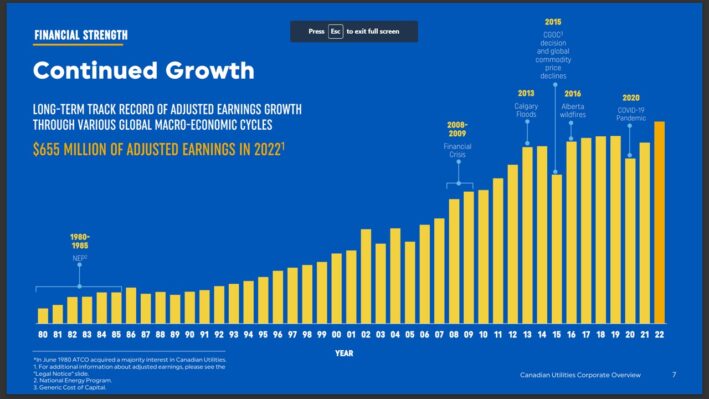

The corporate has an extended historical past of producing stable development and constant earnings in the course of the financial cycle.

Supply: Investor Presentation

On July twenty seventh, 2023, Canadian Utilities reported its Q2-2023 effects for the duration finishing June thirtieth, 2023. Earnings for the quarter amounted to $663 million, which used to be 6% decrease year-over-year, whilst adjusted revenue in step with percentage reduced 27.5%, from $0.51 to $0.37.

The lower in revenues resulted basically from value efficiencies generated by way of Electrical energy Distribution and Herbal Fuel Distribution over the second-generation Efficiency Base Legislation (PBR) time period now being handed onto consumers beneath the 2023 Price of Provider rebasing framework, in addition to the verdict of AUC (Alberta Utilities Fee) to maximise the number of 2021 deferred revenues in 2022 on account of charge aid equipped to consumers in 2021 (because of COVID-19 on the time).

The really extensive decline in revenue used to be brought about basically by way of decreased revenues, which squeezed the corporate’s margins, coupled with the have an effect on of inflation at the general prices of the corporate.

All over the quarter, Canadian Utilities invested C$332 million in capital initiatives. Roughly 86% of this quantity used to be allotted on its regulated utilities trade, with the rest 14% invested in its power infrastructure trade.

Expansion Potentialities

Through taking advantage of a solid trade type, Canadian Utilities can slowly however step by step develop its revenue. The corporate persistently invests considerable quantities in new initiatives and advantages from base charge will increase, which generally tend to hover between 3% and four% in step with yr.

As development within the regulated utilities area stays somewhat restricted, Canadian Utilities is now in quest of to amplify its trade in the course of the strategic acquisition of renewable technology belongings. The $730 million funding must give you the corporate with fast scale and long term development in the course of the construction pipeline and benefit from the qualities of long-term acquire energy agreements which might be not unusual in wind initiatives. Additional, control expects that this funding might be accretive to money glide and revenue in 2023.

Combining the corporate’s development initiatives, the opportunity of modest margin enhancements, and – as voluntarily pursued – the postponed charge base will increase, we handle our anticipated reasonable annual development charge over the following 5 years at 4%. Our anticipated annual dividend development charge stays at 2.5%.

The corporate will most probably make stronger its payout ratio sooner than its new initiatives get started generating sufficient money flows to re-accelerate dividend development. The inventory’s ancient 10-year reasonable annual dividend development charge of four.0% is enough to catch up on the foreign money fluctuations, step by step rising traders’ source of revenue.

Aggressive Benefits & Recession Efficiency

The corporate’s aggressive benefit lies within the moat surrounding regulated utilities. With out a simple access into the sphere, regulated utilities revel in an oligopolistic marketplace with little pageant danger. The corporate’s resilience has been confirmed decade after decade.

Some other aggressive benefit is the corporate’s robust monetary place. Canadian Utilities has investment-grade credit score rankings of BBB+ from Usual & Deficient’s and A- from Fitch. This permits the corporate to boost capital at sexy rates of interest.

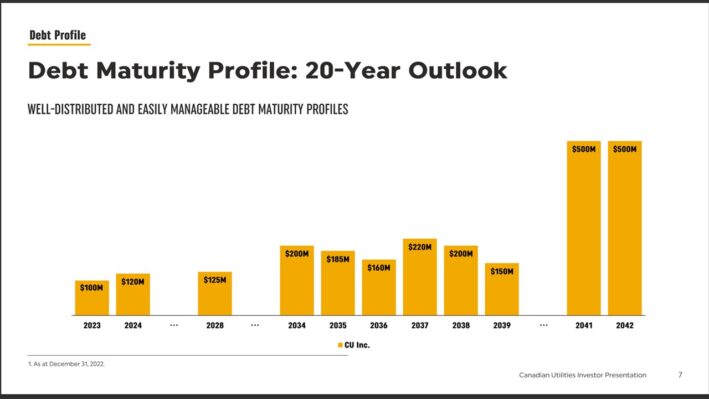

The corporate additionally has a powerful steadiness sheet with a well-laddered debt adulthood profile, which is able to lend a hand stay the dividend sustainable, even supposing rates of interest proceed to upward push.

Supply: Investor Presentation

Regardless of a couple of recessions and unsure environments during the last 50 years, the corporate has withstood each and every certainly one of them whilst elevating its dividend. Whilst Canadian Utilities’ payout ratio got here beneath force all the way through 2020 (regardless that dividends have been actually lined from its running money flows if we’re to exclude depreciation and amortization,) by way of 2028, we predict it to have returned to a lot more at ease ranges of round 76% of its internet source of revenue.

The corporate held up extraordinarily properly all the way through earlier recessions and financial downturns, such because the coronavirus pandemic. We might be expecting Canadian Utilities to accomplish slightly properly in long term recessions, for the reason that the corporate operates in an almost recession-proof business.

Valuation & Anticipated Returns

The usage of the present percentage charge of ~$21 and anticipated earnings-per-share of US$1.66 for the operating fiscal yr, Canadian Utilities is buying and selling at a price-to-earnings ratio of 12.7. Our honest revenue a couple of for Canadian Utilities is 16.0.

Due to this fact, the inventory appears to be undervalued at its present charge stage. If the inventory trades at our assumed honest valuation stage in 2028, it’s going to revel in a 4.8% annualized valuation tailwind over the following 5 years.

Apart from adjustments within the price-to-earnings a couple of, long term returns might be pushed by way of revenue development and dividends.

We predict 4% annual revenue development over the following 5 years, as utilities are usually slow-growth companies. As well as, Canadian Utilities lately can pay a quarterly dividend of CAD $0.4486 in step with percentage. This works out to kind of CAD $1.79 in step with percentage on an annualized foundation. At present alternate charges, this interprets to an annualized dividend of $1.35 in step with percentage in U.S. bucks for a 6.4% dividend yield.

Overall returns may just include the next:

- 0% revenue development

- 4.8% a couple of enlargement

- 6.4% dividend yield

Given the entire above, Canadian Utilities is predicted to supply a mean annual overall go back of 13.5% over the following 5 tears. In consequence, we’ve a purchase advice at the inventory and stay assured within the corporate’s talent to boost dividends via a recessionary surroundings.

Ultimate Ideas

Canadian Utilities has an extended development document and a good long term outlook. We lately to find the inventory undervalued. In consequence, stocks would possibly be offering a 13.5% reasonable annual overall go back over the following 5 years.

The inventory must proceed to boost its dividend for lots of extra years, because the trade is more likely to hang up properly all the way through recessions. Canadian Utilities additionally has a prime yield of above 6%, which is sexy to risk-averse source of revenue traders, corresponding to retirees. Due to this fact, stocks earn a purchase score.

Moreover, the next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

Thank you for studying this text. Please ship any comments, corrections, or inquiries to enhance@suredividend.com.