Via Chainika Thakar and Varun Divakar

If you happen to’ve been keen on leveraging Device Finding out for algorithmic buying and selling with Python, you might be becoming a member of a rising development within the monetary trade. Device studying has received vital reputation amongst quant companies and hedge finances lately. Those entities have recognised the opportunity of mechanical device studying for algorithmic buying and selling.

Whilst particular algorithmic buying and selling methods hired through quant hedge finances are generally proprietary and stored confidential, it’s extensively said that many most sensible finances closely depend on mechanical device studying ways.

For example, Guy Crew’s AHL Measurement program, a hedge fund managing over $5.1 billion, accommodates AI and mechanical device studying in its buying and selling operations. Taaffeite Capital, any other notable instance, proudly claims to industry totally systematically and mechanically the usage of proprietary mechanical device studying programs.

On this Python mechanical device studying educational, we purpose to discover how mechanical device studying has remodeled the arena of buying and selling. We will be able to broaden machine-learning algorithms to make predictions and tell buying and selling choices through harnessing the facility of Python and its various libraries. Whilst the academic won’t divulge particular hedge fund methods, it’ll information you throughout the procedure of making a easy Python machine-learning set of rules to are expecting the last value of a inventory for tomorrow.

Via figuring out the basics of mechanical device studying, Python programming, monetary markets, and statistical ideas, you’ll release alternatives for algorithmic buying and selling the usage of mechanical device studying in Python. From obtaining and preprocessing knowledge to making hyperparameters, splitting knowledge for analysis, optimising type parameters, making predictions, and assessing efficiency, you’re going to achieve insights into all the procedure.

It’s a must to observe that the usage of mechanical device studying in algorithmic buying and selling has its execs and cons.

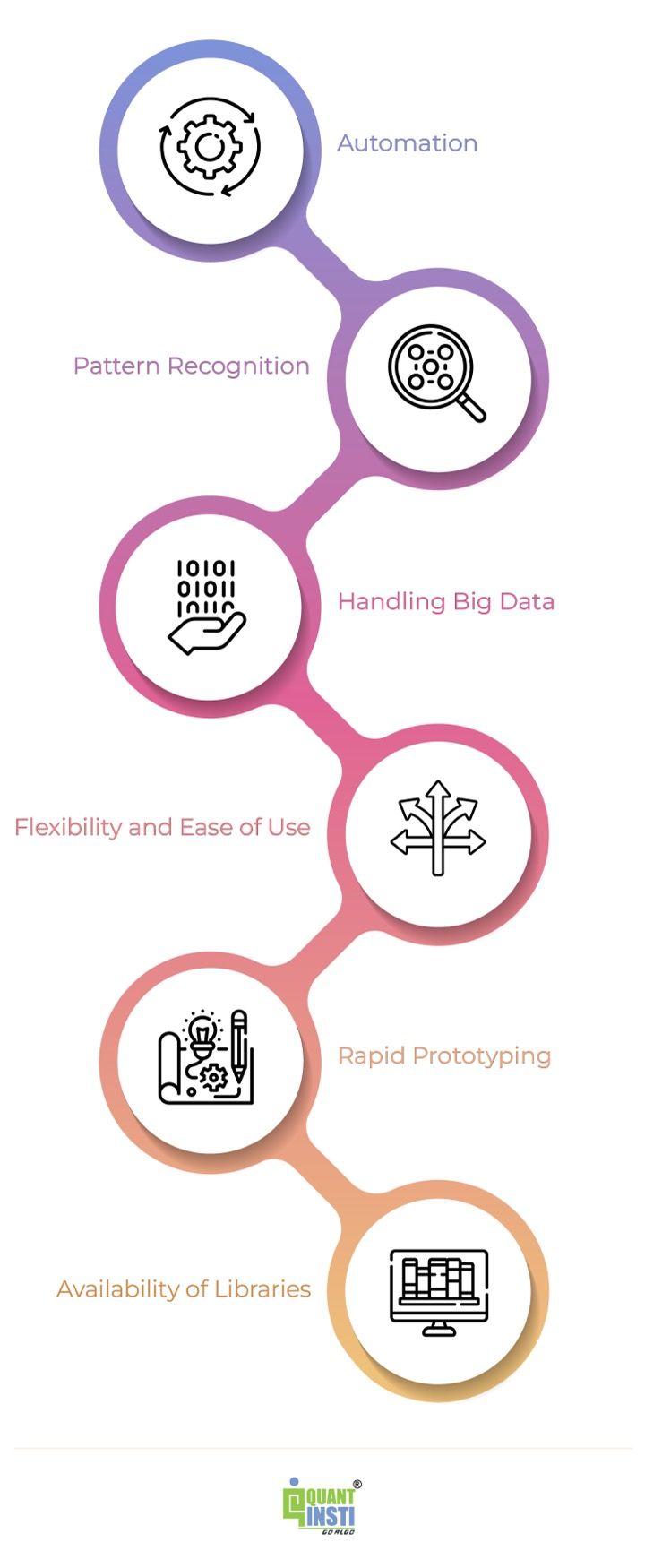

At the sure aspect, it gives automation, trend reputation, and the power to maintain huge and complicated datasets. Alternatively, demanding situations similar to type complexity, the danger of overfitting, and the wish to adapt to dynamic marketplace stipulations will have to be taken into consideration.

Via embarking in this adventure of the usage of mechanical device studying in Python for algorithmic buying and selling, you’re going to achieve treasured wisdom and talents to use in finance and discover the thrilling intersection of information science and buying and selling.

All of the ideas coated on this weblog are taken from this Quantra route on Python for Device Finding out in Finance.

This weblog covers:

How mechanical device studying received reputation?

Device studying programs and libraries are advanced both in-house through companies for proprietary use or through third-party builders who cause them to freely to be had to the consumer neighborhood. The supply of those programs has considerably larger lately, empowering builders to get entry to a variety of machine-learning ways for his or her buying and selling wishes.

There are a large number of mechanical device studying algorithms, each and every categorised in response to its capability. As an example, regression algorithms type the connection between variables, whilst determination tree algorithms assemble determination fashions for classification or regression issues. Amongst quants, sure algorithms have received reputation, similar to

- Linear Regression

- Logistic Regression

- Random Forests (RM)

- Make stronger Vector Device (SVM)

- Ok-Nearest Neighbor (kNN) Classification and

- Regression Tree (CART) Deep Finding out

Those Device Finding out algorithms for buying and selling are utilized by buying and selling companies for quite a lot of functions together with:

- Analysing historic marketplace behaviour the usage of huge knowledge units

- Decide optimum inputs (predictors) to a technique

- Figuring out the optimum set of technique parameters

- Making industry predictions and so forth.

Why use mechanical device studying with Python in algorithmic buying and selling?

Because of its energetic and supportive neighborhood, Python for buying and selling has received immense reputation amongst programmers. Consistent with Stack Overflow’s 2020 Developer Survey, Python ranked as the highest language for the fourth consecutive 12 months, with builders expressing a robust need to be informed it. Python’s dominance within the developer neighborhood makes it a herbal selection for buying and selling, specifically within the quantitative finance box.

Python’s luck in buying and selling is attributed to its medical libraries like Pandas, NumPy, PyAlgoTrade, and Pybacktest, which permit the advent of refined statistical fashions very easily. The continual updates and contributions from the developer neighborhood make sure that Python buying and selling libraries stay related and state of the art. Moreover, there’s the provision of libraries like

- Pandas

- NumPy

- PyAlgoTrade and extra.

Coming to mechanical device studying with python, there are a number of the explanation why mechanical device studying with Python is extensively utilized in algorithmic buying and selling:

Additionally, you’ll take a look at this informative video underneath to learn how mechanical device studying for algorithmic buying and selling works.

Necessities for growing mechanical device studying algorithms for buying and selling the usage of Python

In depth Python libraries and frameworks make it a well-liked selection for mechanical device studying duties, enabling builders to put into effect and experiment with quite a lot of algorithms, procedure and analyse knowledge successfully, and construct predictive fashions.

With the intention to create the mechanical device studying algorithms for buying and selling the usage of Python, you’re going to want the next necessities:

- Set up of Python programs and libraries intended for mechanical device studying

- Complete-fledged wisdom of steps of mechanical device studying

- Understanding the applying fashions

Set up a couple of programs and libraries

Python mechanical device studying in particular specializes in the usage of Python for the advance and alertness of mechanical device studying fashions.

Chances are you’ll upload one line to put in the programs “pip set up numpy” You’ll set up the vital programs within the Anaconda Instructed the usage of the codes as discussed underneath.

- Scikit-learn for mechanical device studying

- TensorFlow for deep studying

- Keras for deep studying

- PyTorch for neural networks

- NLTK for herbal language processing

Complete-fledged wisdom of steps of mechanical device studying

Along with common Python wisdom, skillability in Python mechanical device studying necessitates a deeper figuring out of mechanical device studying ideas, algorithms, type analysis, function engineering, and information preprocessing.

Understanding the applying fashions

The principle focal point of Python mechanical device studying is the advance and alertness of fashions and algorithms for duties like classification, regression, clustering, advice programs, herbal language processing, symbol reputation, and different mechanical device studying programs.

use algorithmic buying and selling with mechanical device studying in Python?

Allow us to see the stairs to doing algorithmic buying and selling with mechanical device studying in Python. Those steps are:

- Downside commentary

- Getting the knowledge and making it usable for mechanical device studying set of rules

- Growing hyperparameter

- Splitting the knowledge into take a look at and teach units

- Getting the best-fit parameters to create a brand new serve as

- Making the predictions and checking the efficiency

Downside Observation

Let’s get started through figuring out what we’re aiming to do. Via the tip of this mechanical device studying for algorithmic buying and selling with Python educational, I can display you tips on how to create an set of rules that may are expecting the last value of an afternoon from the former OHLC (Open, Top, Low, Shut) knowledge.

I additionally need to observe the prediction error at the side of the scale of the enter knowledge.

Allow us to import all of the libraries and programs had to construct this machine-learning set of rules.

Getting the knowledge and making it usable for mechanical device studying set of rules

To create any set of rules, we want knowledge to coach the set of rules after which to make predictions on new unseen knowledge. On this mechanical device studying for algorithmic buying and selling with Python educational, we will be able to fetch the knowledge from Yahoo.

To perform this, we will be able to use the knowledge reader serve as from the pandas library. This serve as is broadly used, enabling you to get knowledge from many on-line resources.

We’re fetching the knowledge of AAPL(ticker) or APPLE. This inventory can be utilized as a proxy for the efficiency of the S&P 500 index. We specify the 12 months ranging from which we will be able to be pulling the knowledge.

As soon as the knowledge is in, we will be able to discard any knowledge instead of the OHLC, similar to quantity and altered Shut, to create our knowledge body ‘df ’.

Now we wish to make our predictions from previous knowledge, and those previous options will support the mechanical device studying type industry. So, let’s create new columns within the knowledge body that include knowledge with in the future lag.

Notice: The capital letters are dropped for lower-case letters within the names of recent columns.

Growing Hyperparameters

Despite the fact that the concept that of hyperparameters is worthy of a weblog in itself, for now I can simply say a couple of phrases about them. Those are the parameters that the mechanical device studying set of rules can’t be taught over however must be iterated over. We use them to peer which predefined purposes or parameters yield the best-fit serve as.

On this instance, I’ve used Lasso regression which makes use of the L1 form of regularisation. It is a form of mechanical device studying type in response to regression research which is used to are expecting steady knowledge.

This kind of regularisation could be very helpful if you end up the usage of function variety. It’s able to lowering the coefficient values to 0. The SimpleImputer serve as replaces any NaN values that may impact our predictions with imply values, as specified within the code.

The ‘steps’ are a host of purposes which might be integrated as part of the Pipeline serve as. The pipeline is an overly environment friendly instrument to hold out a couple of operations at the knowledge set. Right here we have now additionally handed the Lasso serve as parameters at the side of a listing of values that may be iterated over.

Despite the fact that It’s not that i am going into main points of what precisely those parameters do, they’re one thing worthy of digging deeper into. In the end, I known as the randomised seek serve as for appearing the cross-validation.

On this instance, we used 5-fold cross-validation. In k-fold cross-validation, the unique pattern is randomly partitioned into okay equal-sized subsamples. Of the okay subsamples, a unmarried subsample is retained because the validation knowledge for trying out the type, and the rest k-1 subsamples are used as coaching knowledge.

The cross-validation procedure is then repeated okay occasions (the folds), with each and every of the okay subsamples used precisely as soon as because the validation knowledge. Move-validation combines (averages) measures of match (prediction error) to derive a extra correct estimate of type prediction efficiency.

According to the match parameter, we make a decision on the finest options.

Within the subsequent phase of the mechanical device studying for algorithmic buying and selling with Python educational, we will be able to take a look at take a look at and teach units.

Splitting the knowledge into take a look at and teach units

First, allow us to cut up the knowledge into the enter values and the prediction values. Right here we go at the OHLC knowledge with in the future lag as the knowledge body X and the Shut values of the present day as y. Notice the column names underneath in lower-case.

On this instance, to stay the mechanical device studying for algorithmic buying and selling with Python educational quick and related, I’ve selected to not create any polynomial options however to make use of handiest the uncooked knowledge.

If you have an interest in quite a lot of combos of the enter parameters and with upper stage polynomial options, you might be unfastened to change into the knowledge the usage of the PolynomialFeature() serve as from the preprocessing package deal of scikit be taught.

You’ll in finding detailed knowledge in Quantra route on Python for Device Finding out in Finance.

Now, allow us to additionally create a dictionary that holds the scale of the teach knowledge set and its corresponding reasonable prediction error.

Getting the best-fit parameters to create a brand new serve as

I need to measure the efficiency of the regression serve as as in comparison to the scale of the enter dataset. In different phrases, I need to see if, through expanding the enter knowledge, we can cut back the mistake. For this, I used for loop to iterate over the similar knowledge set however with other lengths.

At this level, I wish to upload that for the ones of you who’re , discover the ‘reset’ serve as and the way it’ll assist us make a extra dependable prediction.

(Trace: It is part of the Python magic instructions)

Let me give an explanation for what I did in a couple of steps.

First, I created a suite of periodic numbers ‘t’ ranging from 50 to 97, in steps of three. The aim of those numbers is to make a choice the proportion dimension of the dataset that can be used because the teach knowledge set.

2nd, for a given price of ‘t’, I cut up the duration of the knowledge set to the closest integer comparable to this share. Then I divided the overall knowledge into teach knowledge, which incorporates the knowledge from the start until the cut up, and take a look at knowledge, which incorporates the knowledge from the cut up until the tip. The cause of adopting this way and no longer the usage of the random cut up is to care for the continuity of the time collection.

After this, we pull the finest parameters that generated the bottom cross-validation error after which use those parameters to create a brand new reg1 serve as, a easy Lasso regression match with the finest parameters.

Making the predictions and checking the efficiency

Now allow us to are expecting the longer term shut values. To do that, we go on take a look at X, containing knowledge from cut up to finish, to the regression serve as the usage of the are expecting() serve as. We additionally need to see how effectively the serve as has carried out, so allow us to save those values in a brand new column.

As you could have spotted, I created a brand new error column to avoid wasting absolutely the error values. Then I took the imply of absolutely the error values, which I stored within the dictionary we had created previous.

Now it is time to plot and spot what we were given.

I created a brand new Vary price to carry the common day-to-day buying and selling vary of the knowledge. This is a metric I wish to examine with when creating a prediction. The good judgment in the back of this comparability is if my prediction error is greater than the day’s vary, then it’s most likely that it’ll no longer be helpful.

I would possibly as effectively use the day prior to this’s Top or Low because the prediction, which can grow to be extra correct.

Please observe I’ve used the cut up price outdoor the loop. This signifies that the common vary of the day you spot here’s related to the final iteration.

Let’s execute the code and spot what we get.

Output:

Reasonable Vary of the Day: 4.164018979072551

Some meals for concept.

What does this scatter plot inform you? Let me ask you a couple of questions.

- Is the equation over-fitting?

- The efficiency of the knowledge advanced remarkably because the teach knowledge set dimension larger. Does this imply if we give extra knowledge, the mistake will cut back additional?

- Is there an inherent development available in the market, permitting us to make higher predictions as the knowledge set dimension will increase?

- Closing however the finest query: How can we use those predictions to create a buying and selling technique?

FAQs

On the finish of the final phase of the academic Device Finding out algorithms for Buying and selling, I requested a couple of questions. Now, I can solution all of them on the identical time. I can additionally speak about a technique to discover the regime/development available in the market with out coaching the set of rules for tendencies.

You’ll learn extra about 5 Issues to grasp sooner than beginning Algorithmic Buying and selling

However sooner than we pass forward, please use a repair to fetch the knowledge from Yahoo Finance to run the code underneath.

Let’s get started with the questions now, we could?

Q: Is the equation over-fitting?

A: This was once the primary query I had requested. To understand in case your knowledge is overfitting or no longer, one of the best ways to check it will be to test the prediction error that the set of rules makes within the teach and take a look at knowledge.

To do that, we will be able to have so as to add a small piece of code to the already written code.

2nd, if we run this piece of code, then the output would glance one thing like this.

Output:

Reasonable Vary of the Day: 4.164018979072551

Our set of rules is doing higher within the take a look at knowledge in comparison to the teach knowledge. This statement in itself is a pink flag. There are a couple of the explanation why our take a look at knowledge error might be higher than the teach knowledge error:

- If the teach knowledge had higher volatility (Day by day vary) in comparison to the take a look at set, then the prediction would additionally showcase higher volatility.

- If there was once an inherent development available in the market that helped the algo make higher predictions.

Now, allow us to take a look at which of those circumstances is correct. If the variability of the take a look at knowledge was once lower than the teach knowledge, then the mistake will have to have lowered after passing greater than 80% of the knowledge as a teach set, but it surely will increase.

Subsequent, to test if there was once a development, allow us to go extra knowledge from a special period of time.

If we run the code, the end result would appear to be this:

So, giving extra knowledge didn’t make your set of rules paintings higher, but it surely made it worse. In time-series knowledge, the inherent development performs a vital position within the set of rules’s efficiency at the take a look at knowledge.

As we noticed above it might probably yield higher than anticipated effects infrequently. Our algo was once doing so effectively for the reason that take a look at knowledge was once sticking to the primary trend noticed within the teach knowledge.

So, if our set of rules can discover the underlying development and use a technique for that development, then it will have to give higher effects. I can give an explanation for this in additional element underneath.

Q: Can the mechanical device studying set of rules discover the inherent development or marketplace segment (bull/endure/sideways/breakout/panic)?

Q: Can the database be trimmed to coach other algos for various eventualities?

A: The solution to each the questions is YES!

We will be able to divide the marketplace into other regimes after which use those alerts to trim the knowledge and teach other algorithms for those datasets. To reach this, I make a choice to make use of an unsupervised mechanical device studying set of rules.

From right here on, this mechanical device studying for algorithmic buying and selling with Python educational can be devoted to making an set of rules that may discover the inherent development available in the market with out explicitly coaching for it.

First, allow us to import the vital libraries.

Then we fetch the OHLC knowledge from Google and shift it through in the future to coach the set of rules handiest at the previous knowledge.

Subsequent, we will be able to instantiate an unmanaged mechanical device studying set of rules the usage of the ‘Gaussian combination’ type from sklearn.

Within the above code, I created an unsupervised-algo that can divide the marketplace into 4 regimes, in response to the criterion of its opting for. We’ve got no longer supplied any coaching dataset with labels like within the earlier phase of the Python mechanical device studying educational.

Subsequent, we will be able to match the knowledge and are expecting the regimes. Then we will be able to retailer those regime predictions in a brand new variable known as regime.

Then, create a dataframe known as Regimes which may have the OHLC and Go back values at the side of the corresponding regime classification.

After this, allow us to create a listing known as ‘order’ that has the values comparable to the regime classification, after which plot those values to peer how effectively the algo has categorised.

The general regime differentiation would appear to be this:

This graph seems lovely just right to me. We will be able to conclude a couple of issues through having a look on the chart with out in reality having a look on the elements in response to which the classification was once accomplished.

- The pink zone is the low volatility or the sideways zone

- The orange zone is a prime volatility zone or panic zone.

- The blue zone is a breakout zone.

- The golf green zone: No longer completely positive however allow us to in finding out.

Use the code underneath to print the related knowledge for each and every regime.

The output would appear to be this:

Imply for regime 0: 75.93759504542675 Co-Variance For regime 0: 189860766854172.0 Imply for regime 1: 4.574220463352975 Co-Variance For regime 1: 3.1775040099630092e+16 Imply for regime 2: 21.598410250495476 Co-Variance For regime 2: 1583756227241176.8 Imply for regime 3: 7.180175568961408 Co-Variance For regime 3: 2432345114794574.0

The information may also be inferred as follows:

- Regime 0: Low imply and Top covariance.

- Regime 1: Top imply and Top covariance.

- Regime 2: Top imply and Low covariance.

- Regime 3: Low imply and Low covariance.

To this point, we have now noticed tips on how to cut up the marketplace into quite a lot of regimes.

However the query of enforcing a a hit technique continues to be unanswered. If you wish to learn to code a mechanical device studying buying and selling technique then your selection is inconspicuous:

To rephrase Morpheus from the Matrix film trilogy,

That is your final likelihood. After this, there’s no turning again.

You are taking the blue tablet—the tale ends, you get up for your mattress and consider that you’ll industry manually.

You are taking the pink tablet—you keep within the Algoland, and I display you ways deep the rabbit hollow is going.

Consider: All I am providing is the reality. Not anything extra.

A step additional into the arena of Device Finding out algorithms for Buying and selling

Holding oneself up to date is of high significance in lately’s international. Having a learner’s mindset all the time is helping to reinforce your occupation and select up talents and extra equipment within the building of buying and selling methods for themselves or their companies.

Listed below are a couple of books which may well be fascinating:

- Gareth James, Daniela Witten, Trevor Hastie and Robert Tibshirani Advent to statistical studying

- The Hundred-Web page Device Finding out Guide through Andriy Burkov

- Hastie, Tibshirani, and Friedman’s The Parts of Statistical Finding out

Evaluating execs and cons of the usage of mechanical device studying with Python for algorithmic buying and selling

Allow us to now examine the professionals and cons of the usage of mechanical device studying with Python for algorithmic buying and selling underneath:

Execs |

Cons |

|

Automation: Device studying permits the automation of buying and selling processes, lowering the desire for guide intervention and taking into consideration quicker and extra environment friendly execution of trades. |

Style complexity: Device studying fashions may also be advanced, requiring experience and cautious attention in type variety, parameter tuning, and heading off overfitting. Complicated fashions could also be difficult to interpret and might introduce further dangers. |

|

Development reputation: Device studying algorithms excel at figuring out advanced patterns and relationships in huge datasets, enabling the invention of buying and selling alerts and patterns that might not be obvious to human investors. |

Knowledge high quality and biases: Device studying fashions closely depend at the high quality and representativeness of enter knowledge. Biases within the knowledge or unexpected marketplace stipulations can have an effect on type efficiency and result in inaccurate buying and selling choices. |

|

Dealing with giant knowledge: Python supplies powerful libraries like Pandas and NumPy, making it well-suited for dealing with and processing huge and complicated monetary datasets, taking into consideration environment friendly research and modelling. |

Overfitting dangers: Device studying fashions may also be at risk of overfitting, the place they memorise patterns within the coaching knowledge however fail to generalise effectively to new knowledge. Overfitting can lead to deficient efficiency and misguided predictions when carried out to unseen marketplace stipulations. |

|

Flexibility and straightforwardness of use: Python is a flexible and beginner-friendly language, providing a variety of libraries and frameworks for mechanical device studying. Its simplicity and clarity provide help to prototype, experiment, and iterate on buying and selling methods. |

Steady adaptation: Monetary markets are dynamic, and buying and selling methods wish to adapt to converting marketplace stipulations. Device studying fashions might require widespread retraining and changes to stay efficient, which may also be time-consuming and resource-intensive. |

|

Get right of entry to to a wealthy ecosystem: Python has a limiteless ecosystem of open-source libraries devoted to mechanical device studying and finance, similar to scikit-learn, TensorFlow, and so forth.. Those libraries supply pre-implemented algorithms, analysis metrics, and equipment for function engineering, saving building effort and time. |

Possibility control: Device studying algorithms can introduce new dangers, similar to type failure, algorithmic mistakes, or unexpected marketplace dynamics. Right kind possibility control protocols and safeguards wish to be in position to mitigate those dangers. |

Bibliography

- A Device Finding out Inventory Buying and selling Technique The use of Python

- Algorithmic Buying and selling in Python with Device Finding out: Walkforward Research

Conclusion

Total, we have now long gone thru all the adventure of ways you’ll learn how to create and use your very personal mechanical device studying fashions in Python, the usage of quite a lot of examples. All of the procedure is defined with the assistance of Python codes that can be useful for your follow as effectively.

In case you have any feedback or tips about this newsletter, please percentage them with us within the feedback underneath.

If you want to create buying and selling methods and perceive the constraints of your fashions, take a look at this route on Python for Device Finding out in Finance. This route will allow you to to learn how to review the efficiency of the mechanical device studying algorithms and carry out backtest, paper buying and selling and are living buying and selling with Quantra’s built-in studying.

Notice: The unique put up has been made over on 18th August 2023 for accuracy, and recentness.

Disclaimer: All knowledge and knowledge supplied on this article are for informational functions handiest. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any knowledge on this article and might not be accountable for any mistakes, omissions, or delays on this knowledge or any losses, accidents, or damages bobbing up from its show or use. All knowledge is supplied on an as-is foundation.