The full price of property locked (TVL) on decentralized finance (DeFi) tasks recorded a 30% year-on-year decline to drop to its lowest level for this 12 months at $36.95 billion, according to information from DeFillama.

Whilst DeFi tasks began the 12 months strongly, peaking at greater than $52 billion in April, the field has witnessed six months of constant underperformance, dragging it to its present low.

Liquid staking tasks thrive

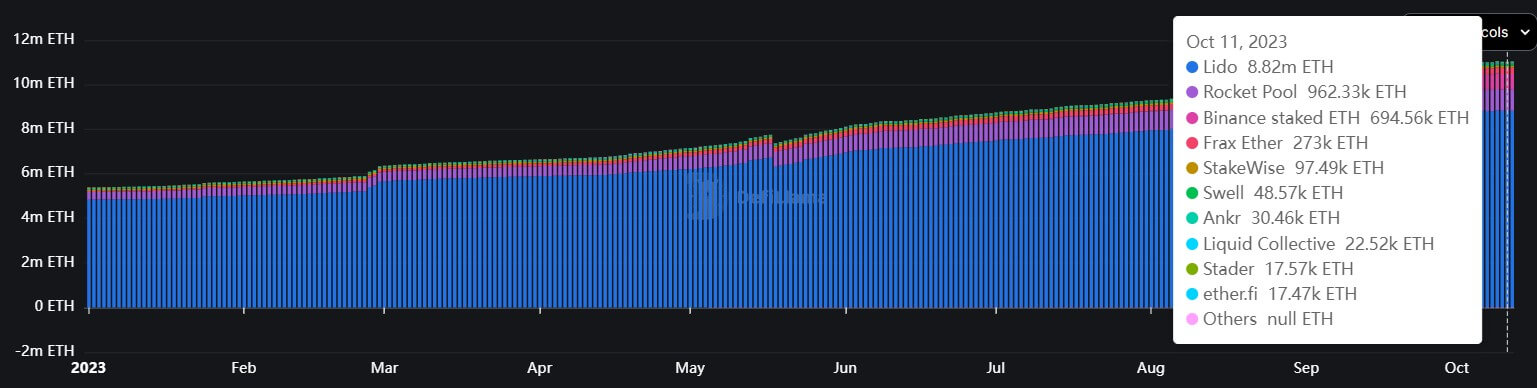

Within the ever-evolving panorama of the DeFi sector, liquid staking tasks have emerged as a beacon of resilience, contrasting with the wider decline observed in different DeFi classes.

Regardless of the existing bearish sentiments, liquid staking tasks have thrived, returning nearly 300% from their 2022 low to just about $20 billion in TVL, in step with DeFillama information. As of the newest figures, TVL now stands at $17.67 billion.

Lido is the dominant participant inside this area of interest, keeping up over 50% of the marketplace proportion, outpacing main contenders like Binance, Coinbase, and Kraken, as according to insights from Nansen information shared with CryptoSlate.

Tron-based tasks TVL upward push

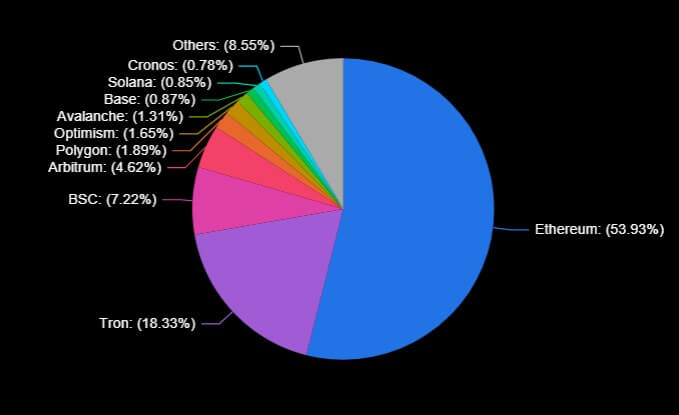

The Tron community, too, has witnessed important expansion in its DeFi tasks, with their contribution to the whole TVL hitting an all-time prime of 18.23% from the 6.5% recorded previous within the 12 months.

On-chain sleuth Patrick Scott attributed Tron’s greater TVL to the expansion of the primary Actual-Global Belongings (RWA) at the community, stUSDT. In step with DeFillama information, the mission’s TVL is nearing $2 billion in simply 4 months since its release.

Then again, CryptoSlate reported that the mission has come beneath scrutiny, basically because of its governance and transparency, whilst a few of its claimed companions, like Tether (USDT), have denied any affiliations.

In the meantime, Ethereum stays the principle platform for DeFi tasks and programs, controlling greater than 50% of the marketplace. Different networks like Binance Sensible Chain, Polygon, Arbitrum, and others additionally host many tasks.

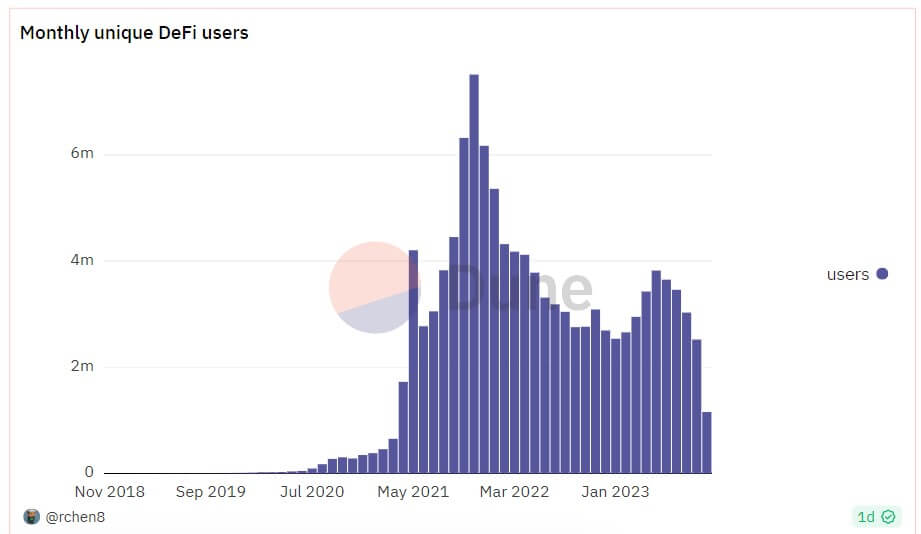

DeFi tasks misplaced 2.5M per thirty days customers.

Because the TVL has flatlined, DeFi tasks have encountered every other problem: a lower of roughly 2.5 million energetic per thirty days customers all over the 12 months, Altindex reported, bringing up a Dune Analytics dashboard via rchen8. In keeping with the document, the decline commenced in Would possibly and has maintained a downward development.

In Would possibly, the DeFi sector boasted over 3.8 million per thirty days customers, however via October, this determine had dwindled to round 1.15 million, in comparison to the two.7 million customers reported the former October. Total, per thirty days distinctive customers have dropped via 66% from the best-ever prime of seven.51 million recorded in November 2021.