Marketplace Evaluate: DAX 40 Futures

DAX futures moved sideways to down remaining week with a endure bar in what seems like a wedge bull flag. However it’s complicated, for some investors it’s at all times briefly. As a result of we broke beneath the swing low, examined and now are transferring down beneath the MA. For different investors, the development isn’t big enough or robust sufficient to opposite it but. So it’ll most likely turn out to be a endure leg in a buying and selling vary.

DAX 40 Futures

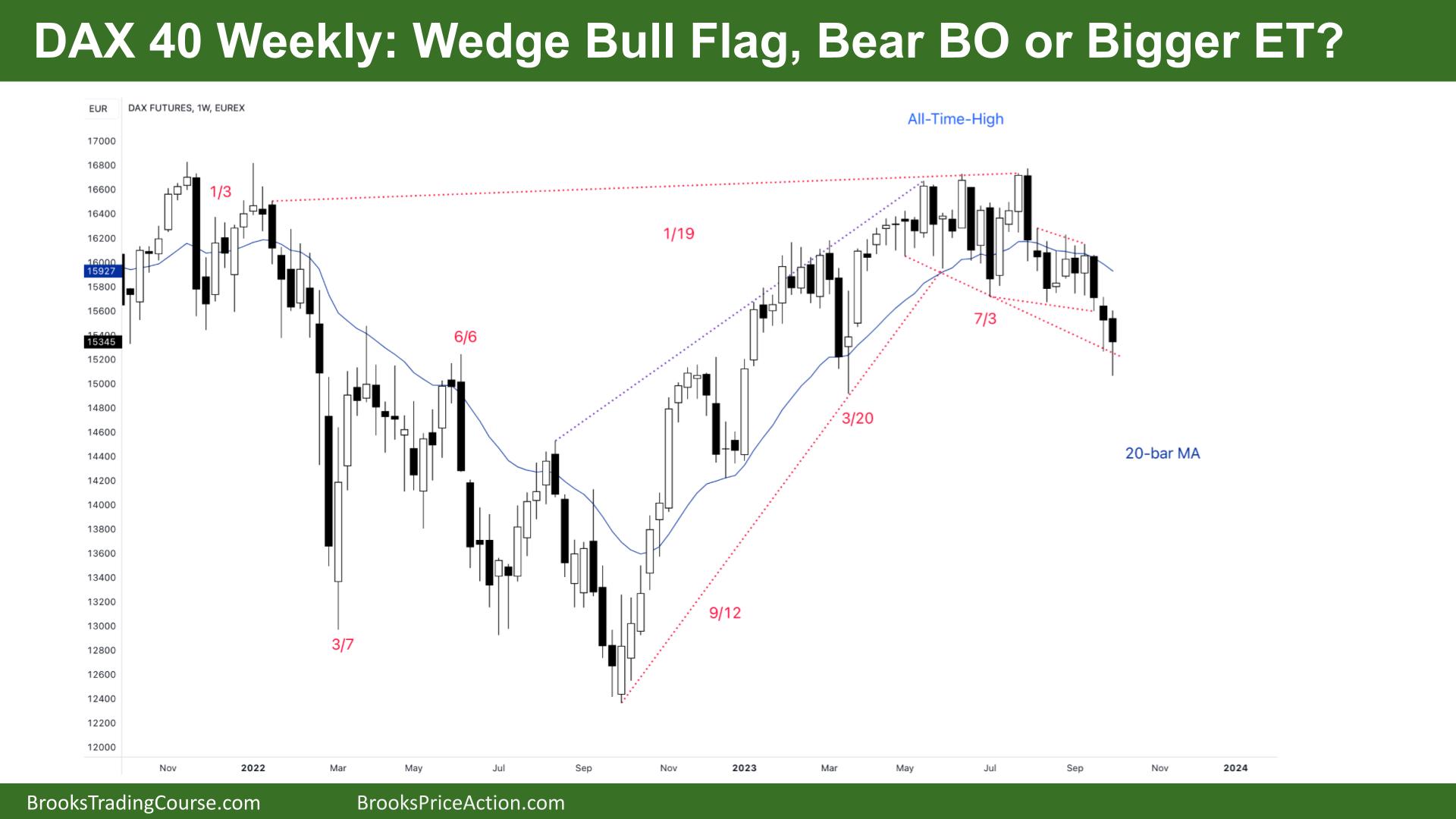

The Weekly DAX chart

- The DAX 40 futures at the weekly chart was once a bigger endure bar with a large tail beneath, ultimate above its midpoint.

- So some computer systems will see it as a bull bar.

- In order that approach this is a Top 1 purchase above subsequent week. Nevertheless it’s a endure bar, in a endure spike beneath the MA, so most definitely a greater prohibit access promote.

- Some bears see it as a failed breakout above the ATH and a endure spike and channel, and we’re most likely in the second one leg.

- Different bears would possibly see the wedge bull flag that failed in July, August and September.

- However whether it is tricky to learn, this is a buying and selling vary.

- We’ve got consecutive endure bars ultimate beneath the MA however now not ultimate on their lows. So I believe it’s extra of a endure channel – a couple of techniques to attract the traces – however importantly, the sells will likely be above the highs and close to the MA.

- Day investors can have a look at it as a breakout and pullback and search for a 2d leg. We would possibly get extra sideways for the following couple of weeks as this leg is powerful, so they may check out for a bigger 2d leg nearer to the MA.

- Not anything to shop for right here for prevent access bulls. Restrict bulls beneath the bar and decrease 3rd.

- The bulls see we’re on the backside of a buying and selling vary with March. Bears had a promote climax bar, which induced and reversed. So, someone who bought early were given a possibility to go out remaining week.

- May just we ruin strongly beneath subsequent week? 3 consecutive bars is a microchannel, and price bulls will glance to shop for at toughen at or underneath a excellent bull bar. So if it doesn’t pause on Monday, then Tuesday generally is a giant down day.

- Now and again, the marketplace gets vacuumed into the toughen or resistance zone.

- Relying on the place you draw the wedge, a dealer would possibly want a reversal bar with a large tail overshooting the road. Both means, BLSHS.

- Be expecting sideways to down subsequent week as investors come to a decision what’s beneath this week.

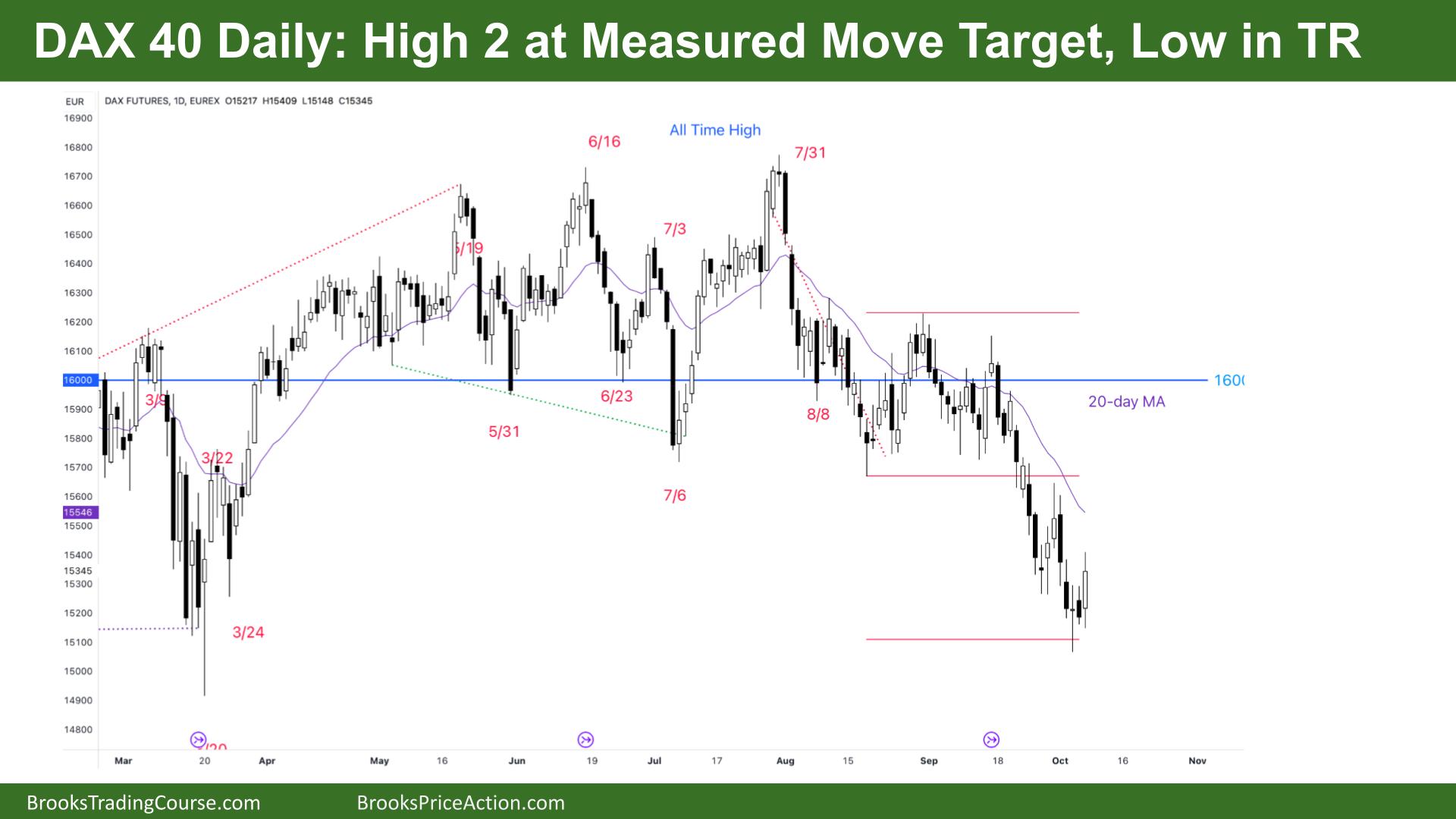

The Day by day DAX chart

- The DAX 40 futures on Friday was once a was once a bull out of doors bar ultimate close to its top with a small tail above.

- The bulls see a Top 2 purchase, a ways from the MA moderate, so a conceivable swing setup.

- The bears noticed a spike and channel, which broke beneath the double backside and examined the BO level. They anticipated a measured transfer down. We simply hit it remaining week.

- We’re a bar vary from the MA so the bulls would possibly get that bar up the place bears will promote a DT endure flag and most likely a low 2 on the MA which is a top chance promote sign.

- A 2d access lengthy low in a TR is a top chance sign.

- At the RTH chart there’s an open frame hole, so bulls want to shut that early subsequent week or the bears will much more likely get extra bars down.

- The dump has been robust however didn’t lure bulls above. But if the bulls were given the BO and FT above endure doji that would possibly have scared bears off from promoting too low. Consumers stepped in beneath the lows and scaled in decrease and mode cash.

- If bulls are being profitable right here then the endure development isn’t robust and maximum bears will then promote upper.

- Monday is essential to look if we get FT. Out of doors bars are increasing triangles on LTF to draw prohibit order investors above and beneath. If the bulls can get a FT bull bar, ultimate above the top of Friday, they may get a 2d leg to the MA.

- If Monday is a endure bar with a tail above the top of Friday then be expecting a transfer again to the bottom shut. The bears would love an OO, consecutive out of doors bars and get a FT beneath that to proceed the spike.

- If you happen to glance left, or at the HTF, we’re on the March TR, and that implies we’re more likely to pass previous its low prior to reversing.

- Bulls want to get the pullback as a ways above 50% as conceivable to create some more or less a backside in this time frame.

- This is a wedge bull flag at the upper period of time however a endure channel, so the upside is restricted.

- Nonetheless at all times briefly so be expecting sideways to down till bulls cause the Top 2.

Marketplace research reviews archive

You’ll be able to get admission to all weekend reviews at the Marketplace Research web page.