The dumpster diving continues, this one is a little messier and riskier.

Pieris Prescription drugs (PIRS) is a medical level biotechnology corporate focused on remedies for breathing sicknesses and most cancers indications. In overdue June, the corporate introduced that their spouse, AstraZeneca (AZN), of their lead product candidate, elarekibep, discontinued its Section 2a trial and this week we discovered that AstraZeneca additionally terminated their R&D collaboration settlement with Pieris. Getting a learn out on elarekibep’s Section 2a trial used to be the corporate’s most sensible strategic precedence, such a lot in order that they restricted funding of their different property, now with out that partnership, the corporate is left in a troublesome place the place they’re burning money and can not lift capital within the present atmosphere.

In comes the strategic possible choices announcement the place they disclosed a 6/30 money steadiness of $54.9MM and a discount in staff of 70%. The CEO’s (4.8% proprietor) feedback have been reasonably particular:

“We’re pursuing strategic choices throughout 3 primary spaces following the hot tendencies that experience impacted our skill to independently advance our breathing techniques,” commented President and CEO Stephen Yoder. “One monitor is accelerating partnering discussions of PRS-220 and PRS-400. A 2d focal space is diligently deciding on the most efficient imaginable construction spouse and deal construction to re-initiate medical construction of cinrebafusp alfa, our former lead immuno-oncology asset, which has proven 100% ORR in 5 sufferers in a HER2+ gastric most cancers trial that used to be discontinued for strategic causes. 3rd, we can discover whether or not our steadiness sheet, place as a public corporate, and different property are of strategic worth to a variety of 3rd events.” Mr. Yoder endured, “Whilst the demanding situations we lately skilled throughout our breathing franchise have compelled us to make very tricky body of workers selections, I will not categorical sufficient gratitude to our departing colleagues for his or her determination, collaborative spirit and integrity.”

I respect the honesty of “place as a public corporate” being of strategic worth, that issues to a opposite merger being prime at the listing, which is not excellent.

Pieris has numerous partnerships, along with AstraZeneca, Pieris has present collaboration offers with Genentech (now a part of Roche), Seagen, Boston Prescription drugs and Servier. Those are along with the property discussed within the above quote. PRS-220 and PRS-400 are wholly owned and regulated, PRS-220 is these days in a Section 1 trial in Australia and PRS-400 remains to be pre-clinical. Plus they have got cinrebafusp alfa (do not question me to pronounce that) which prior to now had a a hit Section 1 learn about, they have been starting up a Section 2, however stopped to redirect company sources to the failed AstraZeneca program. In PIRS’s personal phrases in the newest 10-Q, earlier than the strategic possible choices announcement:

In July 2022, we gained speedy monitor designation from FDA for cinrebafusp alfa. In August 2022, we introduced the verdict to stop additional enrollment within the two-arm, multicenter, open-label section 2 learn about of cinrebafusp alfa as a part of a strategic pipeline prioritization to center of attention our sources. Cinrebafusp alfa has demonstrated medical receive advantages in section 1 research, together with unmarried agent job in a monotherapy atmosphere, and within the section 2 learn about in HER2-expressing gastric most cancers, giving the Corporate self belief in its broader 4-1BB franchise. In April 2023, medical information appearing an unconfirmed 100% purpose reaction charge and promising rising sturdiness profile used to be offered on the American Affiliation of Most cancers analysis annual assembly. Those information supplied encouraging proof of medical job for this program and we’re taking into account a variety of transaction to facilitate the continuation of cinrebafusp alfa, together with an immuno-oncology centered spinout to standard partnering transactions.

Between the strategic possible choices press unencumber and the language within the 10-Q, it does not seem Pieris is simply starting the method, however reasonably they have been in search of techniques to lift capital all alongside by means of promoting those 3 property (as a result of they wanted money to get to their earlier mid-2024 AstraZeneca readout timeline), right here there may well be faster asset sale catalyst than others within the damaged biotech basket.

However as standard, I don’t have any actual ideas at the science at the back of any of this, however a number of the partnerships and the wholly owned techniques, there may well be some worth nuggets above and past the money at the steadiness sheet.

The partnerships do create some quirky accounting. Pieris has gained in advance bills in each and every of those offers for the licensing rights and a few R&D collaboration on long run construction, they account for the in advance fee by means of making a deferred earnings line merchandise for the earnings gained however the place services and products have not been carried out (like R&D spend). Whilst this presentations up as a legal responsibility, as you learn in the course of the long description of each and every partnership, it seems that (be at liberty to thrust back in this) like their companions can not claw again budget and its no longer a real debt or legal responsibility.

One may almost definitely determine the margin in this deferred earnings through the years by means of performing some information mining, however with the 70% relief in staff, most probably over listed to the R&D group, it does not seem the corporate is just too taken with no longer having the ability to acknowledge this earnings or having it clawed again.

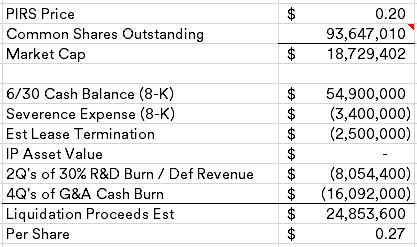

Working via my again of the envelope math, I get a hold of the next liquidation estimate (reminder, that is most probably no longer a liquidation):

The stocks exceptional quantity is a little wonky, the corporate has most popular inventory exceptional to their biggest investor, Biotechnology Price Fund, this is convertible at 1,000 stocks of not unusual for each and every pref proportion. I consider that is absolutely transformed within the 93.6MM quantity that used to be reported in BVF’s newest 13D. However please test my math, I’ve low self belief in that quantity, however it is optimistically proper inside a couple of million stocks.