Quince Therapeutics (QNCX) ($55MM marketplace cap) is a damaged biotech this is buying and selling smartly under money and is going through activist power from two events having a look to both achieve the corporate for money or put the corporate into liquidation. Within the first part of 2022, Quince (referred to as Cortexyme on the time) purchased Novosteo in a opposite merger, then on this previous January, the corporate offered their previous drug portfolio again to the former control of Cortexyme who now run privately held Lighthouse Prescribed drugs for a 7.5% fairness stake in Lighthouse (plus a CVR of as much as $150MM in line with assembly positive milestones). Along the asset sale, Quince additionally introduced a 47% relief in power and that they might be pursuing an out-licensing technique for his or her final drug candidate, NOV004, which is designed to boost up bone fracture therapeutic. The go-forward technique now’s:

On January 30, 2023, the Corporate equipped an replace on its construction pipeline and industry outlook for 2023. The Corporate intends to prioritize capital sources towards the growth of its construction pipeline thru opportunistic in-licensing and acquisition of clinical-stage property focusing on debilitating and uncommon sicknesses. The Corporate plans to out-license its bone-targeting drug platform and precision bone expansion molecule NOV004 designed for speeded up fracture restore in sufferers with bone fractures and osteogenesis imperfecta.

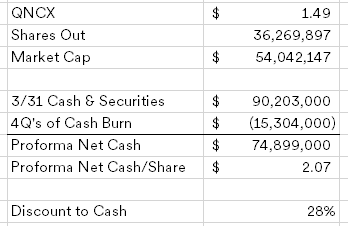

This acquisition technique seems to be doubtful given their monitor document, the present marketplace temper in opposition to opposite mergers and/or speculative biotech corporations. Biotechs on this place will have to display some humility, liquidate and let the shareholders come to a decision the place to redeploy that capital, now not control. My tremendous easy again of the envelope math for those damaged biotechs is as follows:

This example has stuck the eye of 2 traders:

- Kevin Tang owns just below 10% of the stocks and in line with different an identical eventualities, one can suppose he is requested if control can be open to an be offering to shop for QNCX for some cut price of money plus a CVR for any proceeds the pipeline brings in a sale;

- Echo Lake Capital submitted a non-binding proposal to shop for QNCX for $1.60/proportion, which was once officially rejected through the corporate, who then followed a poison tablet. Echo Lake adopted up this week with any other letter criticizing control.

Whilst control hasn’t given up right here like I would favor to peer, they’ve lower prices and that is principally a money shell at this level and not using a industry, to not dissimilar to different concepts within the damaged biotech basket. If Tang or Echo Lake arrange to power control’s hand, a strategic possible choices or liquidation announcement can be a catalyst to transport the inventory upper.

Disclosure: I personal stocks of QNCX