Social media corporate Meta Platform’s (NASDAQ:META) efforts to beef up its place within the AI (synthetic intelligence) race have won important traction in contemporary months. The inventory has risen via 162% year-to-date, outperforming the S&P 500’s (SPX) 12% acquire, and analysts see extra upside forward. Meta’s try to beef up and monetize its already fashionable social media platforms via adopting generative AI may just spice up its earnings and profits in the following few quarters. Therefore, I’m bullish on META inventory now.

Meta Platforms: Gearing Up for Some other Robust Quarter

Meta (previously Fb) is part of the large tech FAANG team, which additionally comprises Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Alphabet (previously Google) (NASDAQ:GOOGL).

Meta Platforms owns social media platforms Fb, WhatsApp, Instagram, Messenger, the not too long ago introduced Threads, and others. Those fall underneath one in all its segments, Circle of relatives of Apps (FoA). Its augmented and digital reality-related services fall underneath its different reportable section, Fact Labs (RL).

Fact Labs hasn’t been successful for the corporate. In Q2, it reported a $3.7 billion working loss, on the other hand, because of its FoA section, which is making up for the wear carried out. It introduced in $31.7 billion in earnings, accounting for a bit of general earnings, leading to a $13.1 billion working benefit.

CEO Mark Zuckerberg had set 2023 because the “12 months of potency” and has been operating onerous to make that occur. It entailed layoffs, lowering spending on much less important tasks, and specializing in extra AI-related tasks. Throughout its Q2 profits name, the corporate mentioned how its AI-related investments over time are in any case paying off.

Meta Inventory: Powering Thru AI Inventions

No doubt, it’s been a 12 months of potency. Maximum not too long ago, at Meta’s Attach convention, CEO Mark Zuckerberg unveiled the corporate’s new generative AI merchandise, which sparked marketplace pleasure. Meta AI is a complicated conversational assistant that may generate textual content responses and photo-realistic photographs and is built-in with Meta’s fashionable merchandise, WhatsApp, Messenger, and Instagram.

Meta AI is powered via Llama 2, its huge language fashion, which it launched in July in collaboration with Microsoft (NASDAQ:MSFT). The corporate intends to include Meta AI into its combined actuality headset, Quest 3, and any other new providing, a brand new era of Ray-Ban Meta good glasses. The corporate will release Quest 3 on October 10.

Zuckerberg described Quest 3 as the most efficient price within the trade for combining virtual and real-world studies at a low value. Certainly, it’s cheap, priced at $500, whilst competing with Apple’s Imaginative and prescient Professional Headset, which is able to include a price ticket of round $3,500. Apple’s headset is ready to hit the marketplace in early 2024.

What’s extra, its new era of Ray-Ban Meta good glasses, in collaboration with EssilorLuxottica, are priced at $299. The glasses might be introduced within the 1/3 week of October. Meta claims the glasses can take footage, document movies, and hook up with social media.

Along side those, Meta has added generative AI stickers to its messaging apps. It would use AI to free up extra financial doable within the wildly fashionable messaging app WhatsApp, which it bought for $19 billion in 2014. Extra options from the corporate come with its per 30 days subscription fees for ad-free Instagram and Fb app use in Europe, which may well be round 10 euros ($10.60 at present change charges).

CFO Susan Li said that the corporate’s capital expenditures may just upward thrust in 2024 because it navigates AI and metaverse alternatives via increasing its staff with extra technical roles.

Taking a look forward, control anticipates earnings within the 1/3 quarter to be within the $32 billion to $34.5 billion vary, representing an outstanding 16% to twenty-five% building up over Q3 2022. In the meantime, analysts be expecting its earnings to be within the $29 billion to $34 billion vary, with profits estimates starting from $2.27 to $4.27 consistent with proportion, with the consensus EPS estimate touchdown at $3.59. On October 25, Meta will file its third-quarter profits.

Moreover, Meta closed its Q2 with a hefty money stability of $53.5 billion and $18.3 billion in long-term debt. Given the corporate’s speedy enlargement in earnings and income, repaying the debt shouldn’t be onerous. Moreover, it generated a large $11 billion in unfastened money float within the quarter, which will have to support in debt compensation and long run mission financing.

Whilst in pursuit of having forward within the AI race, Meta additionally believes this generation continues to be in its early levels and thus intends to construct it responsibly.

Is META Inventory a Purchase, In line with Analysts?

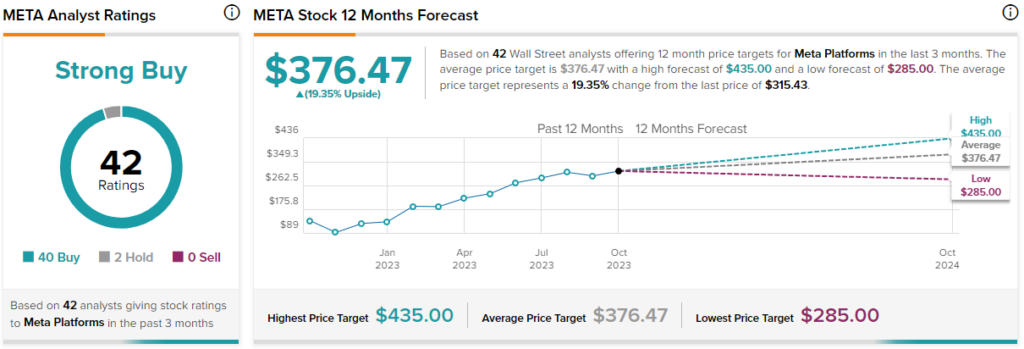

Turning to Wall Boulevard, TipRanks charges Meta as a Robust Purchase, with 40 Buys, two Holds, and no Promote rankings assigned previously 3 months. The moderate META inventory worth goal of $376.47 implies 19.35% upside doable. The perfect worth goal for the inventory stands at $435, whilst the bottom is at $285 consistent with proportion.

The Takeaway

Summing up, sitting at a marketplace cap of $811.6 billion, Meta may be very with reference to becoming a member of the $1 trillion membership. With Meta’s efforts to monetize its social media apps and capitalize at the huge enlargement caused via AI, the corporate is well-positioned to reach this function. Regardless that the AI area of interest is engaging, it’s also at risk of marketplace fluctuations. However for now, I proportion Wall Boulevard’s optimism about META inventory’s exceptional long-term potentialities.