Up to date on October third, 2023 via Bob Ciura

Spreadsheet information up to date day by day

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Listing beneath incorporates the next for each and every inventory within the index amongst different necessary making an investment metrics:

- Payout ratio

- Dividend yield

- Value-to-earnings ratio

You’ll be able to see the entire downloadable spreadsheet of all 50 Dividend Kings (in conjunction with necessary monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) via clicking at the hyperlink beneath:

The Dividend Kings listing contains fresh additions akin to Archer Daniels Midland (ADM), Walmart (WMT), Nucor Corp. (NUE), and Gorman-Rupp (GRC).

Every Dividend King satisfies the main requirement to be a Dividend Aristocrat (25 years of consecutive dividend will increase) two times over.

Now not all Dividend Kings are Dividend Aristocrats.

This surprising result’s for the reason that ‘best’ requirement to be a Dividend Kings is 50+ years of emerging dividends.

Then again, Dividend Aristocrats will have to have 25+ years of emerging dividends, be a member of the S&P 500 Index, and meet sure minimal dimension and liquidity necessities.

Desk of Contents

How To Use The Dividend Kings Listing to In finding Dividend Inventory Concepts

The Dividend Kings listing is a smart position to seek out dividend inventory concepts. Then again, no longer all the shares within the Dividend Kings listing make a really perfect funding at any given time.

Some shares could be overrated. Conversely, some could be undervalued – making nice long-term holdings for dividend expansion buyers.

For the ones unfamiliar with Microsoft Excel, the next walk-through displays how one can clear out the Dividend Kings listing for the shares with probably the most horny valuation in line with the price-to-earnings ratio.

Step 1: Obtain the Dividend Kings Excel Spreadsheet.

Step 2: Practice the stairs within the tutorial video beneath. Word that we display screen for price-to-earnings ratios of 15 or beneath within the video. You’ll be able to make a selection any threshold that ideally suited defines ‘worth’ for you.

However, following the directions above and filtering for upper dividend yield Dividend Kings (yields of two% or 3% or upper) will display shares with 50+ years of emerging dividends and above-average dividend yields.

Searching for companies that experience an extended historical past of dividend will increase isn’t a really perfect approach to establish shares that can build up their dividends yearly sooner or later, however there’s substantial consistency within the Dividend Kings.

The 5 Best possible Dividend Kings Nowadays

The next 5 shares are our top-ranked Dividend Kings lately, in line with anticipated annual returns over the following 5 years. Shares are ranked so as of lowest to absolute best anticipated annual returns.

Overall returns come with a mix of long term earnings-per-share expansion, dividends, and any adjustments within the P/E a couple of.

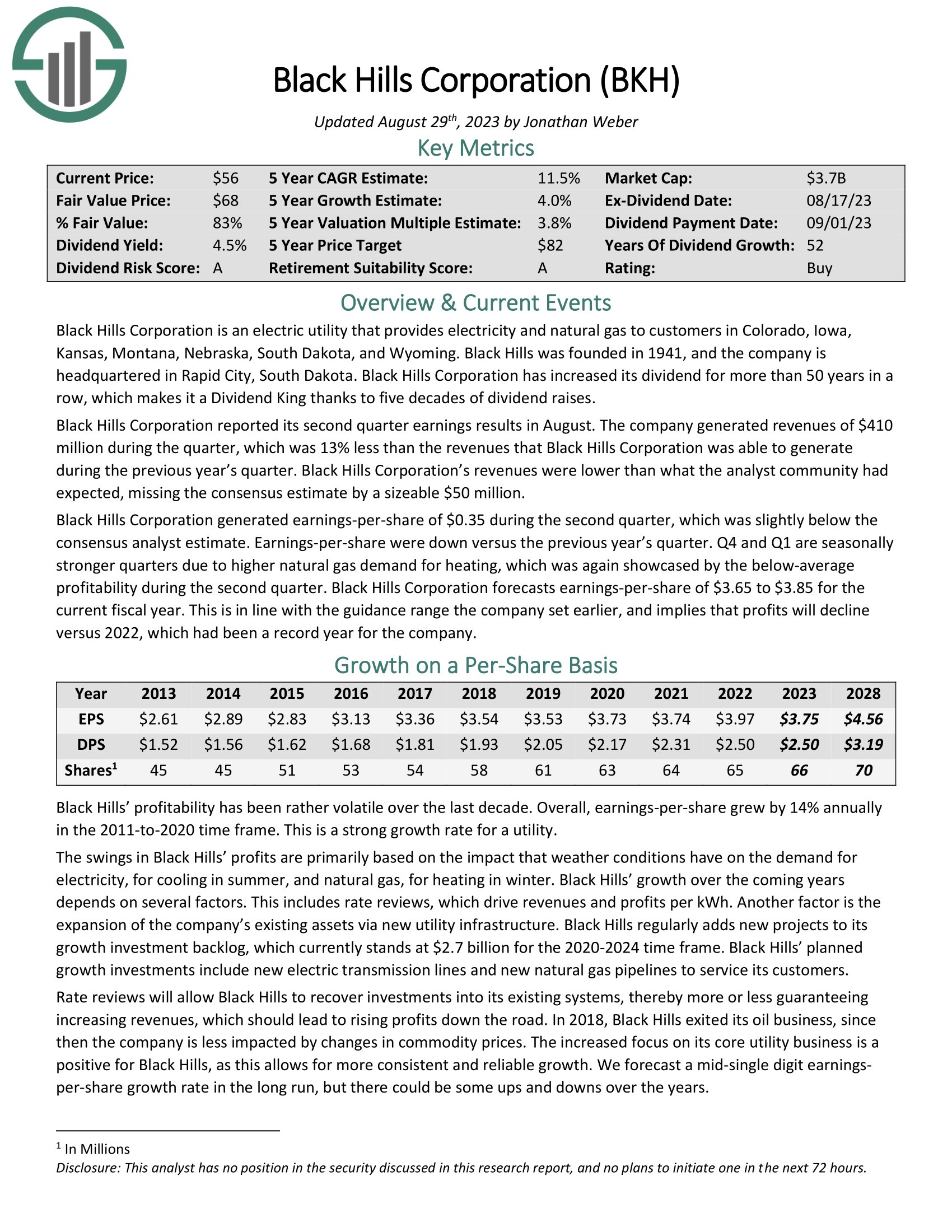

Dividend King #5: Black Hills Company (BKH)

- 5-12 months Annual Anticipated Returns: 15.2%

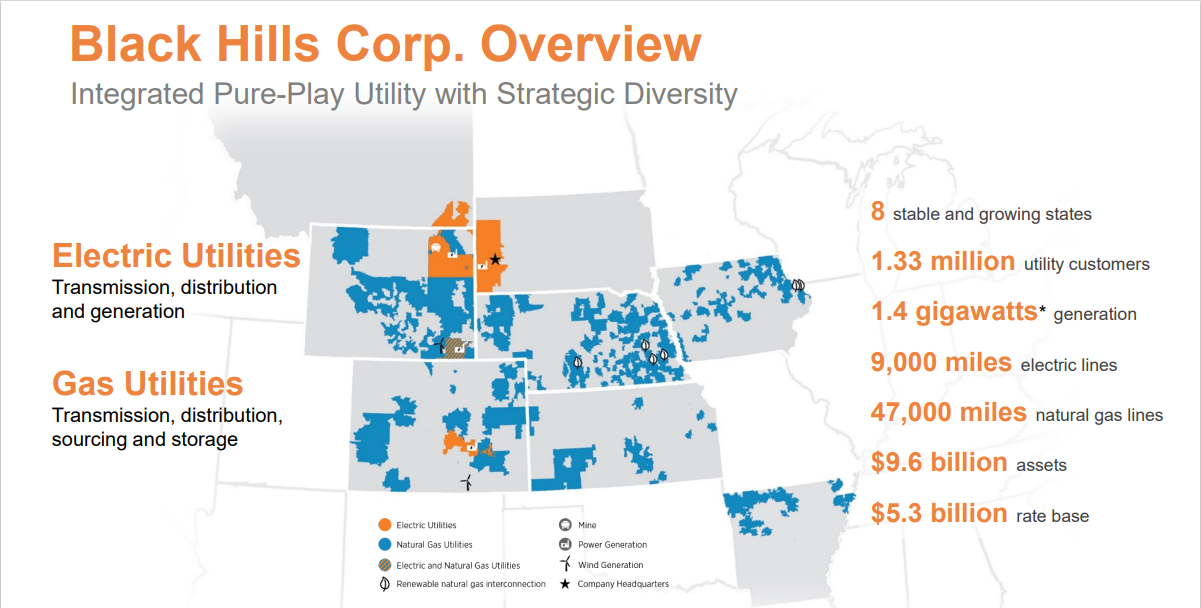

Black Hills Company is an electrical application that gives electrical energy and herbal fuel to shoppers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.33 million application shoppers in 8 states. Its herbal fuel property come with 47,000 miles of herbal fuel strains. One by one, it has ~9,000 miles of electrical strains and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Within the 2023 2d quarter, revenues of $410 million declined 13% year-over-year and ignored the consensus estimate via $50 million. Profits-per-share of $0.35 was once somewhat beneath the consensus analyst estimate. The application forecasts earnings-per-share of $3.65 to $3.85 for the present fiscal yr.

Utilities like Black Hills are proof against recessions as call for for electrical energy and fuel isn’t very cyclical. Black Hills must stay winning below maximum cases. The truth that shoppers have a tendency to stay with their supplier signifies that Black Hills operates a quite solid industry fashion.

Click on right here to obtain our most up-to-date Positive Research document on BKH (preview of web page 1 of three proven beneath):

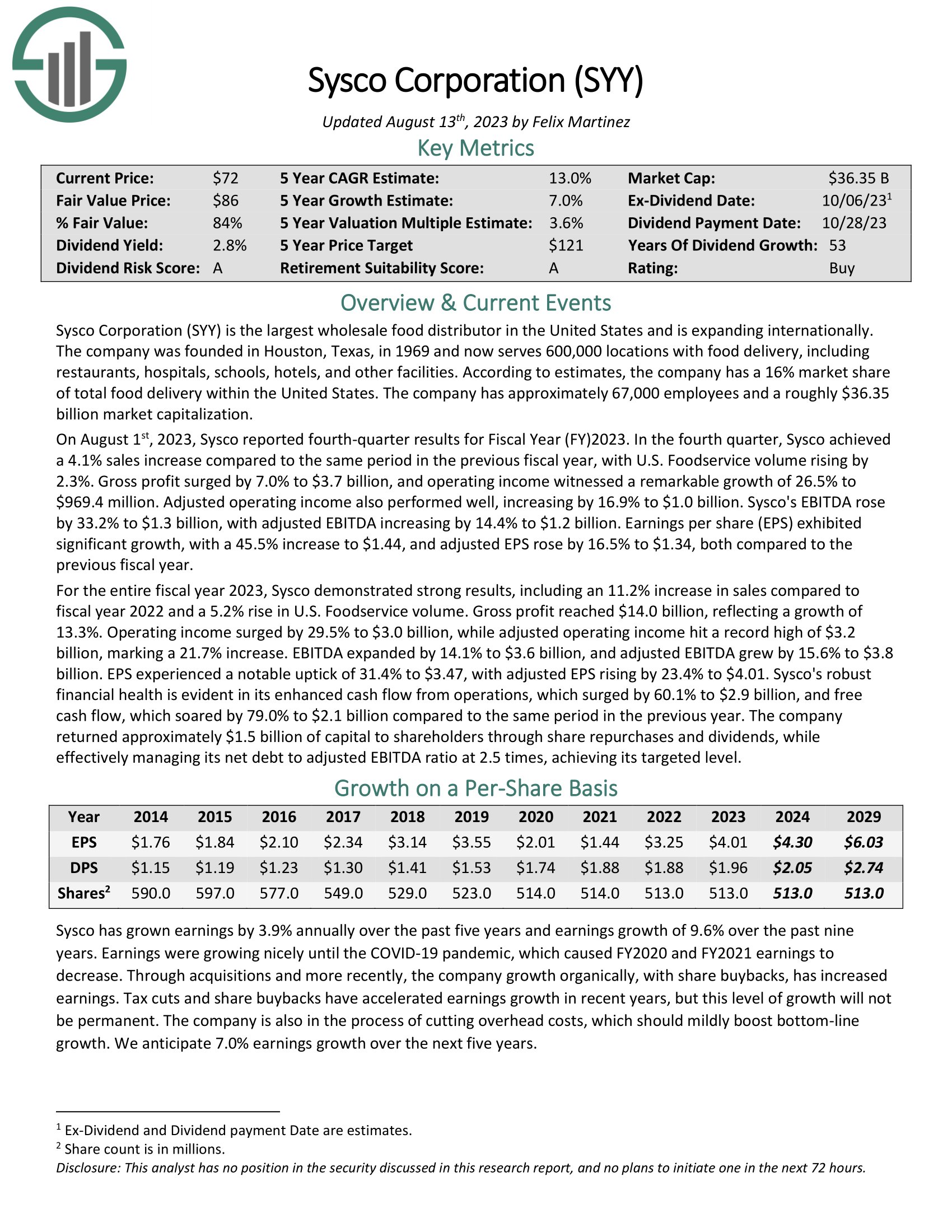

Dividend King #4: Sysco Company (SYY)

- 5-12 months Annual Anticipated Returns: 15.3%

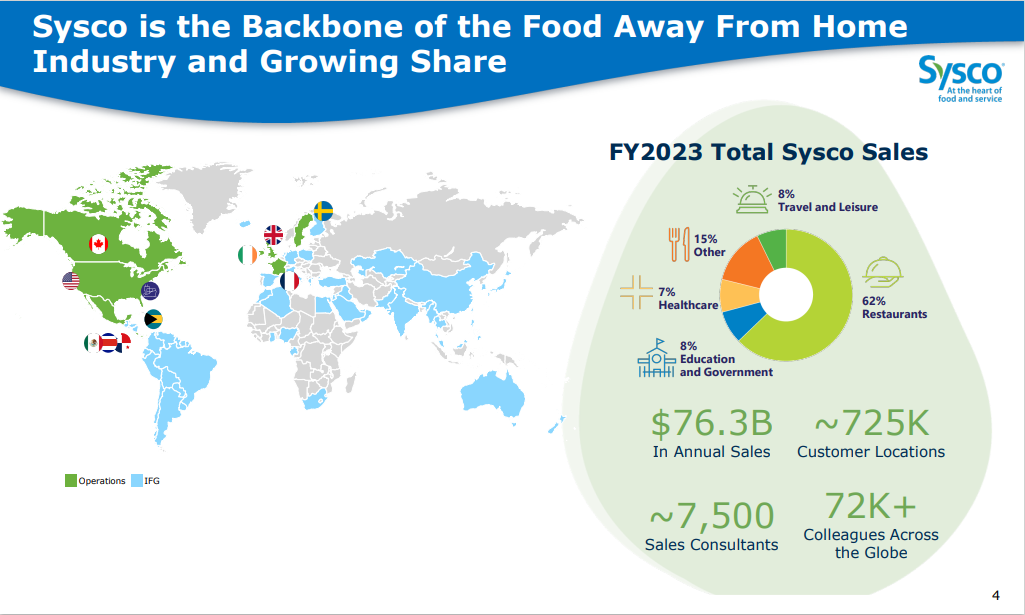

Sysco Company is the most important wholesale meals distributor in america. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, accommodations, and different amenities. In step with estimates, the corporate has a 16% marketplace percentage of overall meals supply inside america.

Supply: Investor Presentation

On August 1st, 2023, Sysco reported fourth-quarter effects for Fiscal 12 months (FY) 2023. Within the fourth quarter, Sysco accomplished a 4.1% gross sales build up in comparison to the similar duration within the earlier fiscal yr, with U.S. Foodservice quantity emerging via 2.3%. Adjusted EPS rose via 16.5% to $1.34, in comparison to the former fiscal yr.

For all the fiscal yr 2023, Sysco grew earnings via 11% with a 5.2% upward thrust in U.S. Foodservice quantity. Adjusted earnings-per-share higher 23% to $4.01.

Click on right here to obtain our most up-to-date Positive Research document on SYY (preview of web page 1 of three proven beneath):

Dividend King #3: Stanley Black & Decker (SWK)

- 5-12 months Annual Anticipated Returns: 15.5%

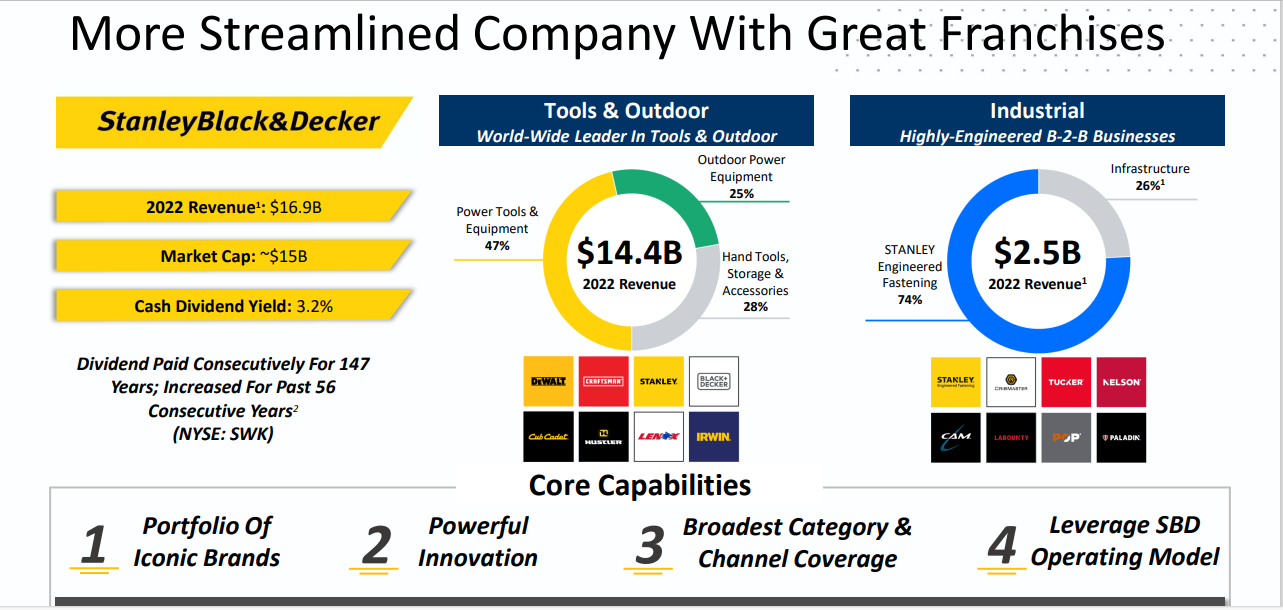

Stanley Black & Decker is a global chief in energy equipment, hand equipment, and similar pieces. The corporate holds the highest world place in equipment and garage gross sales. The corporate consists of 2 segments: equipment & out of doors, and commercial.

Supply: Investor Presentation

Within the 2023 2d quarter, earnings fell 5.3% to $4.2 billion, however this was once $70 million greater than anticipated. The corporate reported an adjusted earnings-per-share lack of $0.11, in comparison with a benefit of $1.77 in keeping with percentage in the similar quarter closing yr.

Natural expansion fell 4% for the quarter. Natural gross sales for Equipment & Out of doors, the most important phase throughout the corporate, declined 5% as a 1% get pleasure from pricing was once as soon as once more greater than offset via a decline in quantity. North The united states was once down 6% whilst Europe was once decrease via 3% for the quarter.

Click on right here to obtain our most up-to-date Positive Research document on SWK (preview of web page 1 of three proven beneath):

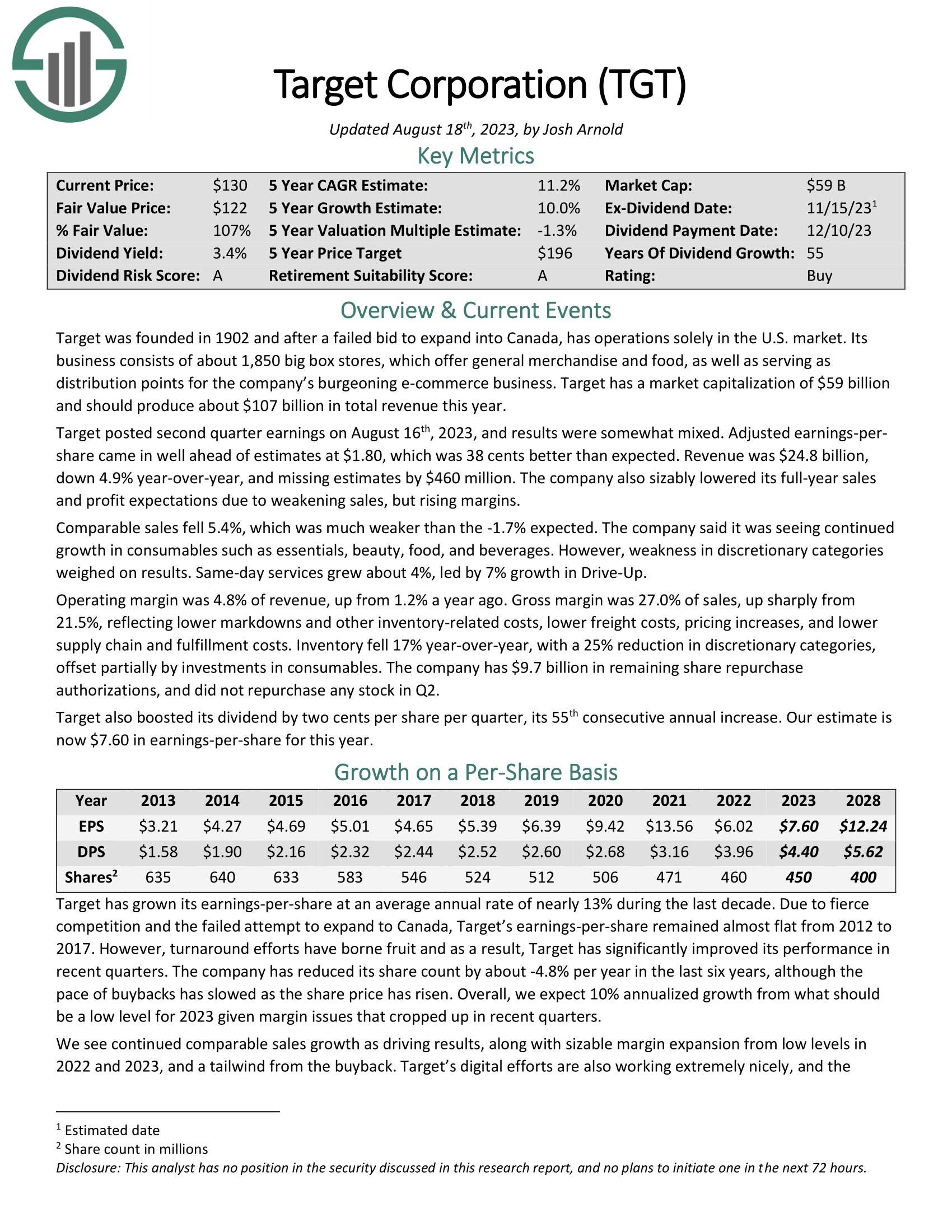

Dividend King #2: Goal Company (TGT)

- 5-12 months Annual Anticipated Returns: 15.8%

Goal is a cut price retail operations only within the U.S. marketplace. Its industry is composed of about 2,000 giant field retail outlets providing common products and meals and serving as distribution issues for its burgeoning e-commerce industry.

Goal has invested closely in e-commerce. The upward push in e-commerce to start with stuck many retail corporations flat-footed. Goal has in reality remodeled its on-line choices and has noticed implausible expansion charges.

Supply: Investor Presentation

Goal posted 2d quarter income on August sixteenth, 2023, and effects have been fairly combined. Adjusted earnings-per-share got here in smartly forward of estimates at $1.80, which was once 38 cents higher than anticipated.

Earnings was once $24.8 billion, down 4.9% year-over-year, and lacking estimates via $460 million. The corporate additionally decreased its full-year gross sales and benefit expectancies because of weakening gross sales, however emerging margins.

Click on right here to obtain our most up-to-date Positive Research document on Goal Company (preview of web page 1 of three proven beneath):

Dividend King #1: 3M Corporate (MMM)

- 5-12 months Annual Anticipated Returns: 19.9%

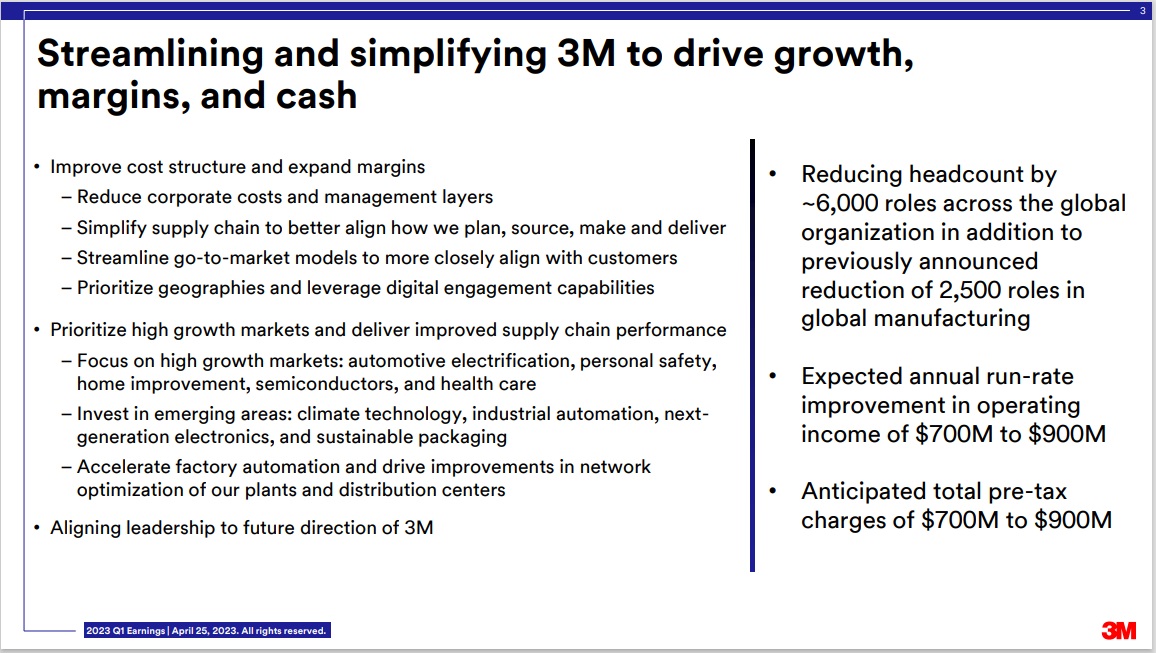

3M sells greater than 60,000 merchandise which are used on a daily basis in houses, hospitals, place of business constructions and colleges across the global. It has about 95,000 staff and serves shoppers in additional than 200 nations.

3M is now composed of 4 separate divisions: Protection & Commercial, Healthcare, Transportation & Electronics, and Client.

The corporate additionally introduced that it might be spinning off its Well being Care phase right into a standalone entity.

Supply: Investor Presentation

3M’s innovation is without doubt one of the corporate’s largest aggressive benefits. The corporate objectives R&D spending an identical to six% of gross sales (~$2 billion yearly) with a view to create new merchandise to fulfill shopper call for.

This spending has confirmed to be very recommended to the corporate as 30% of gross sales all through the closing fiscal yr have been from merchandise that didn’t exist 5 years in the past. 3M’s dedication to growing cutting edge merchandise has ended in a portfolio of greater than 100,000 patents.

Click on right here to obtain our most up-to-date Positive Research document on 3M (preview of web page 1 of three proven beneath):

Research Stories On All 50 Dividend Kings

All 50 Dividend Kings are indexed beneath via sector. You’ll be able to get admission to detailed protection of each and every via clicking at the title of each and every Dividend King.

Moreover, you’ll be able to obtain our latest Positive Research Analysis Database document for each and every Dividend King as smartly.

Elementary Fabrics

Client Discretionary

Client Staples

Power

Monetary Products and services

Healthcare

Commercial

Actual Property

Utilities

Efficiency Of The Dividend Kings

The Dividend Kings under-performed the S&P 500 ETF (SPY) in September 2023. Go back information for the month is proven beneath:

- Dividend Kings September 2023 overall go back: -5.2%

- SPY September 2023 overall go back: -4.7%

Strong dividend growers just like the Dividend Kings have a tendency to underperform in bull markets and outperform on a relative foundation all through endure markets.

The Dividend Kings don’t seem to be formally regulated and monitored via anyone corporate. There’s no Dividend King ETF. Because of this monitoring the historic efficiency of the Dividend Kings may also be tricky. Extra in particular, efficiency monitoring of the Dividend Kings frequently introduces important survivorship bias.

Survivorship bias happens when one appears at best the corporations that ‘survived’ the time frame in query. Relating to Dividend Kings, which means that the efficiency find out about does no longer come with ex-Kings that decreased their dividend, have been obtained, and so forth.

However with that stated, there’s something to be received from investigating the historic efficiency of the Dividend Kings. In particular, the efficiency of the Dividend Kings displays that ‘dull’ established blue-chip shares that build up their dividend year-after-year can considerably outperform over lengthy classes of time.

Notes: S&P 500 efficiency is measured the usage of the S&P 500 ETF (SPY). The Dividend Kings efficiency is calculated the usage of an equivalent weighted portfolio of lately’s Dividend Kings, rebalanced yearly. Because of inadequate information, Farmers & Traders Bancorp (FMCB) returns are from 2000 onward. Efficiency excludes earlier Dividend Kings that ended their streak of dividend will increase which creates notable lookback/survivorship bias. The information for this find out about is from Ycharts.

Within the subsequent phase of this newsletter, we will be able to supply an outline of the field and marketplace capitalization traits of the Dividend Kings.

Sector & Marketplace Capitalization Assessment

The field and marketplace capitalization traits of the Dividend Kings are very other from the traits of the wider inventory marketplace.

The next bullet issues display the collection of Dividend Kings in each and every sector of the inventory marketplace.

- Client Staples: 14

- Industrials: 12

- Utilities: 7

- Client Discretionary: 3

- Well being Care: 4

- Financials: 4

- Fabrics: 4

- Actual Property: 1

- Power: 1

The Dividend Kings are obese within the Industrials, Client Staples, and Utilities sectors. Apparently, The Dividend Kings have only one inventory from the Knowledge Era sector, which is the most important part of the S&P 500 index.

The Dividend Kings even have some fascinating traits with appreciate to marketplace capitalization. Those traits are illustrated beneath.

- 5 Mega caps ($200 billion+ marketplace cap; ABBV, JNJ, PEP, PG, KO, WMT)

- 23 Huge caps ($10 billion to $200 billion marketplace cap)

- 14 Mid caps ($2 billion to $10 billion)

- 8 Small caps ($300 million to $2 billion)

Apparently, 22 out of the 50 Dividend Kings have marketplace capitalizations beneath $10 billion. This displays that company longevity doesn’t must be accompanied via large dimension.

Ultimate Ideas

Screening to seek out the most efficient Dividend Kings isn’t the one approach to in finding top of the range dividend expansion inventory concepts.

Positive Dividend maintains identical databases at the following helpful universes of shares:

There may be not anything magical about making an investment within the Dividend Kings. They’re merely a gaggle of top of the range companies with shareholder-friendly control groups that experience sturdy aggressive benefits.

Buying companies with those traits at truthful or higher costs and keeping them for lengthy classes of time will most likely lead to sturdy long-term funding efficiency.

Thank you for studying this newsletter. Please ship any comments, corrections, or inquiries to beef up@suredividend.com.